ADP Employment Comes in Above Expectations

Highlights:

|

Index: |

March: |

April: |

Wall Street Expected: |

Take Five Expected: |

|---|---|---|---|---|

|

Employment Change: |

208,000(r) |

192,000 |

183,000 |

188,000 |

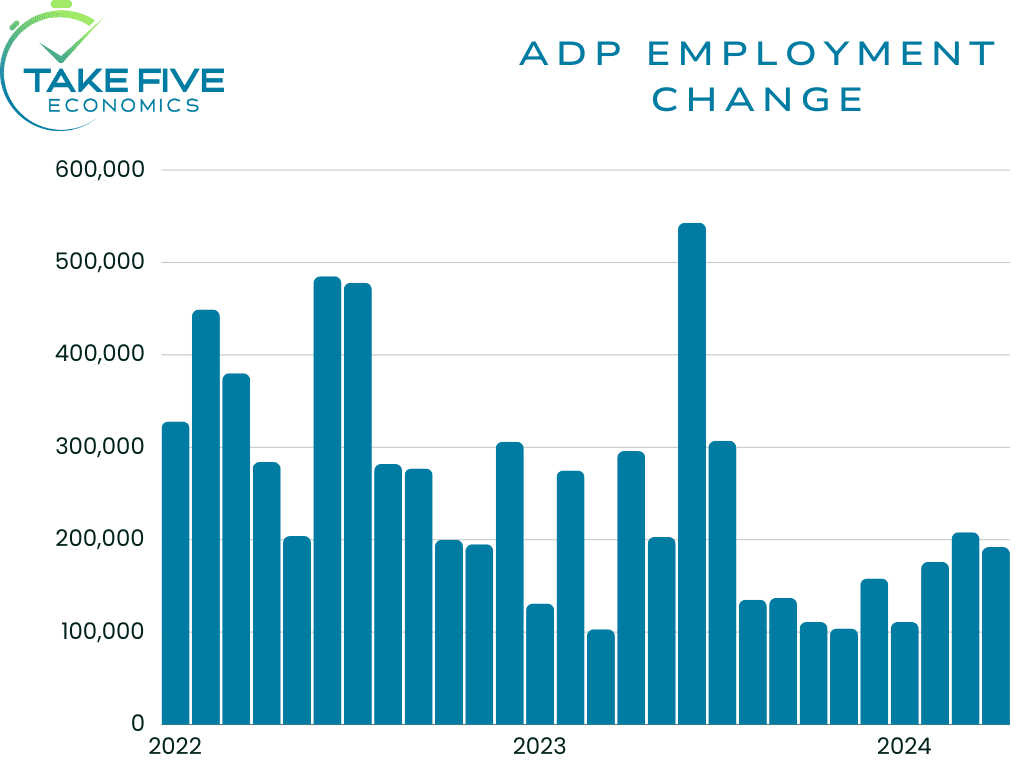

U.S. private sector employment increased by 192,000 in April, coming in higher than Wall Street's and our own expectations and followed an upwardly revised 208,000 (from 184,000) in the prior report.

Year-over-year pay gains for those who stayed in their jobs remained steady in April at 5%. However, pay growth for job changers declined from 10.1% in March to 9.3%. Despite the drop, it remains higher than at the beginning of the year.

Finer Details:

The gains seen in the report primarily were within the service-providing sector, which added 145,000 jobs, while the goods-producing sector added 47,000 jobs.

- Within the goods-producing sector, construction saw the largest increase with 35,000 jobs added, followed by manufacturing with 9,000 jobs added.

- Within the service-providing sector, the leisure and hospitality industry saw the largest increase with 56,000 jobs added, followed by education and health services with 26,000 jobs added.

- Employment gains were seen across all establishment sizes, with large establishments (500+ employees) leading with 98,000 jobs added.

- By US region, the South experienced the largest increase with 124,000 jobs added, followed by the Northeast with 36,000 jobs added.

Putting It Together:

These last two months have seen the largest two-month increase in employment since the middle of 2023, with hiring increasing in nearly all sectors and industries. Wage growth was essentially flat in April as well. This could be a more positive sign for markets going forward into Q2 as the employment cost index for Q1 showed that wages accelerated by 1.2%, the highest mark since Q1 of last year, which markets weren't too thrilled over.

The report wasn't anything too out of the ordinary. While markets may have mixed feelings about this data, it isn't their chief concern and will likely be somewhat overlooked as the Fed meeting will be held later today, and the bigger and more monitored BLS Employment Situation data will be released on Friday.