Inflation Expectations - What's Just Noise & What's a Cause for Concern?

Highlights:

|

Index: |

April: |

May (Prelim): |

Wall Street Expected: |

Take Five Expected: |

|---|---|---|---|---|

|

Consumer Sentiment: |

77.2 |

67.4 |

77.0 |

70.0 |

|

Current Conditions: |

79.0 |

68.8 |

-- |

-- |

|

Expectations: |

76.0 |

66.5 |

-- |

-- |

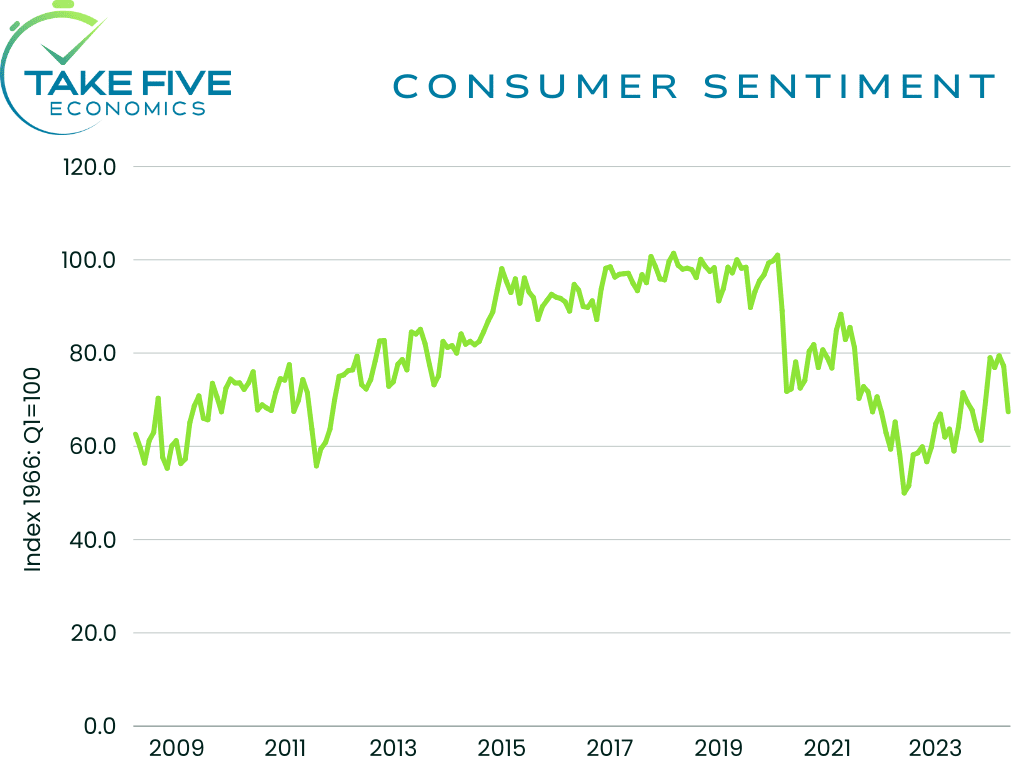

University of Michigan's consumer sentiment came in at 67.4 in May for the preliminary reading and brought the index to its lowest level in about six months. It fell below Wall Street's and our own expectations and fell sharply from 77.2 in the final reading in April.

