A Double Whammy - Productivity Drops & Labor Costs Skyrocket

Highlights:

|

Index: |

Q4 2023: |

Q1 2024: |

Wall Street Expected: |

Take Five Expected: |

|---|---|---|---|---|

|

Productivity: |

3.5% (r) |

0.3% |

0.5% |

0.4% |

|

Unit Labor Costs: |

0.0% (r) |

4.7% |

4.0% |

4.2% |

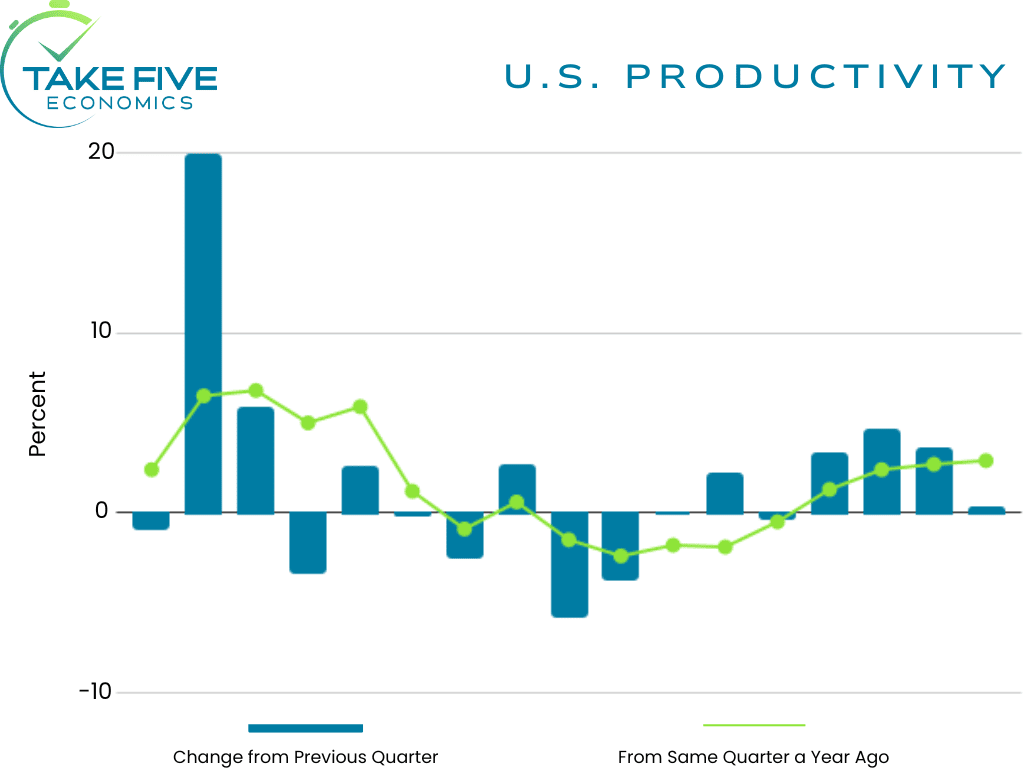

U.S. productivity increased by only 0.3% in Q1. This fell short of both our own and Wall Street's expectations and followed an upwardly revised 3.5% (from 3.2%) in Q4 of 2023. From the same quarter a year ago, productivity increased by 2.9%.

