The Market is Wrong

Background:

The Fed has reached a point where their effective rate is in a "balanced stage" between being too high and too low. Last week Fed Chair Jerome Powell said that another increase in the fed funds rate was unlikely and took a very surprising dovish stance, giving markets more of what they wanted to hear and provided them and the bullish narrative with more fuel to extend their rally. He also went back on his previous, more hawkish stance on rate-cuts. This stance was likely taken because he probably got the payroll data (set to be released that Friday) early, but that's beside the point.

The point is that Powell thinks that interest rates are restrictive, i.e. the banks restrict liquidity with higher rates which lowers the money supply by making loans, credit, mortgages, etc. more expensive which in turn, should constrict demand and slow economic growth. And therein lies the problem, it hasn't, at least not to the extent that it should've by now, but the markets believe that it has.

Effects of Monetary Policy:

Labor Market:

While the labor market remains sturdy by historical standards, jobs are much less abundant than they were a few years ago. Workers now are much less likely to change their jobs and have been staying in their current positions more and more in what job recruitment agencies (e.g. ZipRecruiter, Monster, etc.) have been naming in their latest earnings calls, "The Great Staying" or "The Great Stay" (it's a working title). This follows "The Great Resignation", a period following the pandemic that saw easy money become easier than easy, which allowed demand to skyrocket which in

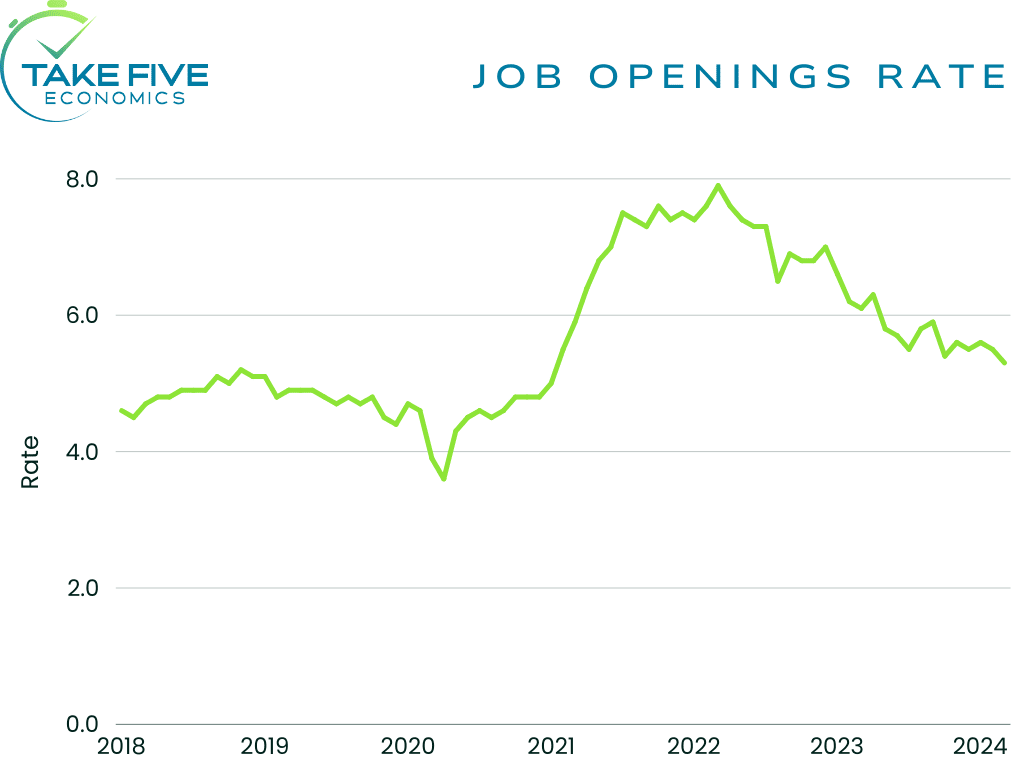

turn, created an extremely high demand for labor as you can see above.

