Job Openings Slide to Three-Year Low in March

Highlights:

|

Index: |

February: |

March: |

Wall Street Expected: |

Take Five Expected: |

|---|---|---|---|---|

|

Job Openings: |

8.8m (r) |

8.5m |

8.7m |

8.6m |

|

Hires: |

5.8m (r) |

5.5m |

-- |

-- |

|

Total Separations |

5.5m (r) |

5.2m |

-- |

-- |

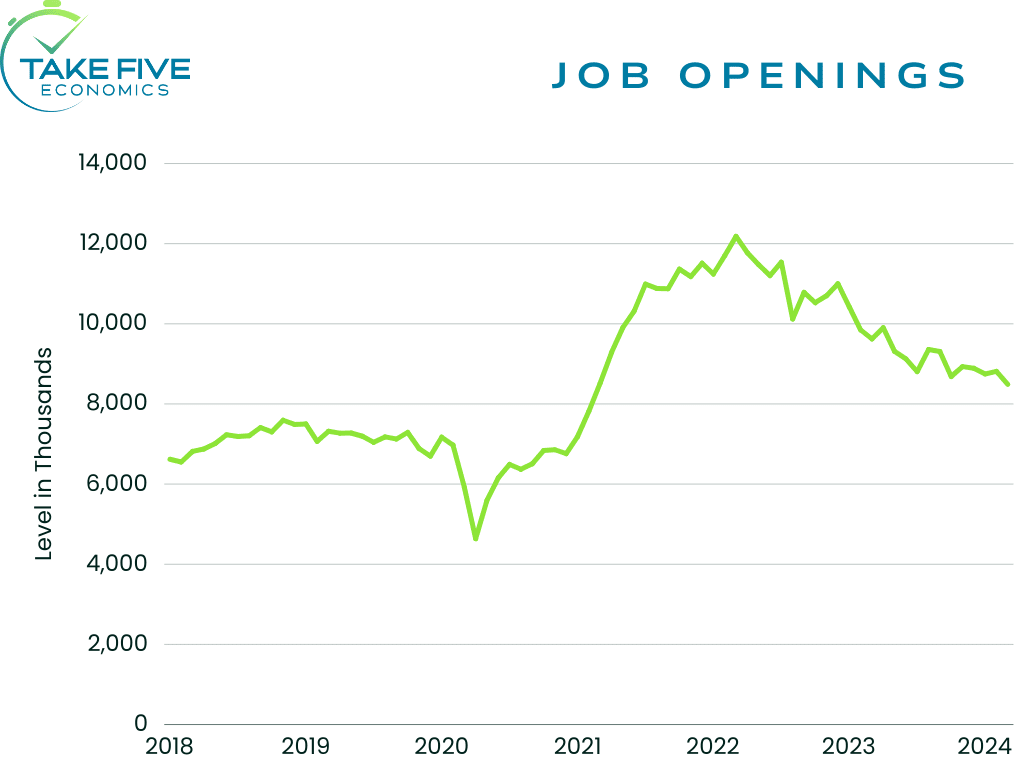

Job openings in March came in at 8.5 million which was below both Wall Street's and our own expectations and followed an upwardly revised 8.8 million (from 8.7 million) in the prior report with the job openings rate continuing its slide to 5.1% in March. The index was down -1.1 million over the past year.

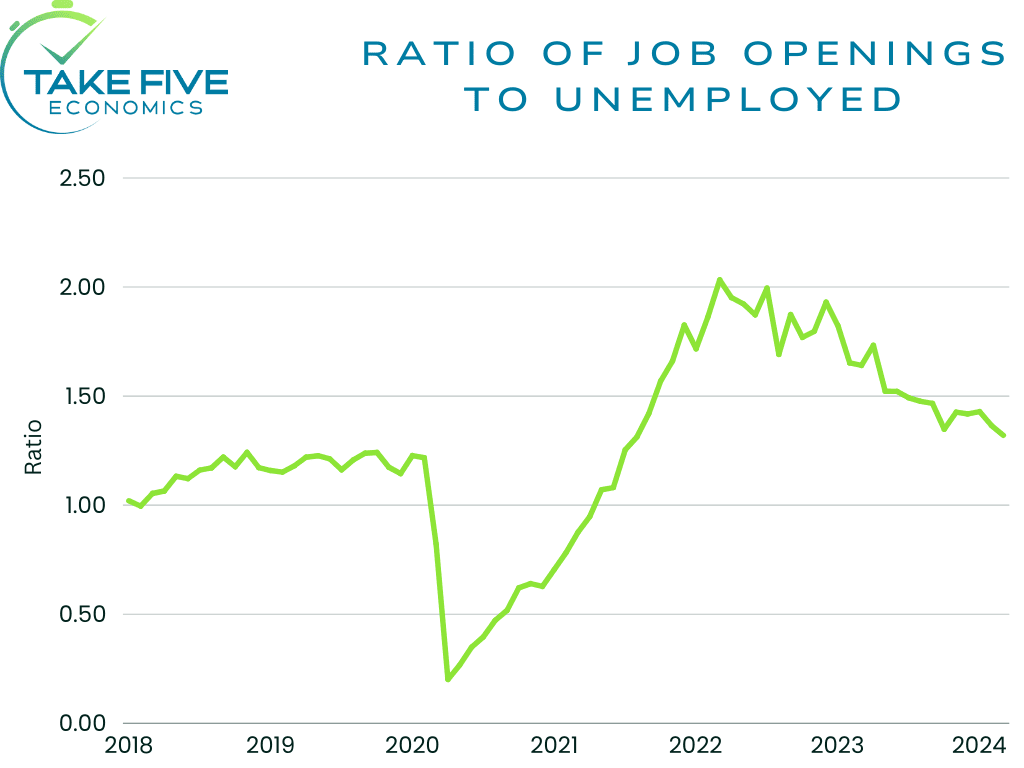

Job openings decreased in construction (-182,000) and in finance and insurance (-158,000) but increased in state and local government education (+68,000). The ratio of job openings to unemployed workers fell to 1.3 in March, the lowest level since August of 2021.

In March, the number of hires remained largely unchanged at 5.5 million, reflecting a year-over-year decrease of 455,000. The hiring rate dropped to 3.5%, matching the lowest mark since the start of the pandemic.

Additionally, the total separations decreased to 5.2 million, a decline of 339,000 from the previous month. The separation rate remained unchanged at 3.3%.

During the month, the number of quits totaled 3.3 million, down by 480,000 compared to the previous year. The quits rate, which is a measure of confidence in the labor market slid to 2.1%, the lowest since August 2020.

Meanwhile, the number and rate of layoffs and discharges remained stable at 1.5 million and 1.0%, respectively. Despite a decrease in arts, entertainment, and recreation (-39,000), there was an increase in private educational services (+18,000).

Putting It Together:

The report reflects the slowdown in labor demand that the Federal Reserve aims for, showing a decrease in job openings rather than actual job losses. The ADP employment change report released earlier today and reflected continued strength in the labor market. In this data set however, it showed that labor demand is continuously weakening. This falls in line with what we saw in the consumer confidence survey yesterday, i.e. that people are finding it harder to find and/or change jobs and that they expect labor conditions to worsen in the coming months. The JOLTS data can be taken as a net positive for the market narrative, but a net negative for the labor market. If the labor market shows more weakness, consumer spending is likely to slow along with it.