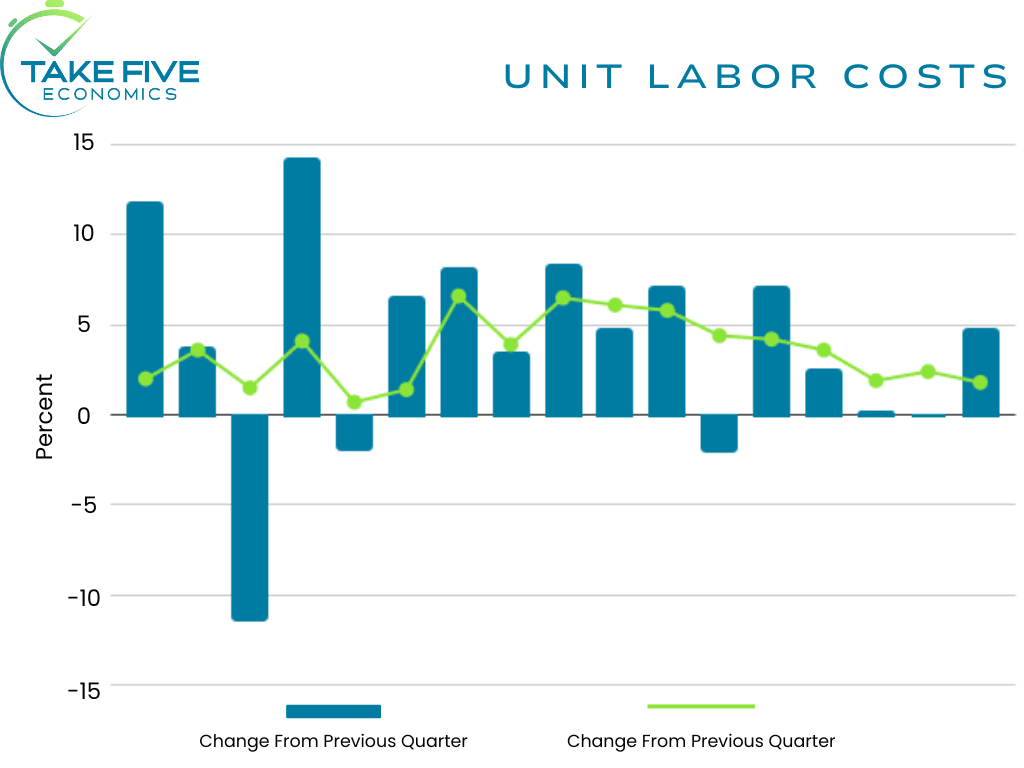

Unit labor costs jumped by 4.7% in Q1 and came in much hotter than we and Wall Street were expecting and followed a downwardly revised 0.0% (from 0.4%) read in Q4 of 2023. In terms of year over year, unit labor costs increased by 1.8%.

Finer Details:

During the current business cycle, which kicked off in Q4 of 2019, labor productivity has grown at an annual rate of 1.5% and reflects a 2.2% growth rate in output and a 0.7% growth rate in hours worked. This matches the previous business cycle's growth rate from Q4 of 2007 to Q4 of 2019, both of which stand at 1.5%. However, it still remains well below the long-term average since Q1 of 1947, which stands at 2.1%.

The increase in productivity reflected a 1.3% increase in total output, the smallest advance since the metric declined almost two years ago, and a 1.0% increase in total hours worked while the rise in unit labor costs was driven by a 5.0% jump in hourly compensation which sat at 3.5% in the prior quarter. This was partially offset by the 0.3% rise in productivity.

Labor productivity in the manufacturing sector increased by 0.2%. This increase was due to a flat output reading and a -0.2% decrease in hours worked. Productivity in the durable manufacturing sector saw a 1.2% increase, which was driven by a 0.4% increase in output and a -0.8% decrease in hours worked. Conversely, productivity in the nondurable manufacturing sector decreased by -1.3%, as output decreased by -0.4% while hours worked increased by 0.9%. Overall, total manufacturing sector productivity still increased by 1.2% year over year.

Unit labor costs in the total manufacturing sector rose by 3.2% in the first quarter of 2024. This increase was driven by a 3.4% rise in hourly compensation and a 0.2% increase in productivity. Compared to the same quarter a year ago, manufacturing unit labor costs increased by 5.0%, reflecting a 1.2% increase in labor productivity and a 6.3% increase in hourly compensation. Real hourly compensation also rose by 3.0% year over year.

Putting It Together:

Due note that labor costs in recent years have typically jumped to levels such as this in Q1 and usually tempered in the following quarters. This is because many pay raises will occur during this period and while the quarterly productivity figures can be volatile, we don't want to see a continued slowdown as a slowdown in productivity usually means an increase in unit labor costs which would represent another potential "bump in the road" for the Fed and their inflation battle. While the increases seen in compensation hurts the bullish narrative (i.e. the Fed is going to cut rates) that surrounds the dominant force of the market (i.e. the Fed interest rates and inflation), it will likely be somewhat overlooked or at least put off to the side for the reasons mentioned above, but it is something to watch moving forward.