This allowed people to switch to higher paying jobs more easily. Another contributing factor to the resignation was the mass-influx into the more economic, social, and political friendly places where job opportunities were more plentiful and rewarding, and guidelines were less restrictive. But now, people are finding it much harder to find jobs and expect this trend to continue getting worse, as seen in the consumer confidence survey on May 1, thus creating "The Great Stay." Even small businesses, which were the ones who needed the most help over the last few years, have tempered back their hiring plans.

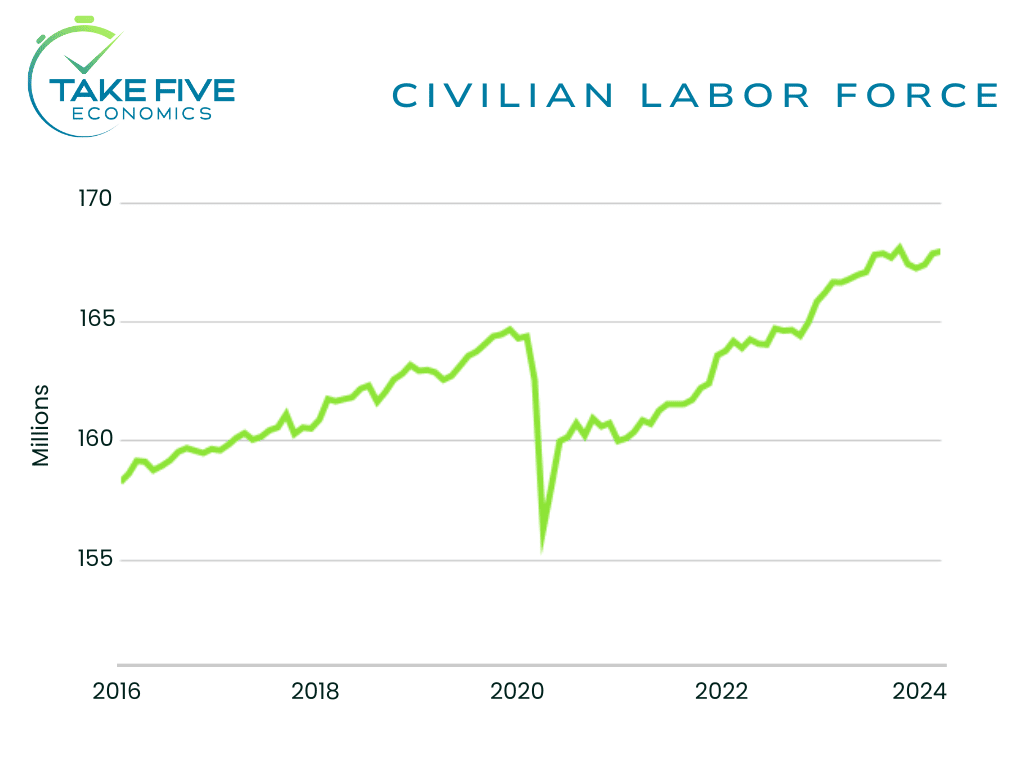

In 2018, the job openings rate, which is calculated by dividing the number of openings by the total number of positions (filled and unfilled), peaked at 5.2%, with the civilian workforce totaling about 163.2 million at the same time. As the latest JOLTS data shows, the job openings rate has now fallen to its pre-pandemic peak, with the total number of workers has increased to 168 million (see below). But is this due to tightening financial conditions, or something else? You'll just have to read on.

