Trump's Economic Plan

November 6, 2024

The entire premise of "Trumpenomics" centers around lower taxes and interest rates. Many Wall Street firms believe that Trump is going to lead inflation higher because he's more likely to run higher debts, cut taxes and stimulate spending, thus leading to higher inflation. I don't believe that will be the case.

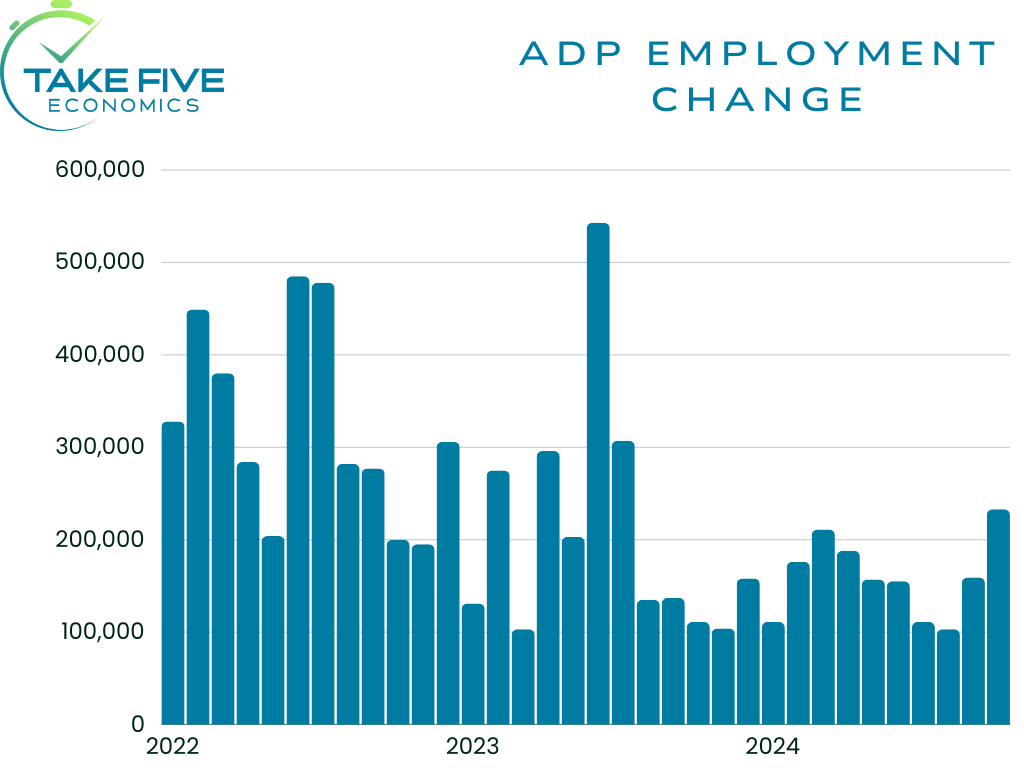

ADP Report - Is This More of What to Expect for Friday's Household Data?

October 30, 2024

While this was about the BLS' household data, the ADP can help provide insight into that report. And I also want to stress that we shouldn't get caught up in the month to month, as it is volatile. The yearly figures are what we should be looking at, and the year over year numbers in the ADP tell a much different story compared to years past, just like the other labor market data sets do as well.

From the Take Five Report: Narrative Catalysts on the Horizon

October 28, 2024

This week is an absolutely loaded week for economic data and narrative catalysts, and I want to take the time now to prepare for the higher implied volatility week. I'll give you our brief thoughts and expectations and provide a quick rundown of what we're seeing and looking for.

