Trump's Economic Plan

Background:

The entire premise of "Trumpenomics" centers around lower taxes and interest rates. Many Wall Street firms believe that Trump is going to push inflation higher because he's more likely to run higher debts and cut taxes in order to stimulate spending.

I don't believe that this is going to be the case. If you look at the level interest rates were at while Trump was in office during his first term as well as the 2017 Tax Cut and Jobs Act, it tells a different story. We actually saw a lot of stimulative growth, a reduction in taxation combined with lower levels of inflation.

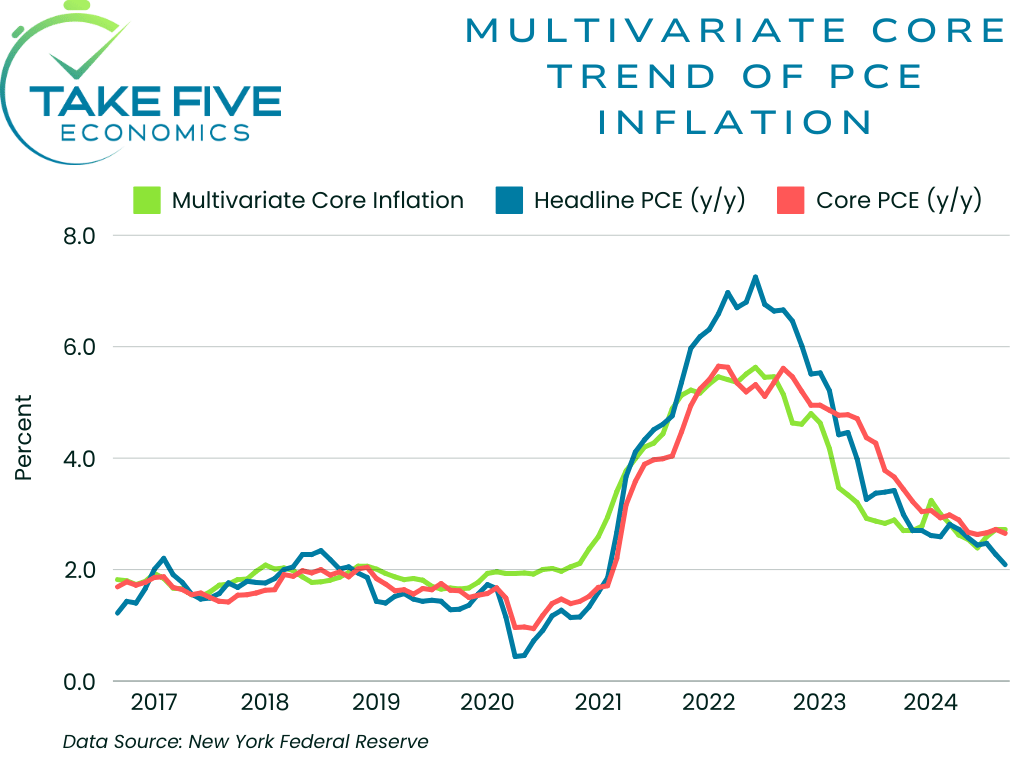

If you look at the multivariate core trend of inflation provided by the NY Fed, the Tax Cut and Jobs Act was passed when multivariate core inflation sat around 2.8% year over year. From that moment on, it never exceeded 2.8% again and actually trended down.

So, while many economists and Wall Street firms believe that a Trump presidency would lead to higher levels of inflation, I just don't believe that will be the case. This is what Treasury yields seem to be pricing in right now. The Fed gave us a 50.

basis point cut, and yields rose by 75 basis points, effectively undoing their attempt at easing policy and tightening financial conditions more than they were before.

Growth Through Tariffs:

McKinley:

Trump gives a lot of credit to our 25th president William Mckinley, who was essentially able to raise enough revenue through tariffs to enable tax reductions and stimulate growth in the economy. Trump and Vance have said that they want to tax less while providing markets and businesses with more money by growing GDP. Lowering corporate taxes and abolishing income tax (fingers crossed) would no doubt accomplish that feat. Since the U.S. imports more than it exports, higher tariffs would be a partial way to offset the revenue the country gets from its current tax policies. If you factor in Trump's other plans to clean up the budget, bringing back manufacturing and oil production, etc., it plants the seeds for further future growth, which may be able to offset everything in its entirety.