Credit: |

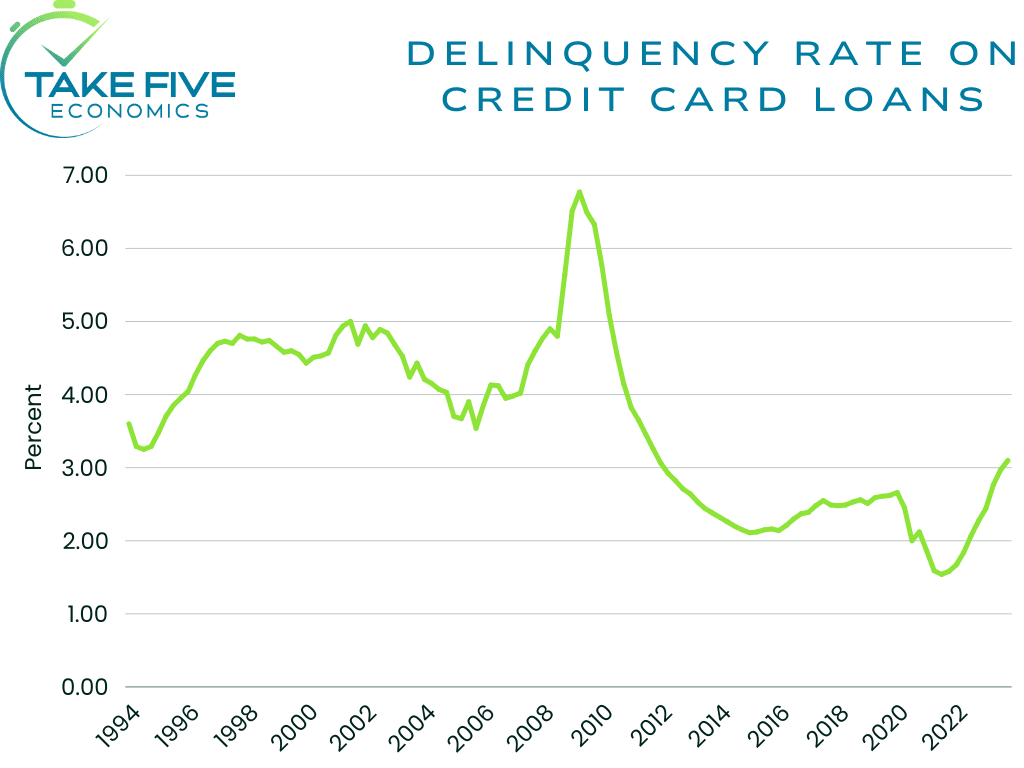

More consumers and businesses are finding it harder to deal with higher rates, as more than 3% of borrowers are considered to be delinquent as of Q4 of 2023, the highest delinquency rate since Q4 of 2011. While not as high as historical standards, the number is still rising fairly quickly.

