The Take Five Report: 9/6/23

I

Markets:

I-I

Global Market Recap:

United States:

- S&P: -0.42%

- Dow: -0.56%

- Nasdaq: -0.08%

- Russell 2k: -2.10%

U.S. indexes would finish lower after returning from Friday’s upbeat close on the back of poor international, as well as domestic economic data. The Dow would open close to breakeven, and prices would slide throughout the session. The S&P opened low, but ping ponged within a narrow range for the entire day while the Nasdaq opened low as well, but rallied throughout the day, and just missed on posting a gain. Small cap activity would move in favor of the bears, as the Russell 2000 lost -2.10% as speculators dumped their trading positions.

Asia:

- Shanghai: +0.12%

- Hong Kong: -0.04%

- Japan: +0.62%

- India: +0.15%

Asian markets were mostly mixed on Wednesday after Saudi Arabia and Russia extended voluntary oil production cuts until the end of the year. Hong Kong listed shares of Chinese property developer Evergrande, rallied 70% after reopening trading after 17 months down -87%, as the property sector moved 4% in the respective market, and has been extremely speculative as of late.

Europe:

- UK: -0.20%

- Germany: -0.34%

- France: -0.34%

- Italy: +0.02%

European markets closed mostly lower in yesterday’s session on the heels of poor PMI readings from many major economies. Germany’s PMI matched its prelim reading of 47.3, but France, Spain, Italy, and Eurozone all saw PMI’s decline this last month. ECB policy makers maintained the notion that they’re not putting a September rate hike off the table, their latest minutes showed.

I-II

U.S. Sectors Snapshot:

- Communication Services: +0.04%

- Consumer Discretionary: -0.09%

- Consumer Staples: -0.83%

- Energy: +0.49%

- Financials: -0.96%

- Health Care: -0.94%

- Industrials: -1.69%

- Info Tech: +0.39%

- Materials: -1.81%

- Real Estate: -0.95%

- Utilities: -1.54%

II

Technicals:

II-I

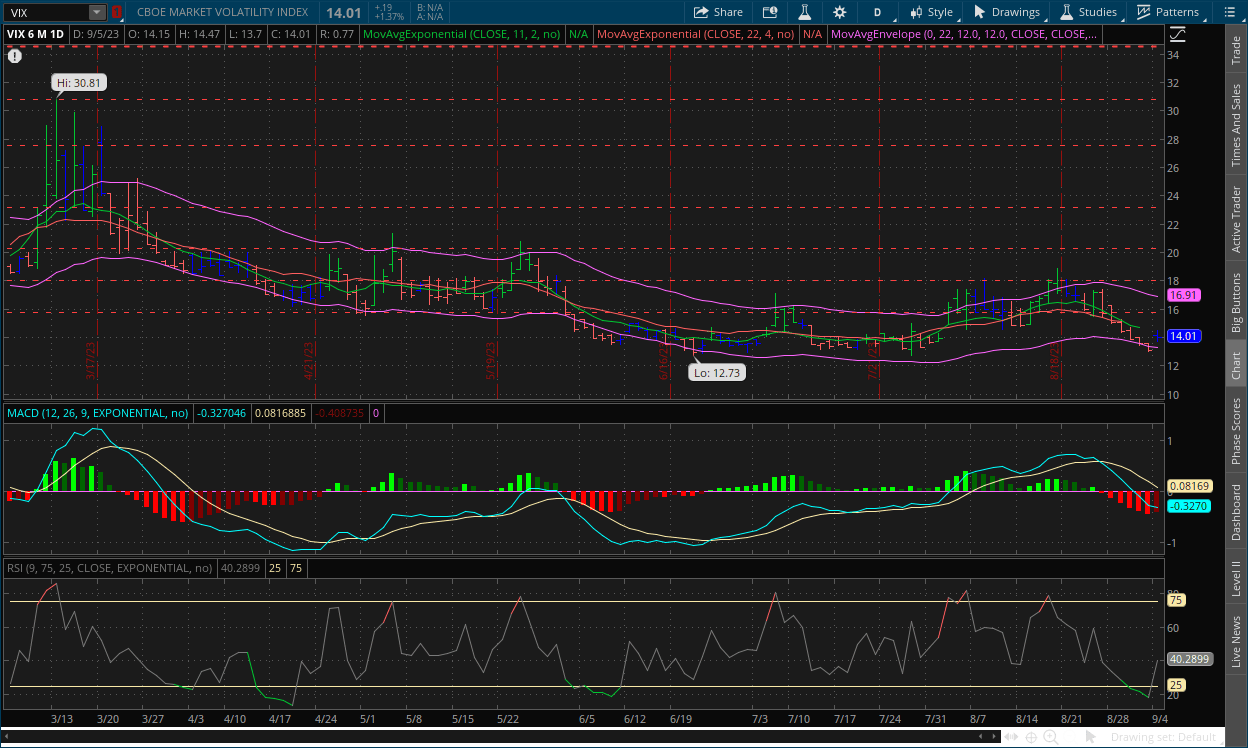

Volatility Index: (VIX)

Tuesday Recap:

The VIX would jump on the back of after hours volume and open the day at $14.15, and work its way to a high of $14.47, and fall to a low of $13.70. Prices would ultimately close near the opening price at $14.01, showing a fairly even split between bulls and bears.

Daily Chart:

Strength would move in favor of the VIX bulls in Tuesday’s session, as the VIX bulls finally let off the gas and decided to relax for another day after the long weekend. Inertia would continue to edge in favor of the VIX bears, but its slope tempered slightly compared to Friday.

Prices bounced following the hit of the $13 support level. This is where we believe the next point of consolidation will be. The MACD's break in downside momentum as well as it hitting a support level compared to other points where the indicator is below the centerline, this looks to be the most likely point of support. There were no strong signals of a reversal in terms of technicals, making the MACD's likelihood of moving too much lower very slim. What we're likely to see in this next stage is as prices consolidate around this point, the MACD will continue to edge back in favor of the VIX bulls.