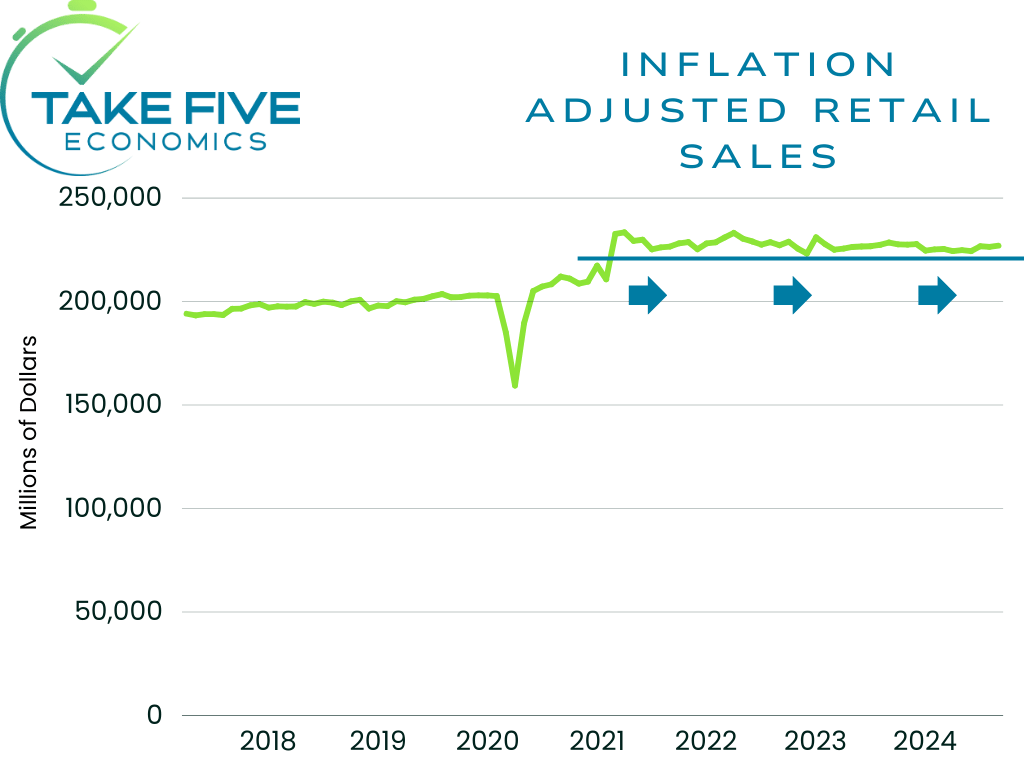

Retail Sales Beats Expectations - But Something Just Ain't Right

October 17, 2024

For those who read yesterday's Take Five Report, you see and understand why I'm becoming a little weary of the seasonal adjustments that the agencies are releasing. It's not that I have the tin foil hat on, it's that I just believe that the seasonal adjustments being made are wrong (and maybe stretched just a bit). I think it's more negligence than anything else.

The Potential Impacts of the Port Strike

October 1, 2024

Across three dozen ports stretching from Maine all the way to Texas, about 45,000 dock workers (and counting) from The International Longshoreman's Association (ILA) have begun their first walkout strike in almost 50 years. The implications and potential impacts that the strike could have are vast, and could cause a lot of problems both economically and politically. Some are expecting it to go on for weeks, even potentially leading into the presidential election next month.

