Retail Sales Beats Expectations, But Something Just Ain't Right

Highlights:

|

Index: |

Aug. |

Sept. |

Wall Street Expected: |

Take Five Expected: |

|---|---|---|---|---|

|

Headline Retail Sales: |

0.1% |

0.4% |

0.3% |

0.3% |

|

Core Retail Sales: |

0.2%(r) |

0.5% |

0.1% |

0.3% |

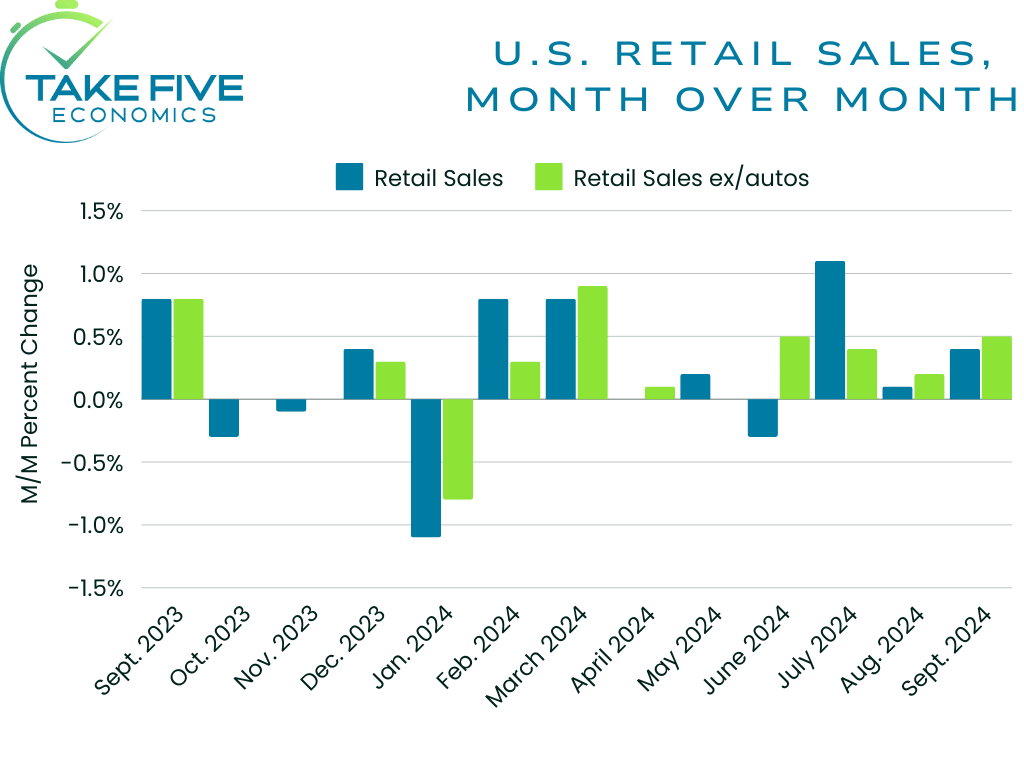

Headline retail sales rose by 0.5% month over month in September, beating both our own expectations as well as Wall Street's. This followed a 0.1% rise in the prior report.

Core Retail Sales (retail sales ex. autos) came in at a surprising 0.5%, well above Wall Street's expectations and our own. This followed an upwardly revised 0.2% (from 0.1%) in the August read.

Finer Details:

A total of 9 out of the 13 indexes advanced in the September read, with miscellaneous retail stores seeing the biggest jump of 4.0% over the month. These are stores that are specific to one specialization. Other advances came from clothing and clothing accessories stores (1.5%), health and personal care stores (1.1%), food and beverage stores, e.g. grocery stores (1.0%), food services and drinking places, e.g. restaurants (1.0%), general merchandise stores (0.5%), nonstore retailers, e.g. e-commerce (0.4%), sporting goods and hobby stores (0.3%), and building material, garden and supplies dealers (0.2%)

The monthly declines were led by electronics and appliance stores, with a -3.3% drop, with furniture stores falling by -1.4%. Gasoline stations dropped by -1.6% in September while motor vehicle and parts dealers came in flat. This contributed to a 0.7% gain in the "super-core" (retail sales ex. autos and gas) reading of 0.7% over the month.

