Finding Order Among Chaos

We tend to focus on the bigger picture rather than getting caught up in the day-to-day price action, which can often seem chaotic. However, these short-term movements contribute to a larger story and narrative over time. Our goal is to identify the pockets of order that emerge amid the chaos because these are measurable, explainable, and can be aggregated. These pockets of order reveal themselves as patterns, which are driven by underlying market psychology.

The market environment is always evolving, driven by changing forces and narratives. Understanding these shifts in market sentiment is key to predicting current and future price movements. By identifying the mood of the market, you can tilt the odds in your favor and anticipate the direction of market trends, as it's the psychological state of the crowd that ultimately determines market direction.

Now the question is, how can you identify the psychological state of the crowd? Well, we'll show you.

Traders vs. Investors

Traders

Investors

Traders and investors are very different in their approach and can be successful, but both share two common struggles that hold them back from unlocking their full potential: They neglect each other, and they neglect the force that changes the market tide - psychology.

The market environment is constantly changing, but the one constant behind every change is the psychology. It's the one permanent principle. If you can identify "the why", you can identify where the market is going and when it's going to go - and it's not as complicated as you might think...

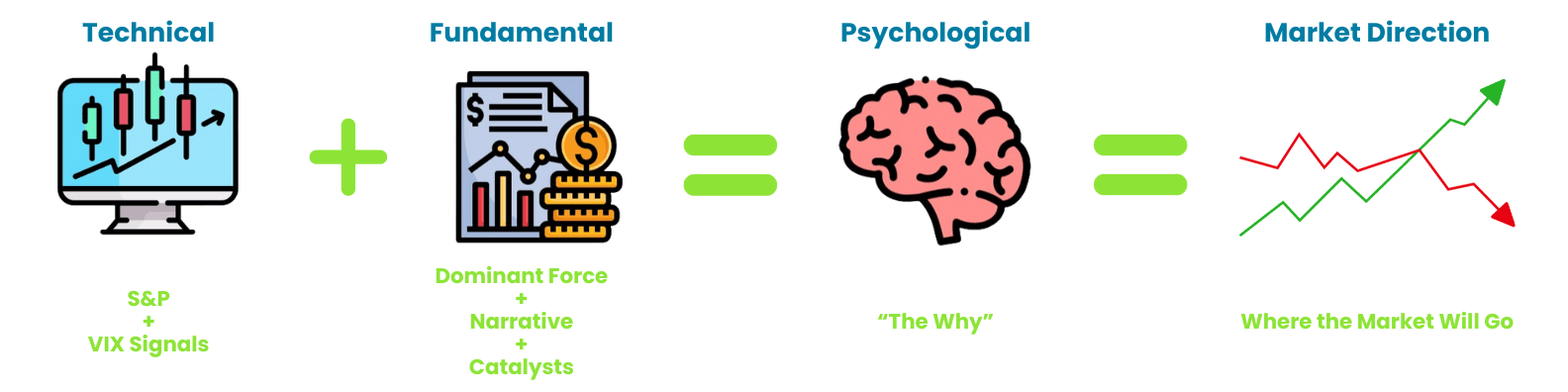

The Take Five Formula

Technical (S&P + VIX Signals)

This is the technical analysis portion of our formula, and we view this aspect as a way to identify the underlying psychology of the market. We analyze the S&P 500 as a way to gauge the overall market. Additionally, we incorporate signals from the Volatility Index (VIX), which measures market volatility and overall sentiment.

By applying our top-secret trading system and its technical indicators to these benchmark indexes, the signals and patterns that emerge is the market's way of telling you what it's feeling, and it reveals some of the pockets of order we need in order to understand the psychological state of the market, or the balance of power between bulls and bears. While we may now understand what the market is feeling, the question of why still remains unanswered, and if we want to figure that out, we need the other half.

Fundamental (Dominant force + Narrative + Catalysts)

Fundamental analysis involves evaluating the underlying factors that drive the market. This includes identifying the dominant forces of the market at that time, understanding the narrative surrounding these forces, and recognizing the specific catalysts that could either fuel, fracture or break that narrative.

The dominant force of the market could include factors such as economic data, monetary policy decisions, geopolitical events or corporate earnings. In order to understand the narrative surrounding these forces, it of course includes technical analysis, but also investor perceptions, media, certain data, and the overall storyline of the market. Additionally, identifying catalysts involves recognizing events or developments that could provide more fuel for the narrative, begin or continue to fracture it, or completely shatter it once it has reached its likely tipping point, but the stars need to align for that (and they do).

Psychological ("The Why") = Market Direction

The combination of technical and fundamental analysis leads to an understanding of market psychology and what we like to refer to as "The Why" behind the market's movements. Sometimes their movements are justified, but other times they're not based in reality. By understanding why investors react the way they do to certain technical and fundamental factors, you can gain the insight you need in order to anticipate where the tide is going.

This will allow for much more informed decisions regarding investment or trade positions by having this level of depth and understanding of what you're potentially putting your capital on the line for. It will help whether it's deciding when to enter and exit a position, identifying potential opportunities and likely turning points, as well as managing risk effectively and much more.

While the market environment constantly changes, the one aspect that never does is human psychology. By understanding all of this, you can develop the comprehensive framework you need in order unlock your full potential in the market.