Upon Deeper Look, This Month's Payroll Data May Not Be as Bullish for Stocks as Initially Thought

September 4, 2023

These numbers are not where the Fed wants them to be in order to say they’re ending their tightening cycle, which is one of the reasons why bond yields started to rise and price action within equities started falling after market participants digested the data.

The Corporate Wealth Gap

September 6, 2023

The resilience of corporate profits has been a key reason why we believe that a much larger recession has been delayed, especially as companies in aggregate are now a beneficiary of higher rates. Yet beneath the mega caps the vast bulk of companies are in trouble.

Renewed Inflationary Pressures? OPEC+ Cuts Production Again

September 7, 2023

This was something we expected and factored in. We looked at the geopolitical landscape specifically, and the question boiled down to this: From their point of view, why wouldn’t they extend and/or increase production cuts?

Silent Layoffs

September 8, 2023

Over the last few months, we’ve talked about “silent layoffs”, or companies reducing costs by firing through attrition rather than through conventional layoffs. This new information shows how one of the globe's biggest enterprises is accomplishing just that.

A Window of Opportunity is Opening Up for Bears

September 11, 2023

The near-term fundamental and technical signals support speculative psychological behavior, which is what has been driving prices up, but the longer-term analysis of the two forces is showing weakness in the current trend, giving the bears an edge over the bulls going forward, allowing the psychology of the crowd to shift at one point or another.

The Rise in Energy Costs, Its Effects, and Our Outlook

September 14, 2023

Prices will likely continue to rise in the coming months, but slowing demand has also been a key issue to look out for as this is one of the main reasons why production cuts have been enacted. This could be looked at as more speculative, but it's too early to tell right now from what we can see. But again, we ask the question of will global demand stay the same, rise, or continue to slow and balance out price stability?

Are Stocks About to Reverse?

September 15, 2023

The weakness in the bulls is reflected clear as day in the technical signals. This latest push following the bearish reads in CPI and PPI, we're looking at as a last-ditch effort by the bulls to continue their trend. The bears' time to shine is quickly approaching.

Stocks Have Reached a Breaking Point

September 18, 2023

Based on our formula (i.e. Technical + Fundamental = Psychological/Market Direction), the technical force is signaling that the bears' opportunity to shift the market is quickly approaching while the fundamental force is showing data that has been overly bearish in an extremely sensitive market environment. This will allow the psychological force to shift in the bears favor once the speculation frenzy is broken, which again, is likely imminent.

UAW Strike - What You Need to Know

September 19, 2023

A complete breakdown of why the UAW is planning to strike, what their demands are, and how they're planning to do it in a way that differs from other strikes as well as some clarification on misinformation.

It's FOMC Day

September 20, 2023

All of the different fundamental data that has been released over the last few weeks has been mostly bearish, but the bulls have been doing their best to hold the line. However, you can't fight the Fed, that's rule #1 of the markets. If Powell and the Fed are more hawkish than anything else today and deliver a rate hike, it will likely be the straw that breaks the camel's back for bulls.

The Straw That Just Broke the Market's Back

September 21, 2023

Markets despite the Fed’s optimism on their outlook were spooked by two things: a.) higher for longer, and b.) a soft landing is not the Fed’s base case scenario. As we said yesterday, a hawkish Fed or a rate hike will likely be the straw that breaks the camel's back, or the bulls' back in this case.

