The Take Five Report: 9/21/23

I

Markets:

I-I

Global Market Recap:

United States:

- S&P: -0.94%

- Dow: -0.22%

- Nasdaq: -1.53%

- Russell 2k: -0.90%

U.S. indexes opened the day on a positive note, and would rally throughout the day leading up to the Fed’s policy meeting. Once the meeting was underway, markets became more volatile, and following the decision (spoiler - no rate hike) and Powell’s speech, markets plummeted through the close and caused all major indexes to lose ground on the day.

Asia:

- Shanghai: -0.77%

- Hong Kong: -1.29%

- Japan: -1.37%

- India: -0.85%

Asian markets fell across the board this morning along with the US markets yesterday following the Federal Reserve’s meeting that made it clear that rates will be higher for longer.

Europe:

- UK: +0.93%

- Germany: +0.75%

- France: +0.67%

- Italy: +1.64%

European markets rallied on Wednesday with the U.S. market leading into the Fed meeting. However European stocks would close before the policy meeting took place. U.K. inflation came in below expectations Wednesday at 6.7% for August, down slightly from the previous month. Economists polled by Reuters had anticipated the headline figure would come in at 7% year over year.

I-II

U.S. Sectors Snapshot:

Communication Services: -1.89%

Consumer Discretionary: -1.09%

Consumer Staples: +0.15%

Energy: -0.96%

Financials: -0.66%

Health Care: +0.02%

Industrials: -0.39%

Info Tech: -1.77%

Materials: -1.03%

Real Estate: +0.13%

Utilities: +0.10%

II

Technicals:

II-I

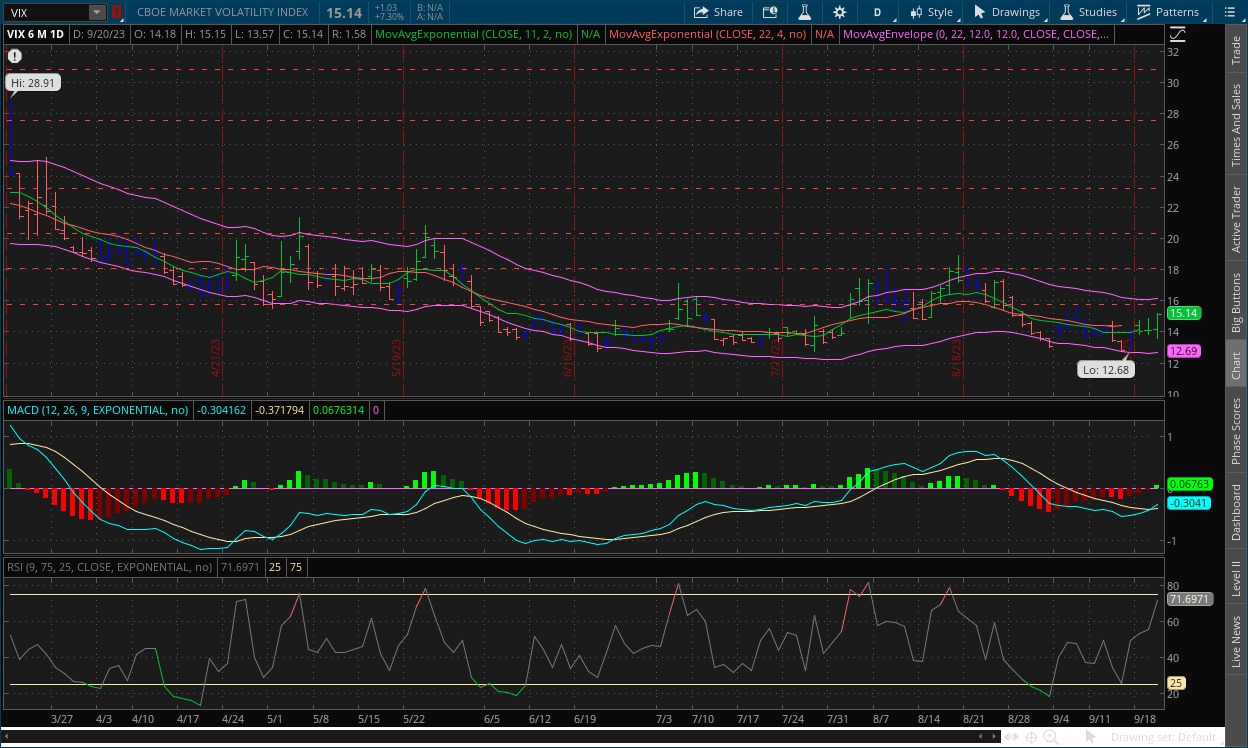

Volatility Index: (VIX)

Wednesday Recap:

The VIX opened the day flat at $14.18 and slid to a low of $13.57 in the first half of the session. After the Fed’s policy meeting, prices jumped off their lows and rallied through the close. Reaching a high of $15.15 and closing just below that mark at $15.14.

Daily Chart:

Strength moved in favor of the VIX bulls in yesterday’s session, and they were able to move the indicator back above the centerline to start another cycle above it. Inertia shifted more in favor of the VIX bulls as well, but again, still down overall as they have a lot of ground to make up in order to truly shift momentum.

In yesterday’s report: “The VIX’s price action will largely depend on the Fed meeting this afternoon. If markets don’t like what they hear from Powell, and especially if we get a rate hike, the VIX will likely jump in reaction and break above $15. As for the extent, as we've said before it would likely retest the $18 level and potentially higher depending on price action at that point. If Powell is more dovish, then the VIX will likely fall back towards the end of its trading range.” Markets definitely didn’t like what they heard from Powell, and a breakout above the $15 resistance level occurred just barely yesterday following the descent to the lower end of the trading range. Today looks to have a true breakout in store.