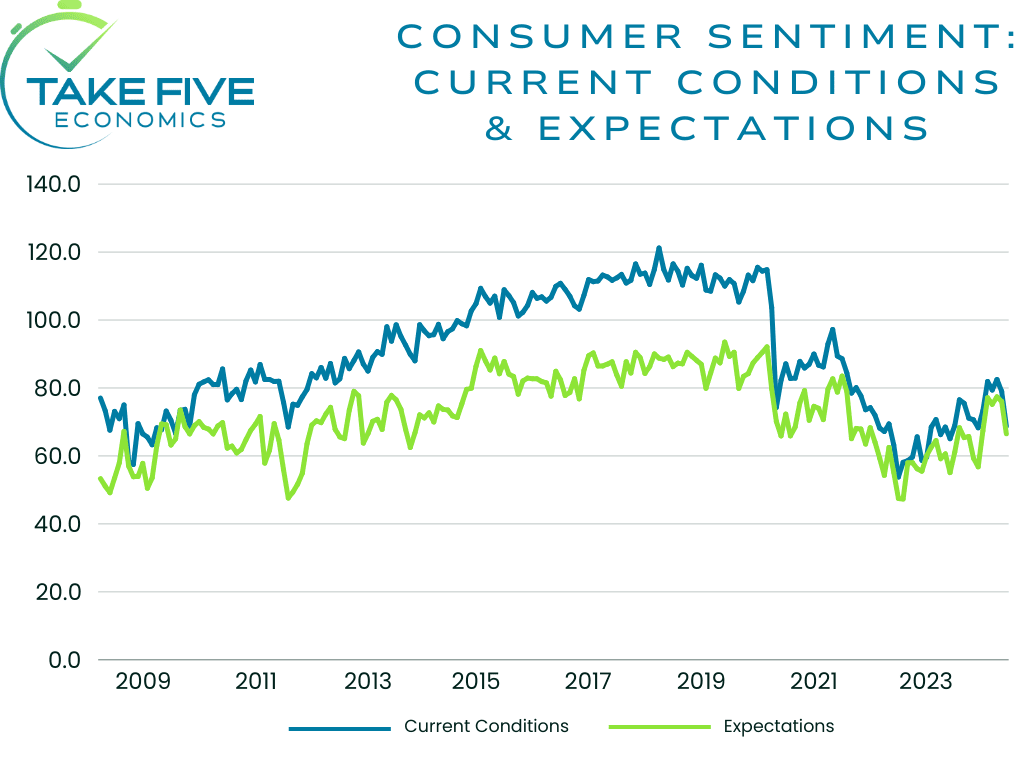

Consumers' feelings towards current economic conditions worsened, falling from 79.0 in April to 68.8 in May's preliminary read with expectations also becoming gloomier, dropping nearly -10 points to 66.5 from 76.0.

Finer Details:

University of Michigan's surveys of consumers director, Joanne Hsu, cited in the report that "This month's trend in sentiment is characterized by a broad consensus across consumers, with decreases across age, income and education groups. Consumers in western states exhibited a particularly steep drop. While consumers had been reserving judgement for the past few months, they now perceive negative developments on a number of dimensions. They expressed worries that inflation, unemployment, and interest rates may all be moving in an unfavorable direction in the year ahead."

The survey's measure of buying conditions for durable goods, i.e. goods that will last over a long stretch of time such as appliances, cars, machinery, etc., some of which can be financed (obviously) decreased to a one-year low.

Consumers' view of their current financial situation as well as their short and long-term economic outlook soured this month as now only 25% of consumers expect the Fed to cut interest rates within the next year, dropping from 32% in the prior report.

Confidence notably deteriorated this month across all political parties going into the November election.

Inflation Expectations:

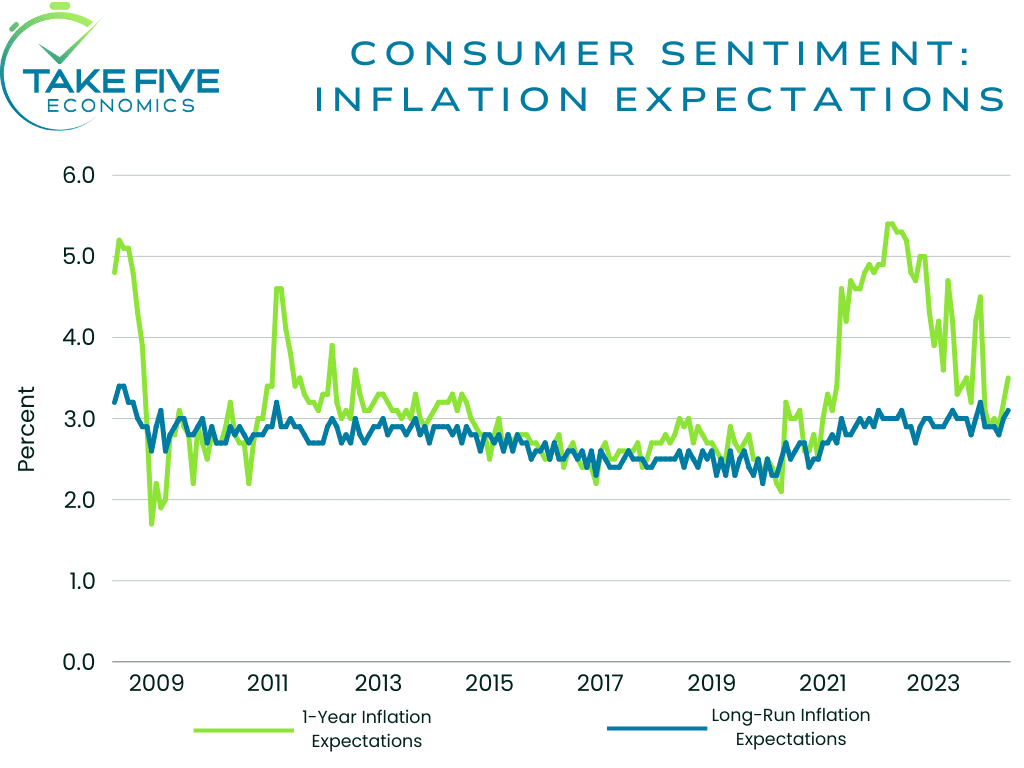

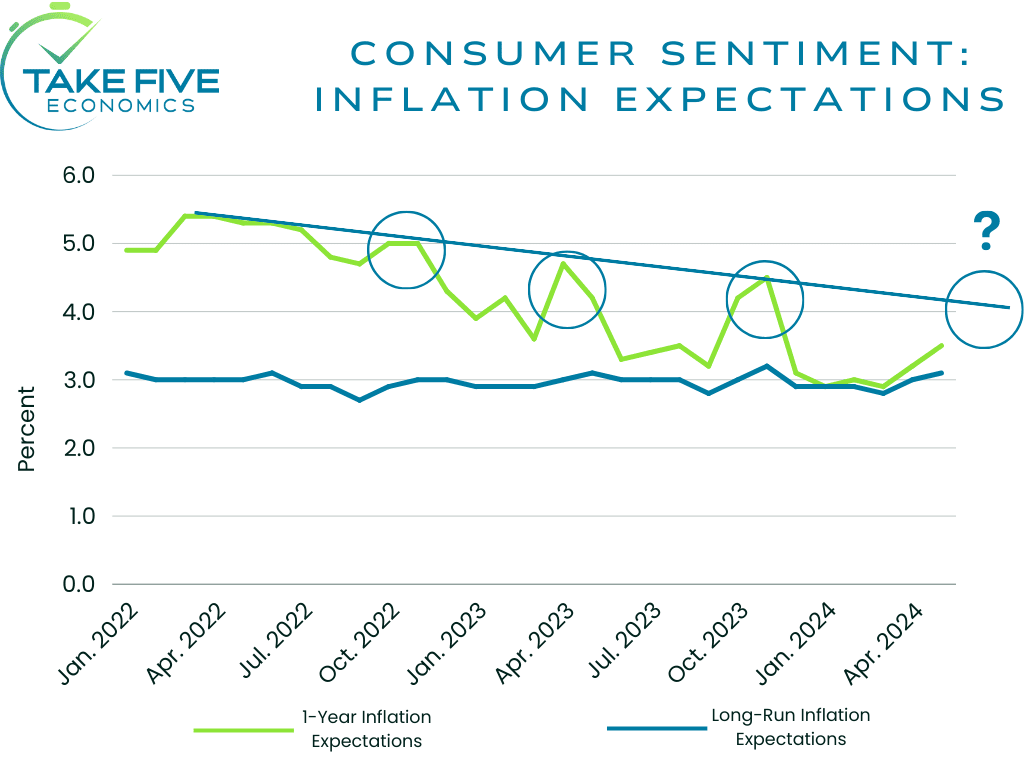

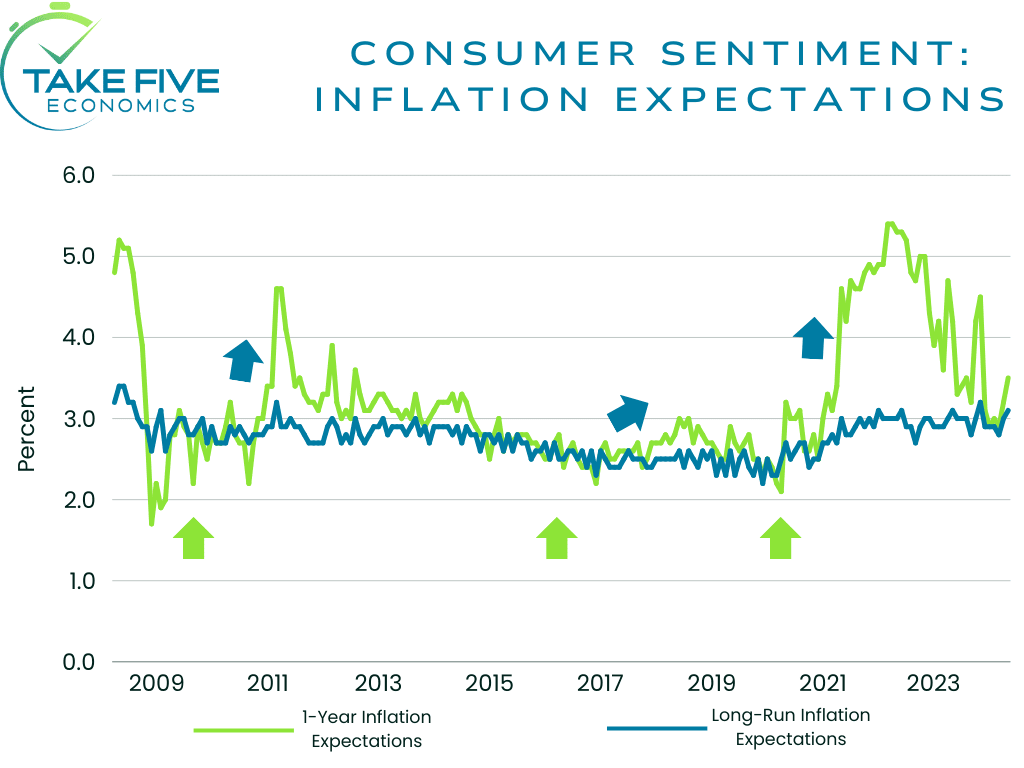

Year-ahead inflation expectations rose from 3.2% in April to 3.5% in May, remaining above its range seen in the two years prior to the pandemic of 2.3%-3.0%. Long-run inflation expectations (i.e. over the next 5-10 years) rose slightly as well from 3.0% in the prior read to 3.1% this month. Long-run inflation expectations have stayed within a very narrow range of 2.9%-3.1% for 30 of the last 34 months, but they're still elevated when compared to the 2.2%-2.6% range seen in the years before 2020.

If people are expecting inflation to rise, they buy, or buy more of whatever they need because they believe that the price of it will be higher in the future. This can also cause businesses to raise prices by x amount, which in causes employees to demand higher wages to keep pace with the increases in prices. When you have people doing this in mass, it creates a self-fulfilling prophecy, and contributes to rising inflation and vice versa. While a rise in inflation expectations is always noteworthy, it is important not to overreact to it and give into F.U.D. (fear, uncertainty, and doubt). There is a reasonable amount of evidence that suggests a rise in 1-year inflation expectations is nothing but "noise" in both the minds of consumers as well as in the minds of markets. But if you see below, there are two ways where it could become more than just noise.

What's Just Noise, & What's a Cause for Concern?

