The Take Five Report: 9/8/23

I

Markets:

I-I

Global Market Recap:

United States:

- S&P: -0.32%

- Dow: +0.17%

- Nasdaq: -0.89%

- Russell 2k: -0.99%

U.S. indexes got off to a rocky open, and all would open lower except the Dow, but it didn’t take long for it to take a nosedive. Markets following the low open would continue to steadily rise throughout the day, but still would close mostly lower.

Asia:

- Shanghai: -0.18%

- Hong Kong: closed

- Japan: -1.16%

- India: +0.50%

Asian markets finished lower in this morning’s session, with Japan leading the major indexes in losses following revised Q2 GDP figures which showed their economy grew at 4.8% compared to a 6% preliminary reading and 5.5% expectation. Hong Kong canceled their trading day due to another storm warning.

Europe:

- UK: +0.21%

- Germany: -0.14%

- France: +0.03%

- Italy: -0.20%

European markets were mixed following a volatile session yesterday. German industrial production slowed once again, and revised estimates for the Euro area economy showed only marginal growth in Q2, reigniting fears of a recession for the region.

I-II

U.S. Sectors Snapshot:

- Communication Services: +0.11%

- Consumer Discretionary: +0.50%

- Consumer Staples: +0.34%

- Energy: -0.22%

- Financials: -0.20%

- Health Care: +0.47%

- Industrials: -0.32%

- Info Tech: -1.57%

- Materials: -0.44%

- Real Estate: +0.71%

- Utilities: +1.26%

II

Technicals:

II-I

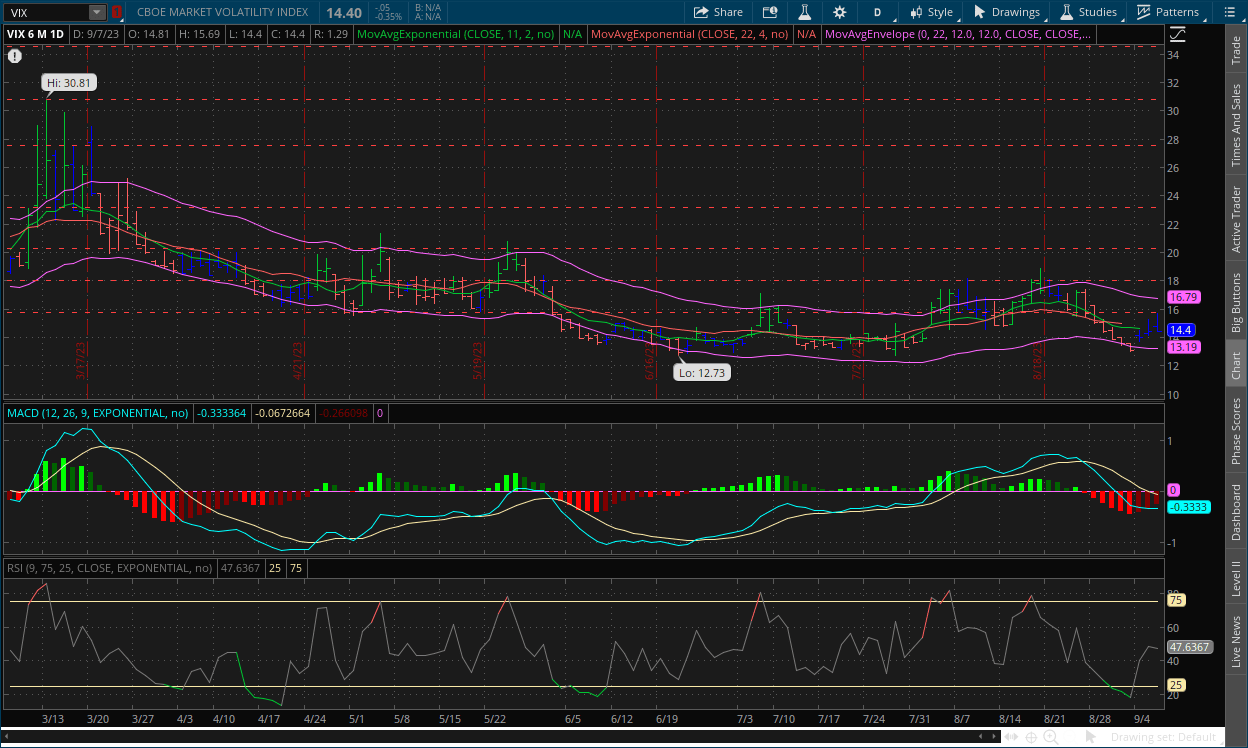

Volatility Index: (VIX)

Thursday Recap:

The VIX would open Thursday’s session at $14.81, up from the day prior. Prices would climb to a high of $15.69, but would ultimately slide for the remainder of the day as volatility tempered, and would reach a low of $14.40 and closing at the same point.

Daily Chart:

Strength would move in favor of the VIX bears for the third straight session as they gather more momentum bringing prices steadily higher. Inertia however would change very little and remain flat overall with a slight edge to the downside.