II-II

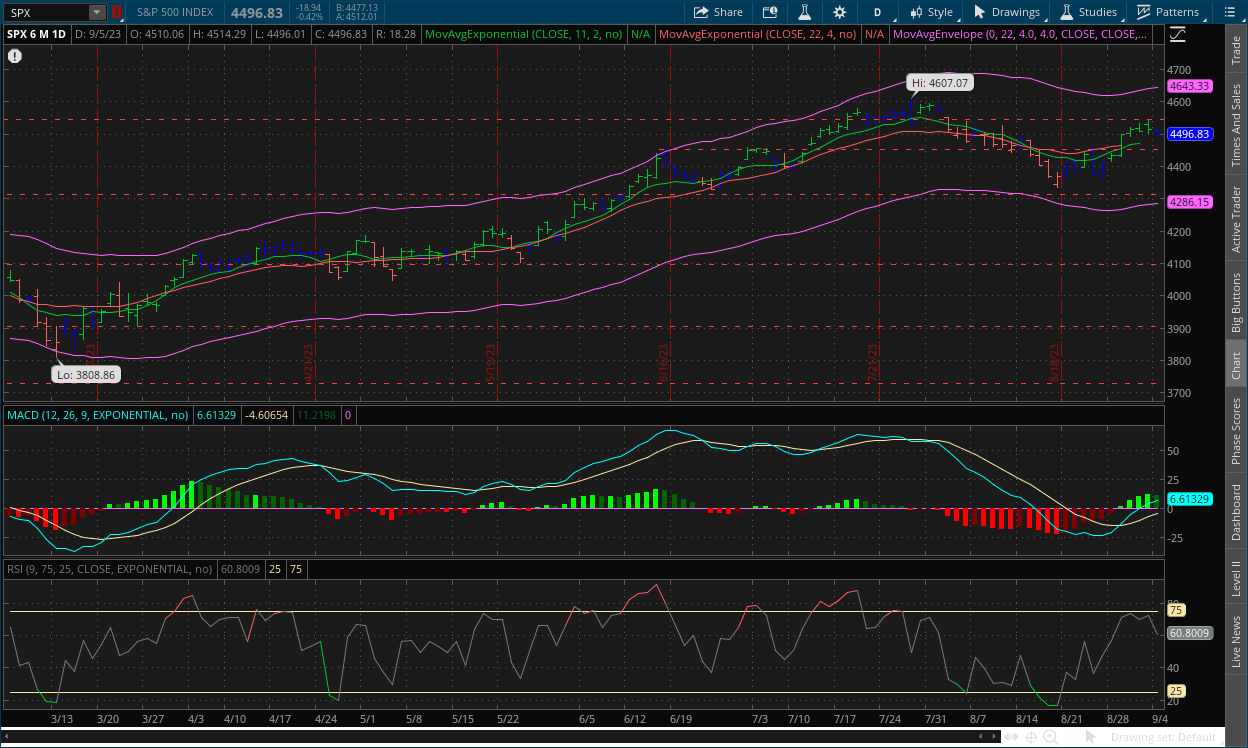

S&P 500: (SPX)

Tuesday Recap:

The S&P would open the session on a lower note at $4,510, and work to a high of only $4,514. Prices would reach a low of $4,496 which was also where they ultimately closed.

Daily Chart:

Strength would move in favor of the bears for the first time since August 14 as price action to the upside have lost its steam over the last few sessions. Inertia would also stay in favor of upward momentum, but like the VIX, its slope tempered slightly.

Prices broke above the $4,500 level and nearly the $4,550 level but were stopped at that point, and price action has tempered since doing this. The resistance level at $4,550 is acting the same as the $13 support level in the VIX, and the range of $4,500 to $4,550 will likely be where the index will consolidate for now and much of the same analysis above can be applied here as well. We still believe the bears are the likely party to take over sooner rather than later, as the longer-term technical signals are in their favor.

III

Fundamentals:

III-I

Headlines:

1.) MarketWatch: German manufacturing orders tumble in July

2.) Bloomberg: China’s distressed property developers soar in wave of speculative buying

3.) Bloomberg: Pump prices hit highest seasonal level in over a decade

4.) Wall Street Journal: Mortgage Rates hit 7.23%, highest since 2001

5.) Financial Times: Top Fed official signals interest rates to stay on hold at September meeting

III-II

The Corporate Wealth Gap:

Background:

A quote per Societe Generale Cross Asset Research; “History shows that, to the (limited) extent economists do actually predict a recession, its tardiness usually means they give up waiting just at the point it arrives (the bus stop dilemma).” The resilience of corporate profits within large-caps so far has been a key reason why recessionary forces have been fended off, especially as companies in aggregate (i.e. all companies total) are now a beneficiary of higher rates. Yet beneath the mega caps the vast bulk of companies are in trouble.