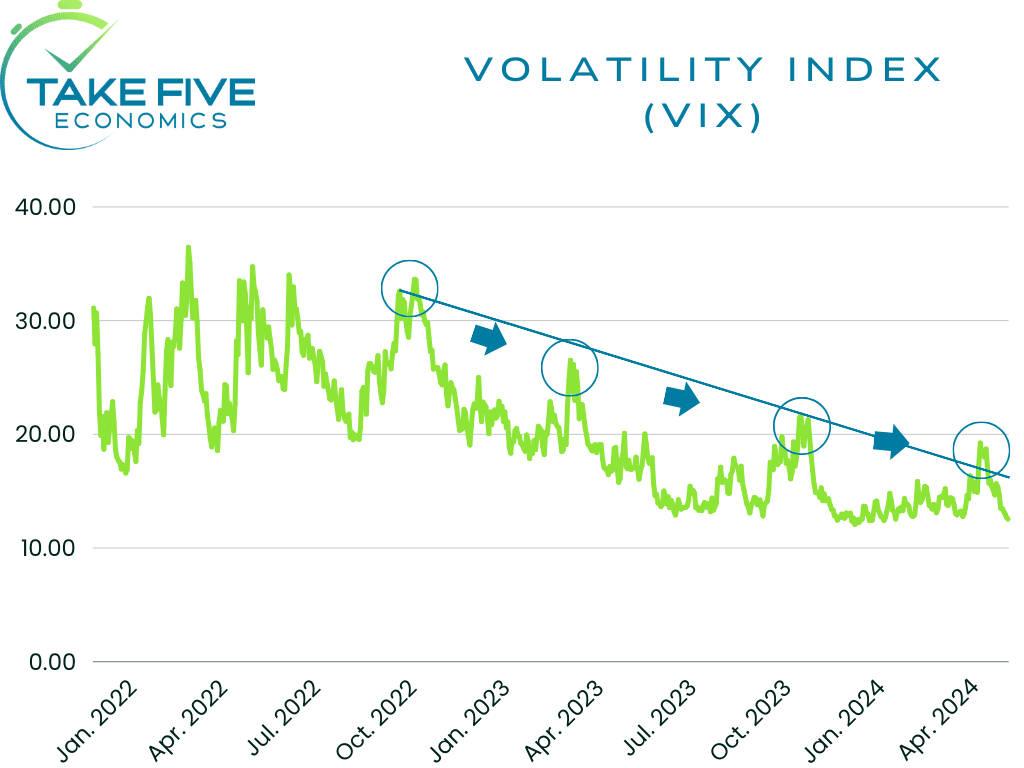

Now, let's apply a little bit of technical analysis, if you see the current downtrend that inflation expectations are on in the chart (left), you'll notice large spikes that have punctured it on the way down, with each spike's high being lower than the previous high. This is something that we see a similar pattern of in the VIX (right), which has mirrored inflation expectations to some degree and has acted as a sort of leading indicator for the measure. If expectations rise further in the coming reports and continue this pattern, then it shouldn't be of too much concern.

The time to be concerned however, is if the pattern breaks. This would come in two potential forms:

- If the next spike (if there is one) breaks above the previous ones high, as is the same case with the VIX. That means that a potential bottom is forming which, as you can see in the VIX, (i.e. inflation 1-year inflation expectations' borderline leading indicator) is already the case as the trend is beginning to flatten out and puncture the trend line even further.

- This next one doesn't factor in the VIX, but the signal is if 1-year inflation expectations fall below long-run inflation expectations (see below), which would also act as a leading indicator. This is because if long-run inflation expectations are higher than they are in the short-term, well it's a self-fulfilling prophecy at that point. This signal hasn't occurred since late 2020, but if it were to occur again in the future, be sure to note when it does.

Putting It Together:

Consumer sentiment confirms much of what was seen in the consumer confidence survey released on April 30, i.e. that consumers' mood about what's going on now and especially for what they expect moving forward is souring quickly.

The decline in sentiment towards the labor market is something to keep your eyes on moving forward and may lead to pullback in consumers' willingness to spend. For a more in-depth discussion on our outlook for the labor market moving forward, see our other most recent Article.

The magnitude of the drop in sentiment is fairly large but expected, at least for us. This week's retail sales figures will provide even more insight into the mind of the consumer as we try to piece more of this puzzle together.