VIX bulls have been gathering momentum over the week, but price action hasn’t been as strong so far. We’ve seen prices break above the $15 minor resistance level (top of the consolidation range) twice now, with each break reaching a higher price followed by a decline back below that level, i.e. a false upside breakout. The more hits that prices have against a certain level, the more likely prices will end up moving in that direction. Therefore, at this point, we see prices in the VIX more than likely moving higher before they move lower and return to trend.

II-II

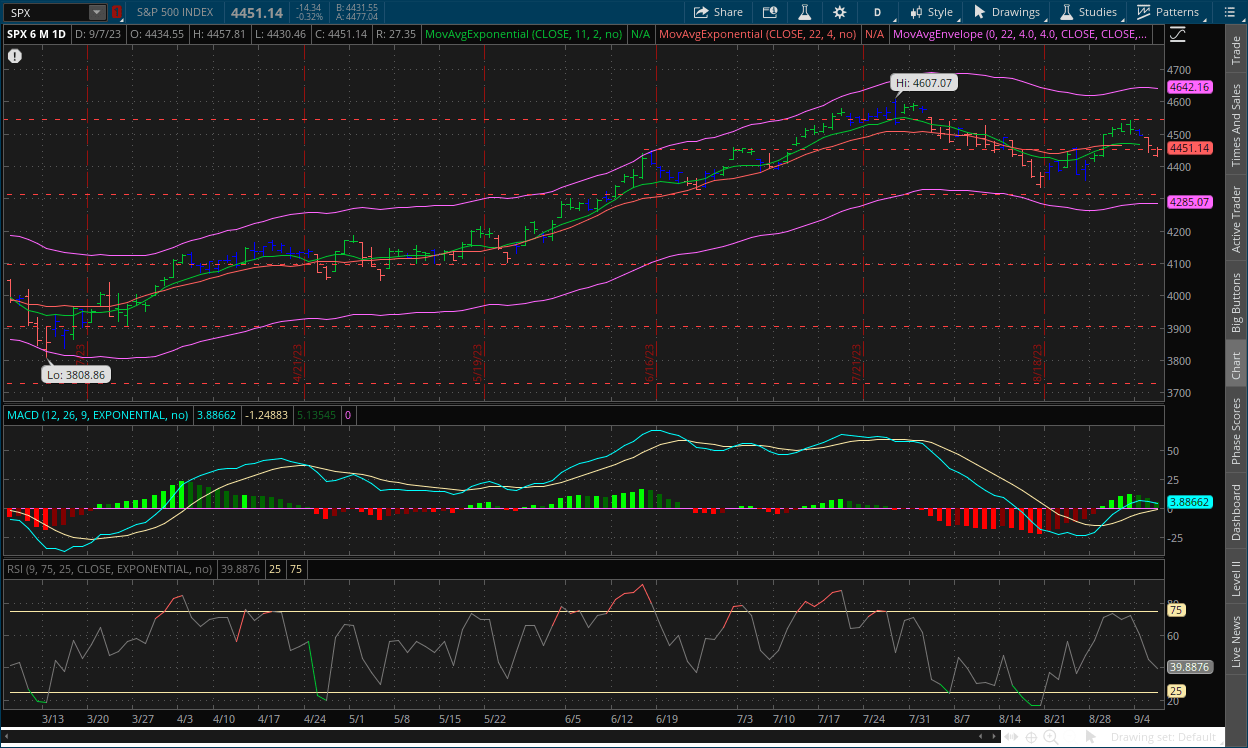

S&P 500: (SPX)

Thursday Recap:

The S&P opened the session at $4,435, and reached a low of $4,430 shortly thereafter. Prices would steadily rise throughout the day, moving to a high of $4,457 before closing at $4,451 and would ultimately still close lower on the day.

Daily Chart:

Bears would continue to push strength back towards the centerline as they gain more momentum, and are likely to bring the indicator back within their control next week if the trend continues. Inertia would move very little, and remain flat but slightly favor the bears.

The bears have gathered some momentum over the last few days, but similar to the VIX, it hasn’t been as strong. We must say however that when an indicator reaches a multi month high or low, price action will usually favor that direction over a longer period of time (i.e. a few weeks at least when this occurs on the daily chart). This happened in the MACD-H, or strength, in its last cycle below the centerline. It’s not a perfect pattern, but it happens more often than not, and with the weaker cycle above the centerline followed by a quicker trend back down, this may be what’s in store, i.e. the bears take over again for a time. The bears would need a strong break below $4,450 first, followed by an even stronger break below $4,400 and $4,300. Given the constantly changing psychology of the market due to fundamental catalysts, it’s hard to predict what will happen, especially with CPI and PPI next week that could cause markets to go in either direction.

III

Fundamentals:

III-I

Headlines:

1.) Bloomberg: Chevron LNG workers in Australia to begin strikes Friday

2.) Bloomberg: G-20 sees risks to long term growth from ‘cascading crises’

3.) Bloomberg: Russia plans to cut sea diesel exports by a quarter in September

4.) Financial Times: China’s renminbi hits 16 year low after exports tumble in August

III-II

Silent Layoffs - Companies Reducing Staff Through Attrition:

Walmart Cuts Pay for New Hires:

Walmart is paying some new store workers less than it would have three months ago, a sign that employers are seeking to cut labor costs as the once hot market for hourly staff cools. The country’s largest private employer changed its wage structure for hourly workers in mid July, according to documents reviewed by the Wall Street Journal and store workers.

