Narrative Catalysts on the Horizon

This week is an absolutely loaded week for economic data and narrative catalysts, and I want to take the time now to prepare for the higher implied volatility week. I'll give you our brief thoughts and expectations and provide a quick rundown of what we're seeing and looking for.

Labor Market:

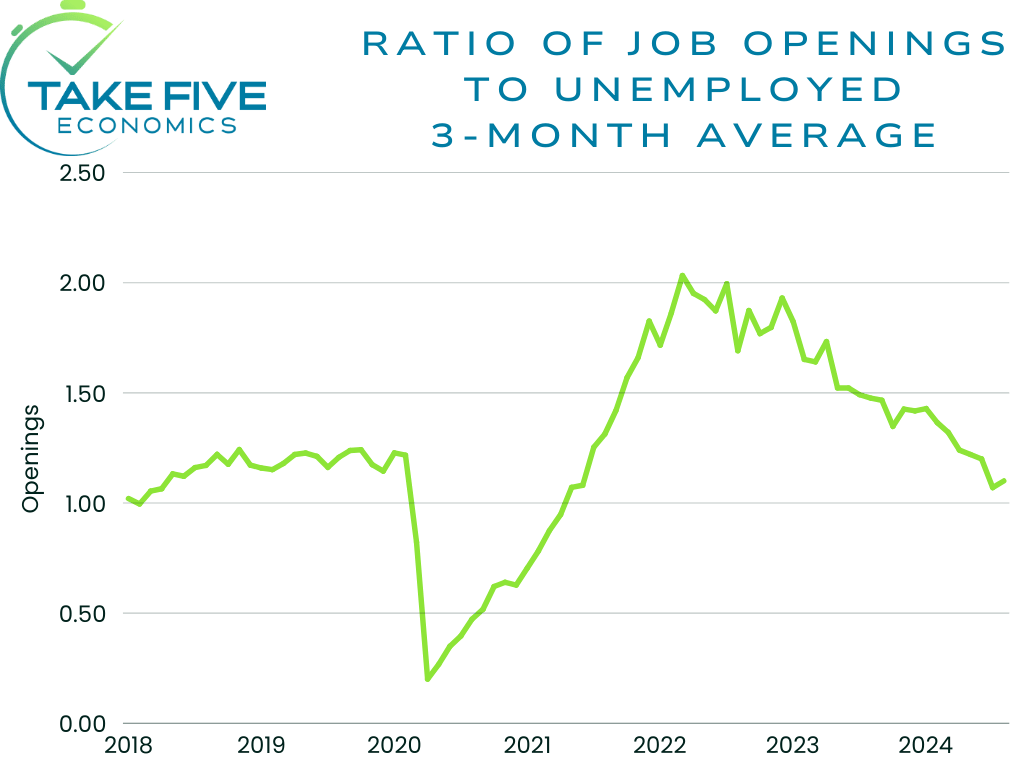

Job Openings - Tuesday: The JOLTS data may provide some short-term increases in price action, especially if it leans in favor of the bulls' narrative (which would be a beat in expectations). But the JOLTS isn't usually a make-or-break data set in terms of the market narrative. However, it does contribute to fracturing or taping it, and that's the lens we'll be looking at it under. What we should be looking at is the trend of where the data is going, specifically within the ratio of job openings to unemployed as well as the headline figures. |

Since this spring, in all of our job openings analysis' (mouthful), we've been keeping an eye on this metric above. My original analysis was that this number was going to keep falling until it reached the normalization level pre-covid, but once it got to that point, to keep an eye on what it did from there. If it kept falling, we're in for a problem. But if it began to normalize and flatten out, then it'd very beneficial for the market and economy. We've gotten a slight dip below it, but we're not in the danger zone yet. That would be if it falls below one. ADP Employment - Wednesday: The data for September was better than July and August's, but it wasn't as much of a blowout report as the BLS' jobs data was. This report is another one of those fracturing or taping ones. Usually, the market doesn't swing on this unless there is a big swing one way or another. The ADP report always falls under the radar. We get the JOLTS and markets react, then by the time the ADP rolls around the next day, markets like to toss it aside (barring any big swings) and salivate for the BLS numbers until they come out that Friday. What we'll be looking for here is anything interesting that may go overlooked, and of course, big swings. BLS Household Labor Data - Friday: If you all remember the 10/16 report... you know I will be looking deep into the numbers on this. As a refresher: "The typical employment level that we have in our economy is just about 2 million job gains created on an annual basis. Right now, we're only sitting at a net of 76,000, with the year over year figure sitting at 314,000. Meaning the next 3-months of data (Q4) is going to be crucial." Remember: "The month over month data is extremely volatile. Over the last 3 recessions, household jobs data has spiked in a range of 171,000 to 649,000 in a single monthly report and we still fell into a recession. The market more than likely rallied on these reports as well, yet the recessions still came because jobs are a lagging indicator. Another reason why I stress that with some, if not most things, the month over month data doesn't mean as much as the annual." So, what we should be looking at is how much the overall report adds or subtracts from the yearly total, meaning revisions will also need to be looked at, especially the September data revisions because we *know* they're coming as well as underlying factors and anything that may be overlooked. And remember all that we said above. This is the report markets are waiting on. If the headline figures beat expectations by a wide margin, expect the bulls to run. If not, it gives the bears a window of opportunity. |

Economy & Sentiment:

Consumer Sentiment & Consumer Confidence:

The consumer sentiment report will come out this Friday, while consumer confidence will be released the following Tuesday. They both typically get a market reaction if something is out of the ordinary, but if not, markets are fairly quiet on them. The reason why we look at them however is because it gives us more insight into the mind of the consumer, which is valuable information. These we'll gloss over, and make sure inflation expectations are held in check.

GDP - Wednesday:

This is going to be the official Q3 GDP read. This can make or break a market narrative depending on the degree of which it beats expectations or depending on the timing of its release. While the timing couldn't be more perfect, I don't believe we're going to see any surprise swings this time around, lessening the potential impact. So for now, view it as another fracturing or healing type of catalysts for the bulls' narrative.

PCE - Thursday:

As we discussed last week. I'm among the belief that barring any unforeseen shockwave sent through the system, *higher* levels of inflation are pretty much behind us right now because companies no longer have the pricing power that they did. This tells me that while the PCE is crucial to the Fed and interest rates, which is crucial for the market narrative, we're not going to get anything that sends shockwaves through the market, and that the most crucial aspect right now will be the labor market.

Putting It Together:

All of these reports RARELY (yes, I used all caps) fall on the same week. We're getting a little bit of everything: the labor market, the state of the economy, sentiment and expectations, inflationary data that's a crucial determinant for the Fed's policy decisions, and more. There are also other reports and data we I'll be looking into as well, e.g. balance in trade goods, housing market data, and manufacturing PMI and ISM. Crazy how it all lands on the week before our presidential election, but that's got to be a coincidence... Higher implied volatility before an election, which also implies higher volatility? Obviously a coincidence... For more information regarding our precise forecasts for each potential report, visit our Economic Calendar.