Putting It Together:

For those who read yesterday's Take Five Report, you see and understand why I'm becoming a little weary of the seasonal adjustments that the agencies are releasing. It's not that I have the tin foil hat on, it's that I just believe that the seasonal adjustments being made are wrong (and maybe stretched just a bit). I think it's more negligence than anything else.

I'll steal a couple paragraphs from yesterday's Take Five Report: " Recently in the establishment survey, 800,000 non-seasonally adjusted teachers got seasonally adjusted to 31,000 establishment jobs in September. Now, since they seasonally adjusted away teachers going back to work, government jobs should be close to zero in terms of a month over month gain. But what we're looking at is the household data, not the establishment data. In this data set, the seasonally adjusted read from August to September explodes from 21.431 million to 22.216 million, 785,000 total... On the non-seasonally adjusted side, the total is up over 1.3 million, which is probably where the teachers fall into, i.e. the difference between those 2 numbers... But even with the teachers seasonally adjusted out, there was still the 785,000 gain and it completely changed the entire report, and it doesn't make sense as to why." Where and what are these jobs?

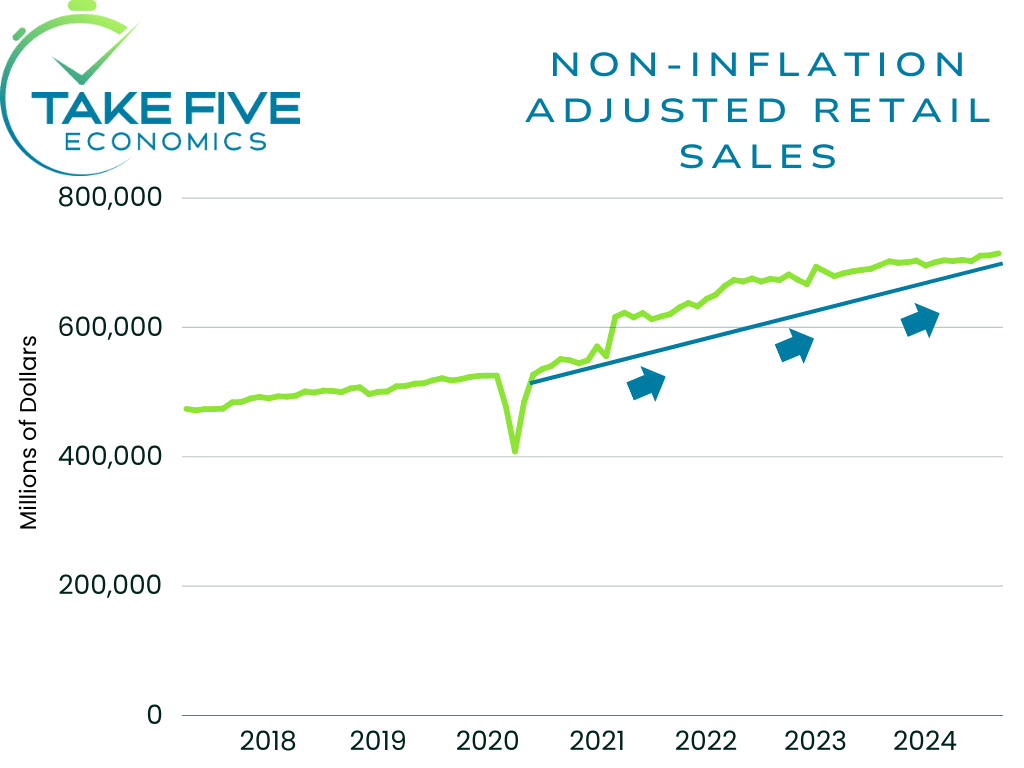

Applying that to the retail sales data we got this morning: on a seasonally adjusted basis, retail sales rose by 1.7% year over year, but on a non-seasonally adjusted basis, they were essentially flat in terms of a percentage, but overall down by -$223 million.