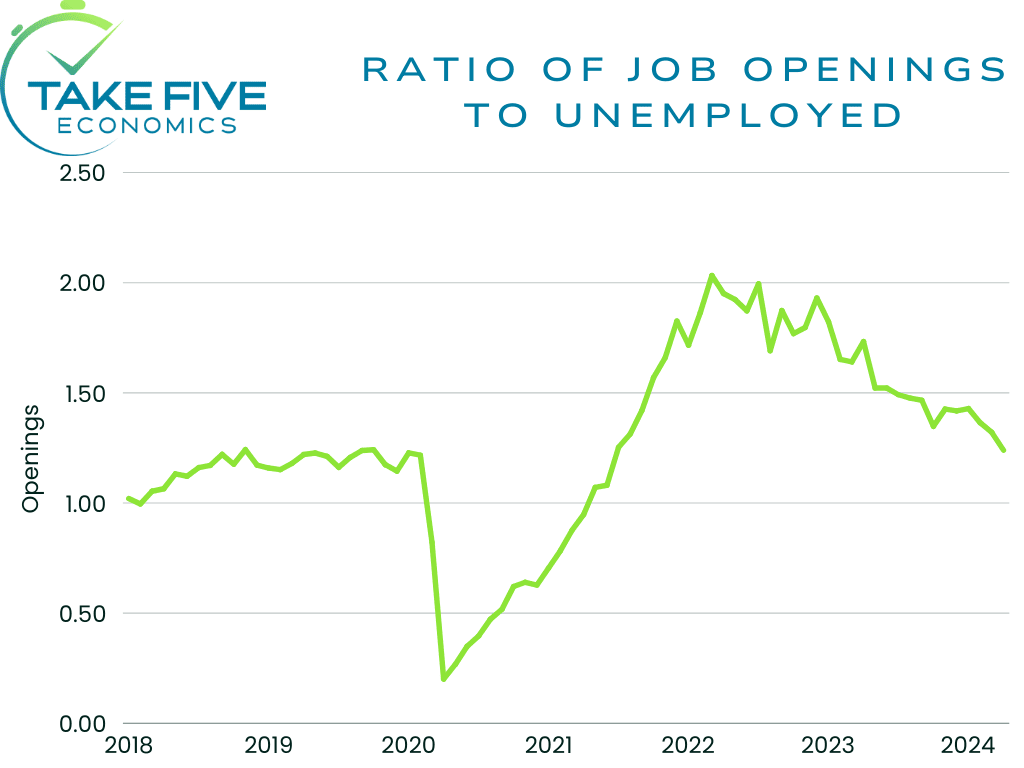

Labor Market Continues to Tighten

June 4, 2024

The total number of job openings fell to 8.055 million in April, coming in below Wall Street's as well as our own expectations and followed a downwardly revised 8.355 million in March. The job openings rate fell to 4.8% in April from 5.0% in March, its lowest mark since December of 2020 as the measure has reached the higher end of its long-term average.