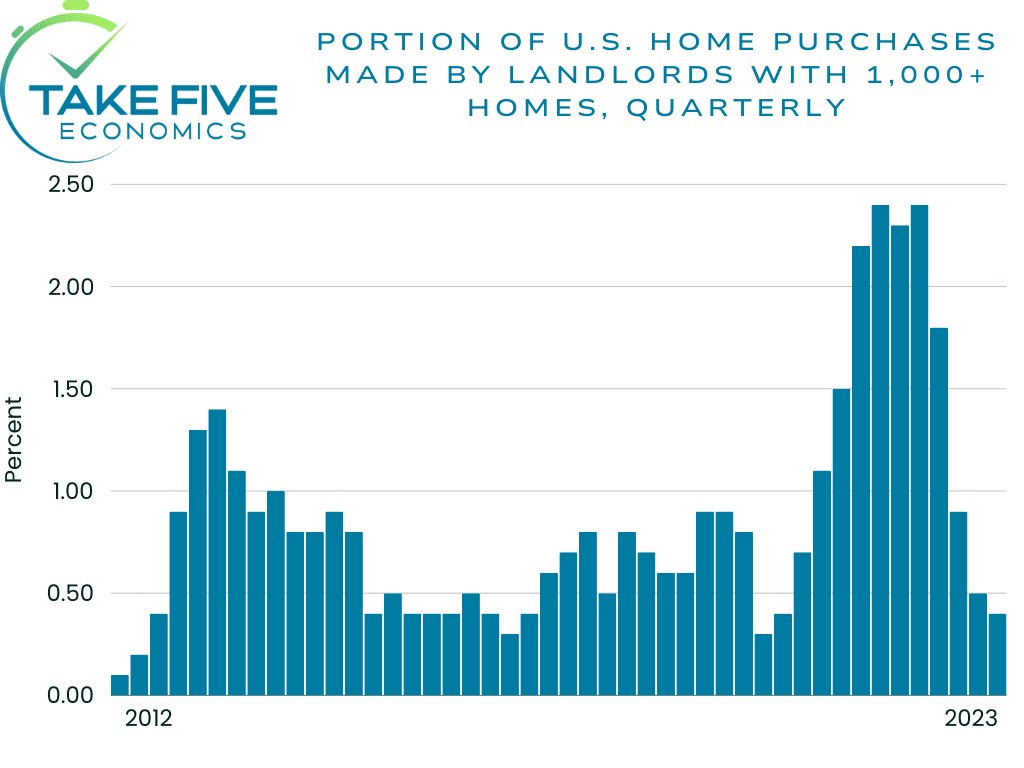

Why are Major Institutions Becoming Net Sellers for Real Estate?

September 22, 2023

Higher borrowing costs and the shortage of properties have slowed home buying from Wall Street’s real estate giants, limiting their ability to grow at the same time rents are climbing. Financing has become extremely expensive, and competition is harsh from the people who are willing to pay a premium for the few homes that are actually hitting the market. Prices have pushed past what some companies like AMH and Invitation Homes can pay or are willing to pay and still meet profit targets.

It's a Loaded Week for Economic Data

September 25, 2023

Potential bear traps are everywhere this week, and we believe Wall Street's estimates are far too dovish. The fundamental force of the market and economy have been moving in favor of the bears, and we can't see why it would suddenly change.

Will Congress Shut Down Over Omnibus Bills?

September 26, 2023

On September 30 the government needs to pass new spending bills or a “continuing resolution” bill that extends government funding and spending through the fiscal year. If they don’t, it leads to a lack of congressionally authorized funding and forces certain functions of government to shut down. This tends to occur when there are disagreements over budget allocations, which is the case today.

The Bears Have Broken the Back of the Bulls Once Again

September 27, 2023

The bears shattered below the $4,300 support level of the S&P in yesterday’s session as fear begins to grip markets even more. The key for bears is to keep prices below this level, but even if the bulls do retake it, we don’t think the trend reverses back to previous highs for some time.

Small Caps Just Gave a Big Warning Signal

September 28, 2023

The Russell 2000 small cap index confirmed a move towards a bearish trend after breaking below key support levels, as the outlook for small caps is fairly negative as we head into the fall season. Small caps giving this signal is a broad market warning sign because they are the ones most sensitive to a recession and shifts in the psychological tide.

Bear Steepening vs. Bull Steepening

September 29, 2023

The famous inverted yield curve (i.e. when short term yields are higher than long term yields) between the 10-year and 2-year treasury bonds is steepening, and no it doesn’t mean the difference between the two is getting wider, it’s actually closing. But is that a good thing? History says it depends.