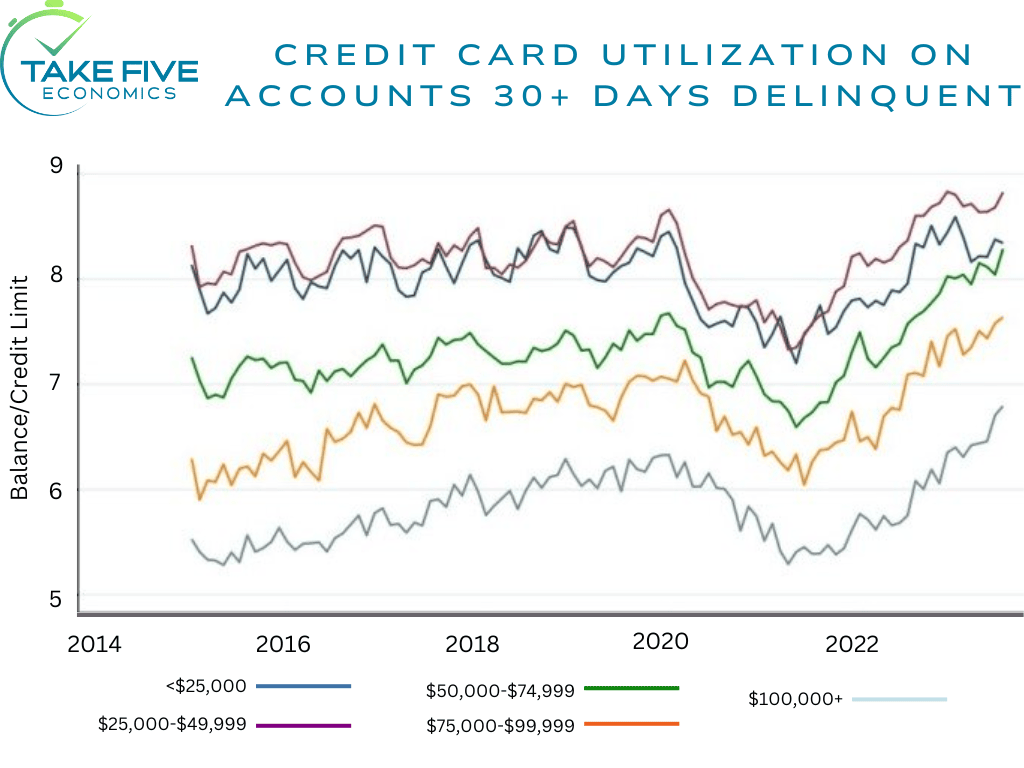

We can go even further with this as well by looking at the credit card usage on accounts who are already 30+ days past due, as these figures are also above their pre-pandemic highs (as of Q4 2023).

This is showing that the consumers who are already behind, are falling behind even further and have to tap into more, and more expensive credit to pay off their old debts, pay for essentials and bills, or just have a spending problem. Even the higher income brackets are falling behind. This chart is a visual representation of a much larger issue that we won't dive into here but stay tuned. Something similar is going on with businesses, i.e. those tip-toeing the line are at a much bigger risk of bankruptcy than what is considered normal by historical standards, even though profits for the

largest companies remain high. This is because higher interest rates haven't affected the larger companies in the way that they have with small and mid-sized ones. See our Take Five Report - "The Corporate Wealth Gap" from 9/6/23 in our Archives for more information on that matter. But you can see the effects in the junk-bond market where more of the lowest-rated junk bonds are trading at extremely low valuations now than during any non-recession period. And before we get side-tracked on the much larger debt-issue for the millionth time we'll restrain ourselves, but feel free to scour through our Archives or your inboxes for many reports where we discuss the matter. Liquidity: |

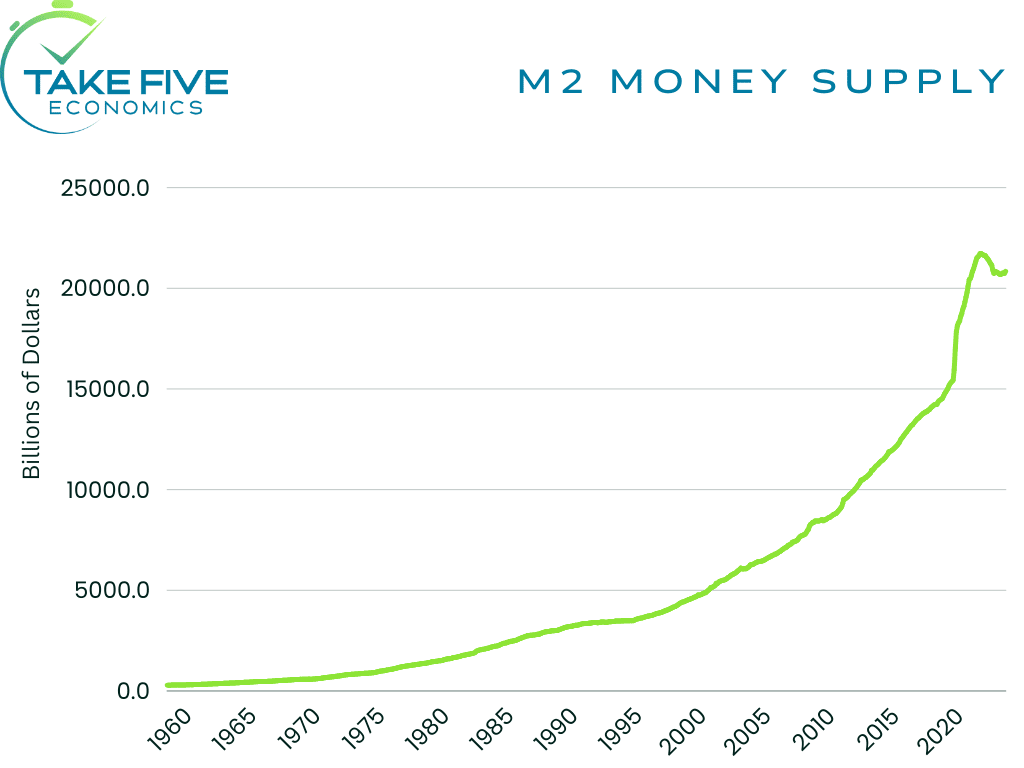

The Fed's tightening has affected the M2 money supply to a fairly great degree and it's fallen every month for the last 16 months, which is something that hasn't been done before. By all of these measures, the Fed's monetary policy is doing what it set out to do, i.e. restrict. But why are there still holes in the data, and more specifically, why aren't these effects showing up in the stock market? |