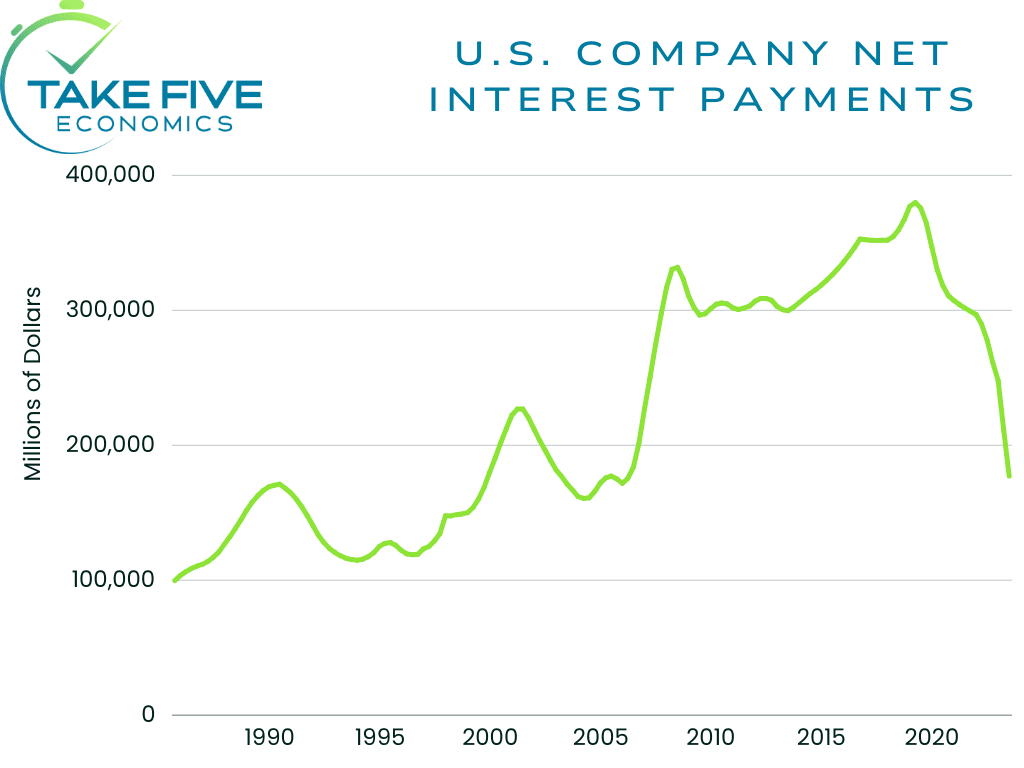

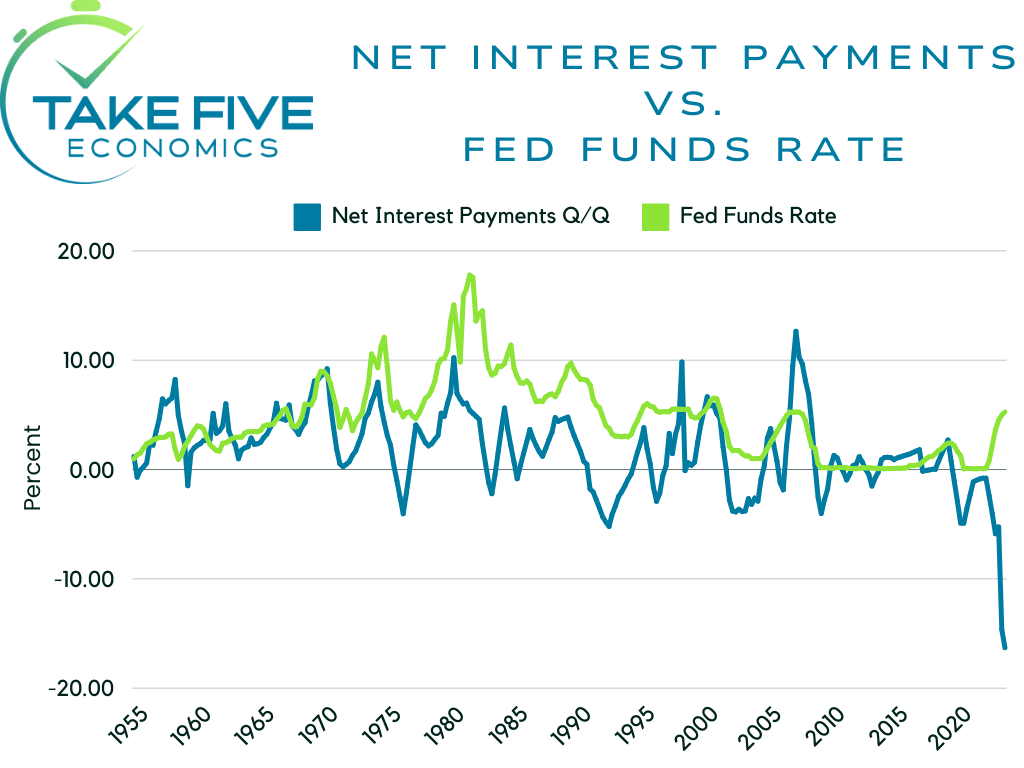

The U.S. corporate sector is a massive borrower, it runs and expands off of debt. Normally, when interest rates rise, so do net debt payments (i.e. the book value of debt on balance sheet, less current assets), which squeezes profit margins and slows the economy. But this isn’t the case this time around. The case this time is that net interest payments have actually gone down as interest rates have risen, as you can see in the chart above, which shows the dollar amount of net interest payments as well as the chart below showing it against the Federal Funds Rate.

How This is Happening:

The purpose of the Fed’s policy is to slow the economy, and in large part by squeezing the corporate sector directly by higher interest payments, as well as indirectly by slowing customer demand. Earnings recessions are a leading indicator of an economic recession, because after profits fall, companies begin to cut back on spending/investment and hiring.

The inverted yield curve (i.e. when long term rates yield less than short term rates) means that short term deposits are paying higher yields than long term loans. So because of the inverted yield curve, the largest and wealthiest companies, e.g. Apple, Amazon, Tesla, Microsoft, are able to borrow long (i.e. 10, 20, 30 years) by issuing bonds at lower rates (because of the demand for them) but are able to make more in the short term with their cash deposits because of their access to the corporate bond market, essentially playing the yield curve in reverse, becoming a beneficiary of higher rates; meaning interest rates very simply, aren’t having the same effect as they once did.

Take this for example: Imagine Apple wants to deposit $1 billion into short term treasuries that yield 5% or into a money market fund (see 8/21/23 report) that yields 5%-6% (because of their access to the Fed’s REPO facility) but then goes and borrows that back on a ten, twenty, or thirty year basis at roughly 4%. In other words, they’re using the cash they’re receiving from money market funds or short-term treasuries to pay off their long-term debt while making an additional return of roughly 1% on top of it and essentially getting paid to borrow money, rendering interest rates useless to larger corporate entities who are able to pull this off.