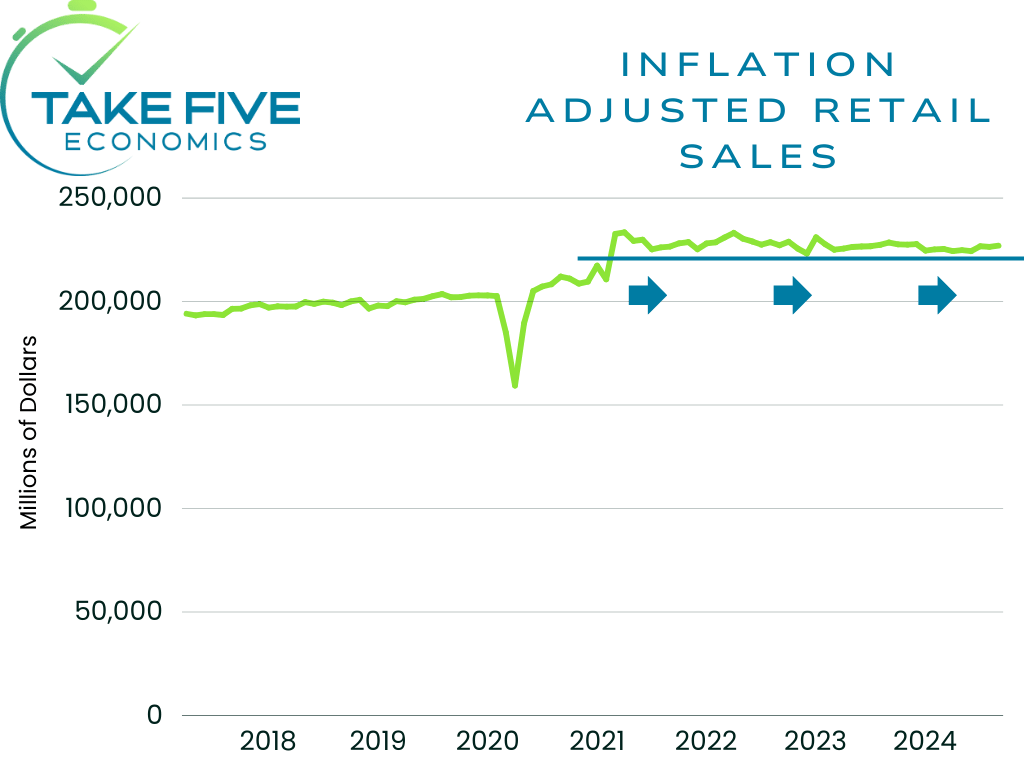

What's even more interesting is the real retail sales figures, which is when you factor in CPI and is something we've talked about multiple times.

As you can see, when accounting for CPI adjusted dollars, the trend for retail sales is essentially flat. Meaning people aren't necessarily buying more but spending more money on the same things. The inflation adjusted chart and trend look a lot more like the non-seasonally adjusted figure and trend. Listen I don't want to be a bear, but I won't ignore the discrepancies either.

Putting it together though, this was a net plus for the market narrative. Participants have shifted their mindset to look for more catalysts that imply growth and stability. Before the Fed cut rates, a bad jobs or retail sales report was considered good (insanity) because people saw it as inflationary. Since they've cut rates, it's now back to normalcy in some sense. But again, they're ignoring the larger picture as they often do.

The blowout jobs report was an indication that this data was going to come in above expectations, something I overlooked a little bit when making my forecast. So the following jobs data will be something to watch out for when looking ahead to October's retail sales read.