Discrepancies in the Narrative:

An economy that has an ample number of problems like the U.S.' does shouldn't be seeing its benchmark index (S&P 500) trading 2.4% below its all-time high at the same time that implied volatility (VIX) is trading at elevated levels by historical standards, or at the same time that the spread between junk bond and treasury yields is as narrow as it is, the narrowest in 30 years, or with the inverted yield curve, or with increased debt service costs combined with low demand for sed debt, or skyrocketing debt in general, the list goes on and on. As we said above, by all of these measures the Fed has done their job in tightening financial conditions but again, why are there still holes in the data, and why are these effects not showing up in the market? Because we believe that the markets are wrong, and that the rallying (with a couple corrections) since late 2022 has been based on pure greed, euphoria, and conviction (G.E.C.) rather than being backed by improving fundamental data. Labor Market: As for labor, the narrative surrounding it has been that it's cooled due to the Fed's tightening campaign, but what if that wasn't the case? What if employers actually weren't shying away from hiring due to higher rates? But the job openings rate started falling when tightening began. The initial shock of the Fed's rate hike campaign could have scared some off, but on the flip side, companies could have gotten the appropriate amount of labor fairly early on, even over-hired and have slowly started reducing their openings over the last few years which would help the rate return to its historical average. This would also confirm the notion that jobs are becoming harder to find and demand for labor is reducing. Another contributing factor could be the historically insane amounts of immigration over the last three years combined with people coming back into the workforce that allowed for jobs to be filled and wage pressures to be reduced. TS Lombard said recently that the sectors experiencing the largest declines in job opening rates (and helping to drag the index down further) are transportation, food services and health care, which faced significant recruitment challenges during and in the aftermath of the pandemic. They had some of the highest job openings rates of any sector, i.e. they hired like crazy, so now, demand for more workers isn't as high as it was since those positions are now being filled, and the rates are now returning to their historical averages. You have to remember, in the years that followed 2020, job openings rose to record levels across most industries, not just the ones mentioned above, so a natural cooling in the metric is the more likely option from where we stand rather than it being mostly from tightening financial conditions since demand on paper technically hasn't fallen and instead, has risen (more on that later). This would mean that the labor market hasn't gotten hit like the market suggests it already has, and that financial conditions haven't actually hit the labor market yet. The rise in unemployment could have simply been a combination of some firms with tighter financials (e.g. tech) laying off workers as well as an increase in the number of available workers at the same time that job opening rates were falling, making it harder for people to find jobs along with people not willing to change jobs. We would also like to bring up our Take Five Report from 9/8/23 titled 'Silent Layoffs', this will provide you with additional information as to why some industries are reducing their hiring through attrition. This is companies that are changing workplace policies or shuffling something around in order to squeeze out a small percentage of employees. For example, in an industry such as retail, Walmart has added a new system that allows them to move employees around in between different departments and into places where they might not be as familiar or comfortable. Simultaneously, they lowered the starting wage price for new employees, so for the small percentage of people that do quit as a result of this, they can be replaced at a lower cost, or they'll rely on reduced staffing if the position cannot be filled which is backed up by the decreasing job openings. Another way, and an obvious one, is through AI. Credit & Overall Consumer Demand: The trouble seen in credit is without a doubt a direct correlation to the Fed's tightening campaign, but it's not obvious that it's widespread enough to truly slow down the economy - yet, and therein lies the other issue. The problems surrounding debt, and there are so goddamn many, are being overlooked by markets because they haven't truly affected the broader economy yet. Companies with lower-income customers have gotten hit, but consumer spending as a whole has remained strong... or has it? |