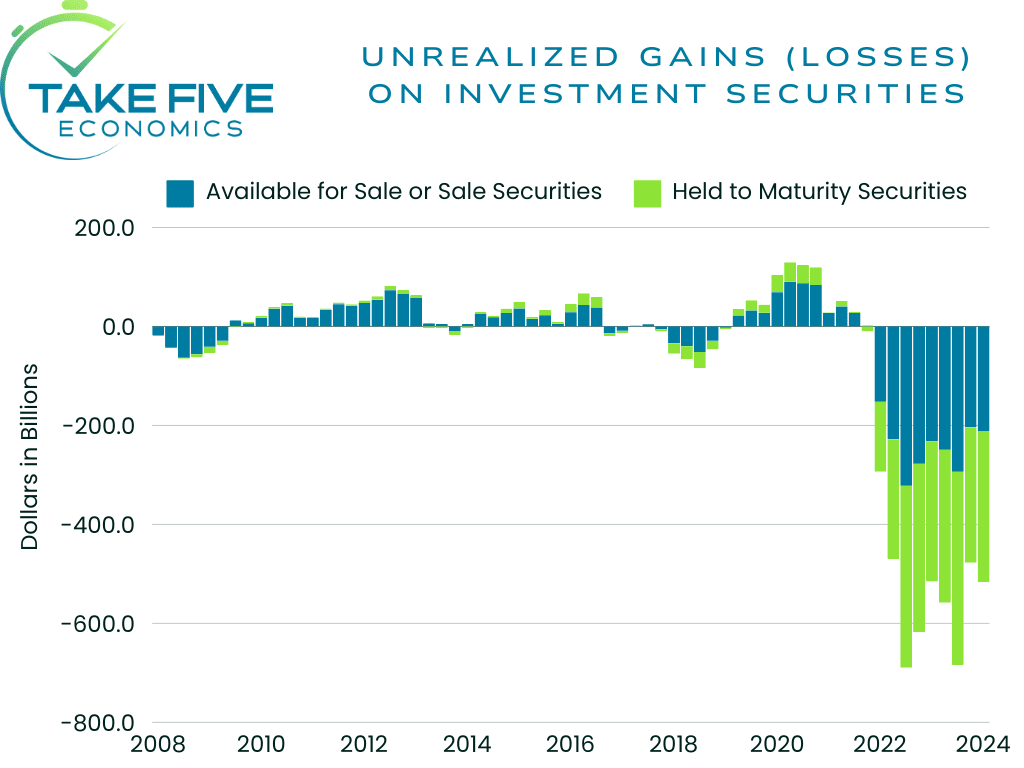

U.S. Banks... We May Have a Problem

June 1, 2024

Last week the FDIC released their quarterly banking profile for Q1 of 2024. This report essentially the FDIC's analysis of the U.S. banking system's current stability and given the environment we find ourselves in today, the information it contains is notable. The question is, will we see something similar to what we saw in March of 2023 with Silicon Valley Bank and Signature Bank again?

FOMC Minutes - Will We See More Rate Hikes?

May 23, 2023

The big news coming out of the latest Fed minutes is that an unspecified number of officials expressed "a willingness to tighten policy further should risks to inflation materialize in a way that such action became appropriate." In plain English, if inflation continues to run hotter, or if any underlying pressures begin to affect the figures on a larger scale, then the Fed isn't afraid to raise rates again.

A Discouraging Sign for the Near and Long-Term Outlook of the U.S. Economy

May 16, 2024

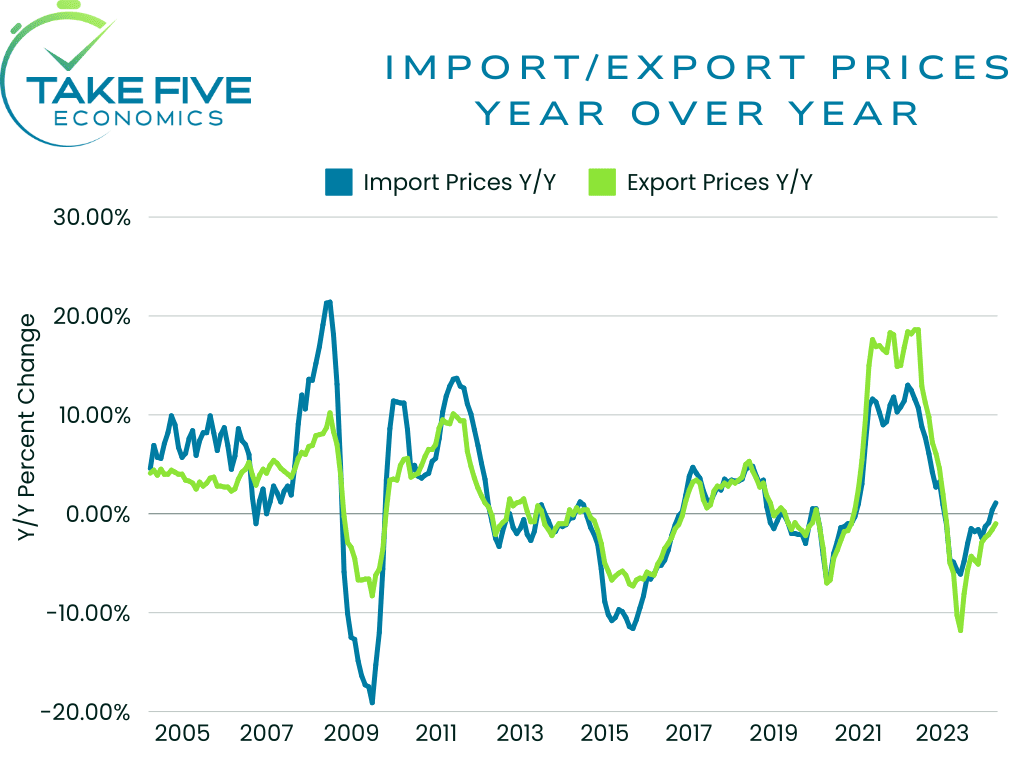

In most categories, prices on imports are outpacing prices on exports. As a whole, they're outpacing them by 2.7% year over year and 0.5% as of April, i.e. the U.S.' cost competitiveness/level of demand for its own products isn't as high as the level of demand the U.S. has for foreign goods. In the grand scheme of things, this isn't what we want to see out of the data.