Under the new structure most new hires will make the lowest possible hourly wage for that store. In the past, some new hires, such as those who collect items for online orders, would have made slightly more than other new hires such as cashiers. Walmart said the change in pay structure allows workers to move between work groups without pay impacts. “This will allow for better staffing throughout the store,” said one of the documents. The change in pay structure allows workers to do different jobs throughout the store, learning new skills to move up in the company, a Walmart spokeswoman said Thursday.

Attrition:

As for existing employees, although the new wage structure doesn’t reduce wages for them, the way they set it up allows people to move through different departments to “learn new skills” and “move up in the company”. For some, if not most, this is okay and doesn’t affect them. But for the small percentage of employees where it does, as in it adds more responsibility, “pressure”, it moves them around from places they like to other places that they’re unfamiliar with, or whatever the case may be, it squeezes those employees out and allows them to be replaced either by a new employee that they hire at a lower cost, or they don’t replace at all.

As for the new hires, because they are offering lower wages than they were just a few months ago and are now minimum wage, people are less likely to seek job openings at Walmart and will likely try and find another place to go that is paying more. So, it’s a best of both worlds scenario for Walmart in terms of cost reduction, although it is a little scummy. Walmart has also pursued other ways to reduce staff through attrition over the years, e.g. expanding the use of self checkout and automating or partially automating its warehouses. We won't get into automation and the future of retail, warehousing and other industries that are trending more in this direction today, but we will in a future discussion.

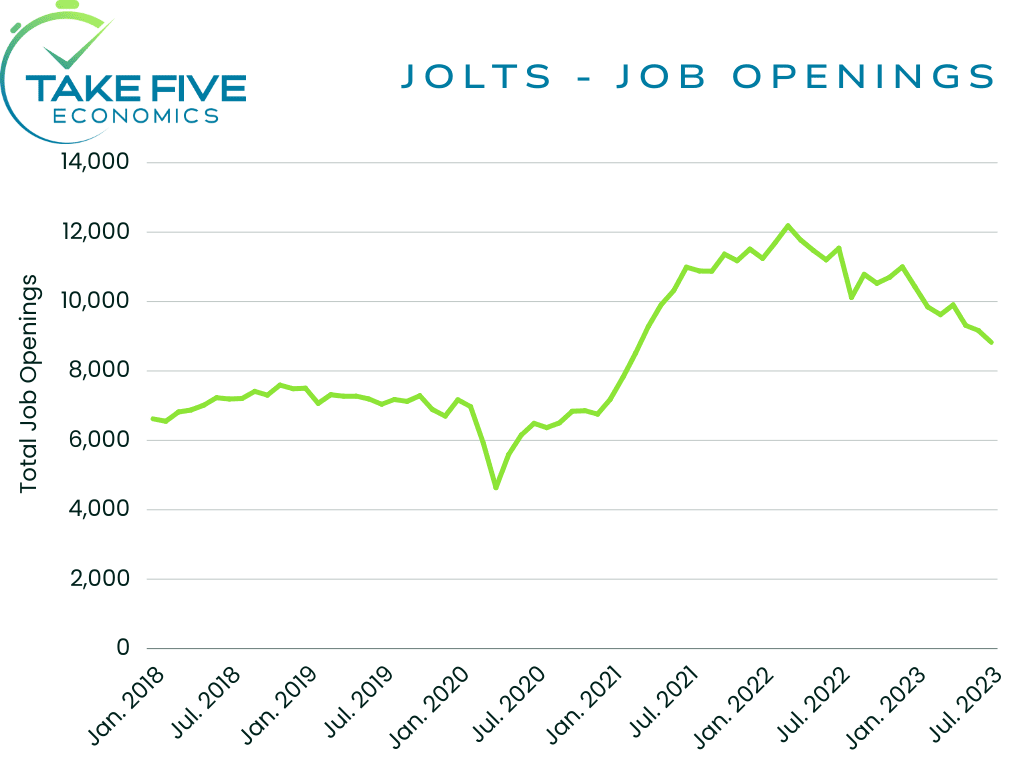

Putting It Together:

The broader U.S. jobs market is cooling. We’ve seen and discussed this over the last few months as we’ve reported on most major labor market releases. Through all of it, we’ve talked about “silent layoffs”, or companies reducing costs by firing through attrition rather than through layoffs. Walmart's new structure helps them do just that.

This is something that isn't just happening at Walmart but in many other places and industries, especially where automation or cheaper migrant workers can save margins.

IV

Market Psychology & Final Thoughts:

Futures have turned positive as we head towards the open, but only marginally and are pretty steady along with bond yields. Brent Crude and WTI futures are still rising however due to the LNG strikes in Australia, and has sent European oil and gas futures up as well. Consumer credit will be released this morning which is something we may cover next week all depending. As always, we hope you found this helpful, learned a thing or two, and have a great weekend.