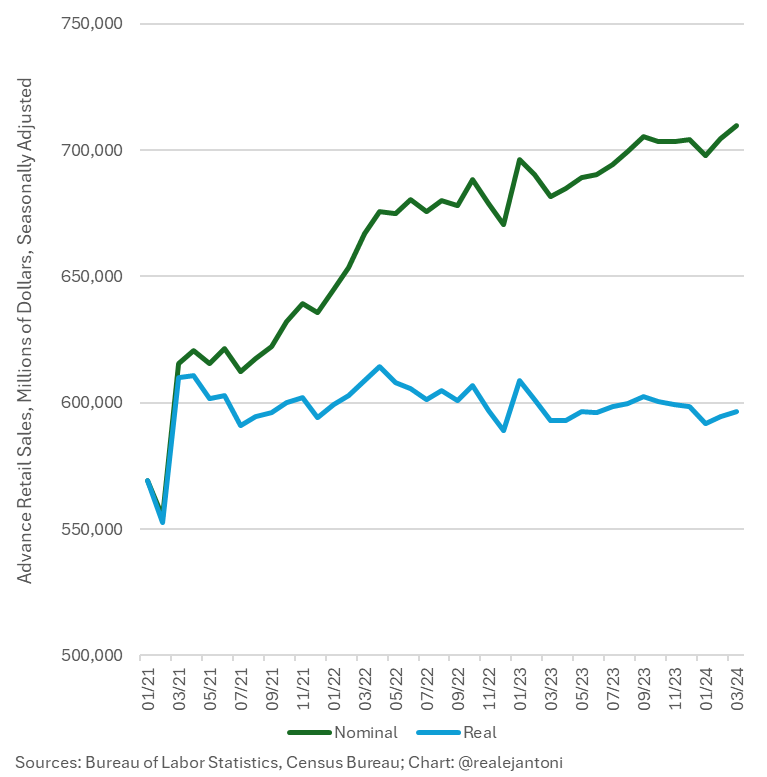

To borrow a quote from our 4/16/24 Take Five Report which also featured this chart: "As you can see, non-inflation adjusted (nominal) total sales, which is represented by the green line, have increased over 15% since March of 2021. Inflation adjusted (real) total sales, which is represented by the blue line, have actually decreased by -2.2% since that time. What this means is that consumers aren't necessarily buying more products, they're just spending more on the same ones... Real retail sales over the last year have grown just 0.2%, with nominal growing by 3.6%. Both of these figures, either way you look at it are below the historical trend of 4.7% nominal and 2.1% real." This essentially says that

demand hasn't increased by too much, and that it's been higher prices that have built profits and not a sheer increase in volume. For example, Verizon in their latest earnings call even admitted that much of their profit in Q1 came from an increase in pricing.

Earnings in 2022 despite the market plunge, advanced by 9.8%. In 2023, while the S&P soared by 25% even with the -10.2% correction from August to the very beginning of November, corporate earnings only rose by a mere 1.5% compared to the prior year, and that does take inflation into account. If the labor market were to drop as we theorized above, consumer spending along with corporate profits (and *potentially* prices) would drop as a result.

Liquidity:

The shrinking of the M2 money supply obviously isn't slowing anything down either and this is likely due to the fact that it was increased by around 33% from February 2020 to June of 2021, and then slightly more after that. So, there's plenty of liquidity still in the system.

Putting It Together:

We believe that the Fed is correct in saying that financial conditions are tighter, but we believe that the market is wrong in their thought process that the worst of it is already behind us. The market narrative is very contradictive in some areas, and we remain firm on the notion that the crash in 2022 was a psychological one produced out of fear rather than one that was backed by truly worsening fundamental data besides inflation and weaker tech earnings. And this is why we believe rallying today is more of a psychological one and a product of euphoric bets on rate-cuts rather than it being backed by true fundamentals. The problem with the markets now is that they're becoming too hyper focused on very specific areas, narratives, and data. Even their investment strategies have been far too overweight the Magnificent Seven and other large caps, but that's a conversation for another time. The market eats, sleeps, shits, and breathes the Fed, interest rates and inflation and that's why we categorize it as the dominant force of the market. Anything outside of it, goes completely overlooked a lot of the time, with a few exceptions. The market and economy are in a clear bubble from debt and inflation, the economy more so we will admit, and it is only a matter of time before it pops. |