Retail Sales a Net Positive for the Market Narrative, But a Net Negative for the Economy

May 15, 2024

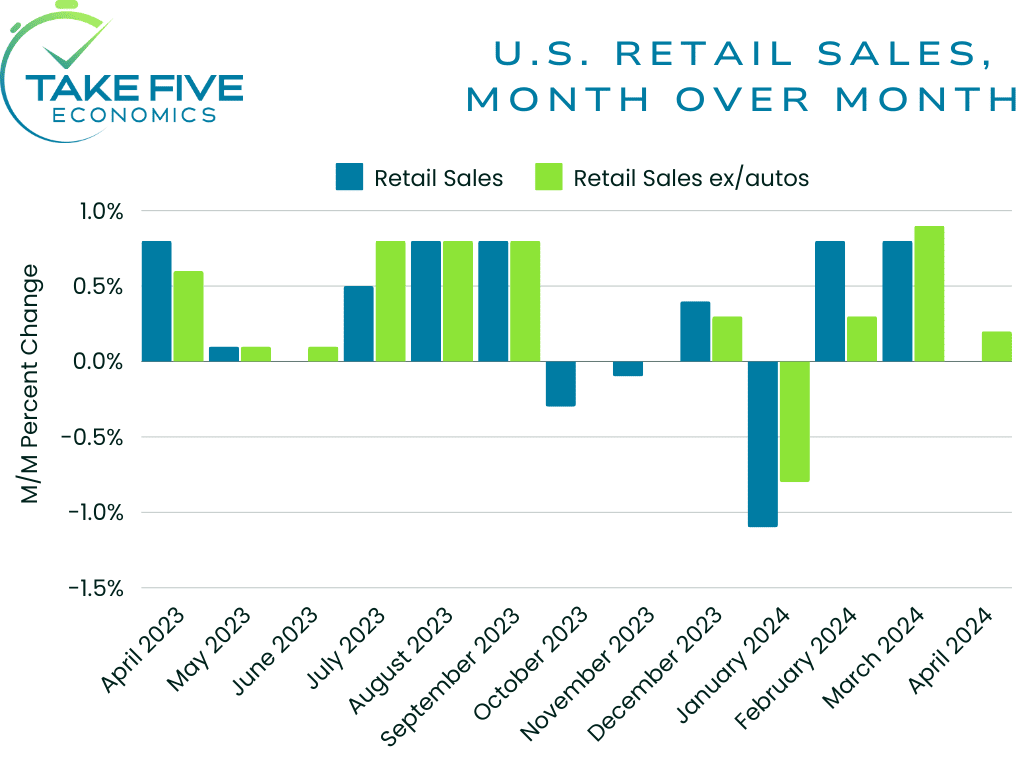

If we're seeing prices for essential purchases rise at the same time that household savings and incomes are getting squeezed with a poor labor market outlook, then the consumer has no other option than to scale back on discretionary items. In our forecast for this report, this is what we took mostly into account since the majority of the indexes in it lean more towards the discretionary side, but we still weren't expecting a pullback to this magnitude.

From the Take Five Report: Inflation Expectations - What's Just Noise & What's a Cause for Concern?