It's important to have some context with the McKinley comparison though. McKinley was president from 1897-1901 when the U.S. was coming out of a recession, and it was fairly easy to have growth since we were coming out of a bottom and in the midst of the industrial revolution. It makes sense why they refer to him but consider the factors of then vs. now. You can make the argument that AI is the next industrial revolution, which I full heartedly believe could be the case. But in making that point, it means they could be right in their comparison.

The Plan:

Trump plans to institute tariffs of 60%-100% on China and a 10% tariff across the board on other countries. While estimates vary across Wall Street, the consensus is that this will add about $1,700 in expenses to the average American per year.

I disagree with this one too, but I believe the research is flawed. Most firms such as the Peterson Institute, are assuming that the 2018-2019 trade war that the U.S. and China had will have a similar impact today as it did then. If that were to be the case, then we would see roughly that amount of an increase in yearly expenses for the average American. The difference between now and then is that businesses have much less pricing power today than they did during that time. As I've talked about in the Take Five Report, "The average American is pretty much tapped, let's be honest. Companies have little room to keep raising prices because average consumers can barely afford the prices where they stand now and are also becoming a lot more selective with what they purchase and rightfully so. Companies had all of the pricing power in the world during and the years after covid, but that has slowly started to dissipate, thus helping to bring down inflation. If their pricing power is gone, then so is higher levels of inflation."

Lower income and corporate taxes would also help with the affordability aspect and the lower levels of demand. More money is kept by the consumer with this policy, allowing them to have more disposable income for discretionary purchases, investments, housing, and more. Companies' margins benefit from lower taxes it as well, combined with a potential increase in volume, making it a likely win-win scenario for both sides.

Another benefit is that Covid substantially expanded supply chains, making them more capable of providing more product at lower costs. Meaning that the greater saturation of products combined with less demand contributes to disinflation, not higher levels of it like you could have had in 2018 and 2019 when the U.S. China Trade War was taking place.

Lastly, tariffs are not sanctions. Sanctions are a form of economic punishment whereas tariffs are a tax on traded goods, which can give more power to negotiate with other countries and I do believe that is what he's trying to accomplish with this ("The Art of the Deal").

Immigration:

Mass immigration without due process is what destroys countries, a consistent principle that has occurred throughout history. Trump is aware of this, and plans to secure the border and deport the millions that have come into the U.S. over the last few years. How successful he'll be in this venture is up for debate, but the policy itself when it comes to the economy is the right call.

Everyday American's are struggling to pay for everyday essentials such as housing, food, gas, etc. Adding millions of people sends a shockwave through the system. Simultaneously, these new people are receiving free housing, health care, and spending allowances provided by the Federal government using the American taxpayer's money. Not only does this get paid for by the American people, it increases the overall competitiveness for labor, income, and housing and increases demand for the same everyday items that people need.

The increase in demand compared to the supply for each product, whether that be gas, housing, food, etc., drives up the costs for them. Making it harder for the American citizen to survive. On top of that, the new lot of people can mostly be hired at cheaper labor costs, allowing companies and businesses to sustain margins at a time where taxes are being pushed up, input costs are higher, and overall demand is flat. The allowance that is received is not only paid for by the American taxpayer, but it also contributes to a devaluing dollar, or inflation as well, as more money needs to be printed to cover these costs.

Securing the border and getting rid of unnecessary expenses will allow the new administration to lower taxes without a negative impact to GDP, and to support lower interest rates without the threat of rising inflation.

Bottom Line:

Trump's economic plan is one that I strongly believe in. Lower taxes across the board I think is a big win. The 2017 Tax Cuts & Jobs Act was very stimulative for the economy, and it prevented us from really slowing down, which was a big fear in 2018 and 2019. I think what we should be doing this instead of handing out money before giving it back to our own people first. Giving it back to our citizens and businesses (big and small) is how you achieve organic economic growth through demand and investment. The argument that he will cause higher inflation is flawed. If anything, this will help balance the scale a little bit more.