The largest 10% of companies (150 stocks in the S&P 500, representing a $48B market cap or higher) represent 62% of the overall non-financial market cap of the S&P 1500, which represents 500 large caps (i.e. S&P 500, markets benchmark index), 600 small caps, and 400 mid-caps. So far, interest rates aren’t yet having much of an effect on the balance sheet stress of the overall market. But the further you move away from large-caps, the harder things are becoming. The effective interest rate percentage for larger companies is roughly 4% on average, but for the middle 40%, it’s around 5% on average, and for the bottom 50%, it’s over 6%.

This is one reason why we’ve seen corporate bankruptcies skyrocket this year up to 402, already surpassing last year's total and nearly on par with 2020 which saw 407 total, which is only surpassed by the GFC in 2008.

This is a problem that needs to be addressed at some point, but we know it likely never will, and it is a corporate representation of the individual wealth gaps that are helping to crush the lower and middle class in this country. With the top 10% of stocks' ability to essentially become banks themselves while the bottom 90% still can only function as normal, it gives those larger stocks a built-in advantage that will only allow them to grow and consume more of their share of the market over time and makes it 10x harder for the bottom 90% to grow beyond the point they're at now.

IV

Market Psychology & Final Thoughts:

We’re likely headed for a lower open as futures are still in the red. Fundamental data has been getting weaker as time has moved on, and not just domestically, but globally. Market participants however are still chiefly focused on central banks, and when they’re tightening policies will subside. Central banks around the world are being careful not to push markets into a state of euphoria again, as that could have a negative impact and cause higher inflation to return, and forcing them to keep hiking rates. Markets are in a state of uncertainty right now, and we expect more consolidation ahead for the time being. As always, we hope you found this helpful, learned a thing or two, and have a great day.