May 13, 2024

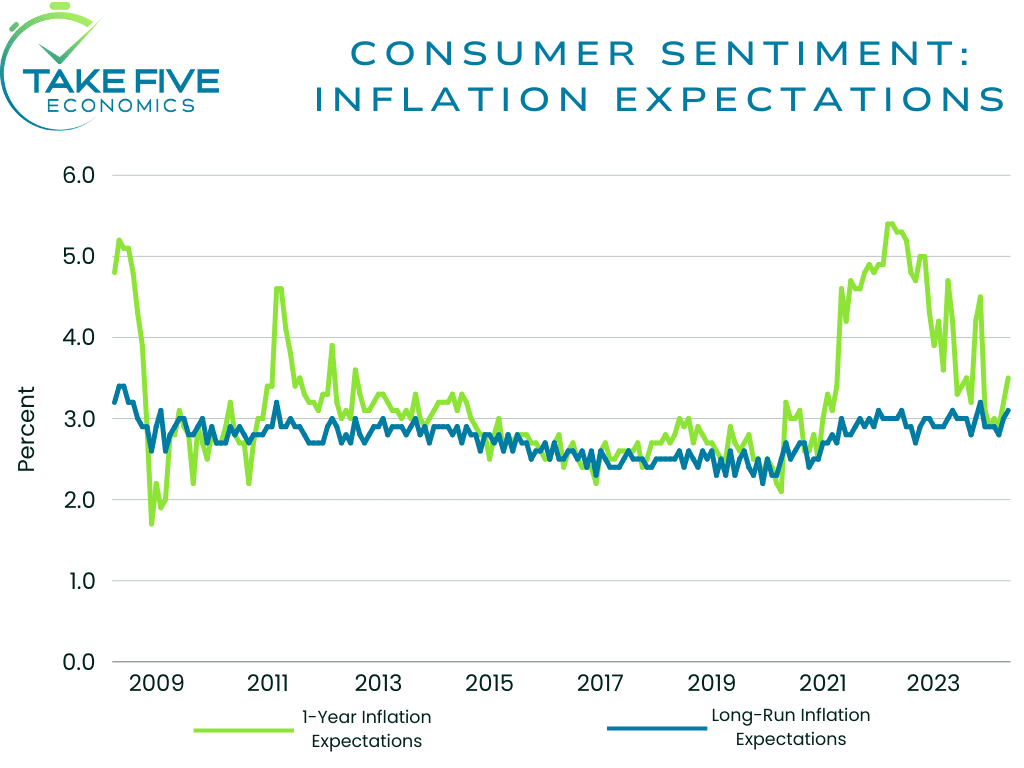

While a rise in inflation expectations is always noteworthy, it is important not to overreact to it and give into F.U.D. (fear, uncertainty, and doubt). There is a reasonable amount of evidence that suggests a rise in 1-year inflation expectations is nothing but "noise" in both the minds of consumers as well as in the minds of markets. But, there are two ways where it could become more than just noise. In addition, see our breakdown and analysis of the latest Consumer Sentiment survey.

From the Take Five Report: The Market is Wrong

May 8, 2024

Powell thinks that interest rates are restrictive, i.e. the banks restrict liquidity with higher rates which lowers the money supply by making loans, credit, mortgages, etc. more expensive which in turn, should constrict demand and slow economic growth. And therein lies the problem, it hasn't, at least not to the extent that it should've by now, but the markets believe that it has.

Double Whammy - Productivity Drops & Labor Costs Skyrocket

May 2, 2024

U.S. productivity increased by only 0.3% in Q1. This fell short of both our own and Wall Street's expectations while unit labor costs jumped by 4.7% in Q1 and came in much hotter than we and Wall Street were expecting.

Job Openings Slide to Three-Year Low in March

May 1, 2024

The JOLTS falls in line with what we saw in the consumer confidence survey yesterday, i.e. that people are finding it harder to find and/or change jobs and that they expect labor conditions to worsen in the coming months. The JOLTS data can be taken as a net positive for the market narrative, but a net negative for the labor market.

ADP Employment Comes in Above Expectations

May 1, 2024

These last two months have seen the largest two-month increase in employment since the middle of 2023, with hiring increasing in nearly all sectors and industries. Wage growth was essentially flat in April as well. This could be a more positive sign for markets going forward into Q2 as the employment cost index for Q1 showed wages accelerate by 1.2%, the highest jump since Q1 of last year.

Consumer Confidence Wasn't Too Confident in April

April 30, 2024

The present situation index, which is an assessment on current business and labor market conditions, declined to 142.9 in April. However, the expectations index, which is consumers' outlook on income, business and labor market conditions, tanked to 66.4 and followed a slightly upwardly revised 74.0 in the prior month. An expectation reading below 80.0 has a history of being a signal for a forthcoming recession.