II-II

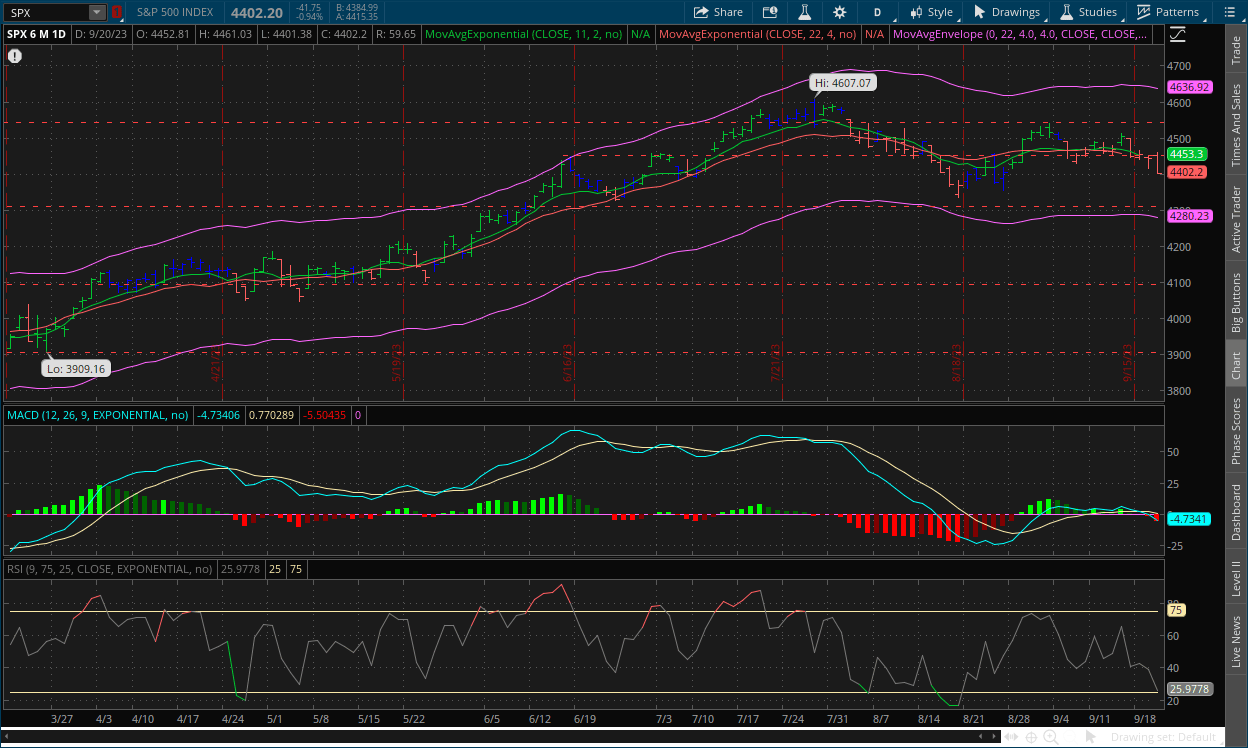

S&P 500: (SPX)

Wednesday Recap:

The S&P would open Wednesday’s session in positive territory at $4,452, and work to a high of $4,461 before the Fed meeting began. As was the case with all indexes and stocks following the meeting, the S&P plummeted to a low of $4,401 and would close at $4,402.

Daily Chart:

Strength would fall in favor of the bears as prices fully broke out below the $4,450 level, while inertia would continue to shift more in favor of downward momentum as the bears look to build up more steam.

In yesterday’s report we said: "today will largely depend on Powell and the Fed's rate hike decision and outlook moving forward. All of the different fundamental data that has been released over the last few weeks has been mostly bearish, but the bulls have been doing their best to hold the line. However, you can't fight the Fed, that's rule #1 of the markets. If Powell and the Fed are more hawkish than anything else today and deliver a rate hike, it will likely be the straw that breaks the camel's back for bulls. The breakout below $4,450 is looking like a true downside breakout.

III

Fundamentals:

III-I

Headlines:

1.) MarketWatch: Lower income households are acting recessionary today, observes JP Morgan

2.) MarketWatch: Philadelphia Fed manufacturing gauge falls back into contraction territory in September

3.) MarketWatch: SEC cracks down on misleading fund names and ‘greenwashing’

4.) Bloomberg: Bank of England keeps rates unchanged for the first time in nearly two years

5.) Bloomberg: Chevron agrees to regulator’s plan to end Australia LNG strikes

6.) Bloomberg: BlackRock, State Street among money managers closing ESG funds

III-II

FOMC Policy Meeting:

Interest Rates:

September Decision:

The Federal Reserve voted to keep interest rates steady at 5.25%-5.50% and revealed a divide over whether they should raise them again, with 12 of 19 officials favoring another hike, while the other seven thinking they can leave them unchanged. This came as no surprise, as markets priced in only a 10% chance the Fed would raise rates in yesterday’s meeting. What they were paying more attention to however was the specifics of what Powell said. Powell did directly say that they will keep raising rates if it is deemed necessary. It sounds scary on paper but given the context, he essentially was saying that if we stay on the current trajectory, they can keep rates where they are. But if there’s a shock or a hard right turn, then they’re not afraid to keep tightening.

Higher for Longer & What it Means for Yields:

Powell said that inflation reached an inflection point in June and added that three reports don’t make a trend (alluding to the last three months of data), but the Fed showed again that they are willing to keep rates as high as possible, and for as long as possible to be sure beyond a reasonable doubt that inflation is down and stays down, and that timeframe could be as long as another year. There is a practical implication for this however, you just have to look at treasury yields..

The supply of treasuries is still insanely high, because a.) The Fed is still undergoing quantitative tightening, i.e. they’re rolling treasuries and mortgage backed securities off their balance sheet and putting them onto the open market, which lowers the price and raises the yield, b.) the treasury department along with the rest of the Congress and government continue to take on debt and funding themselves by issuing more treasuries into the market, and c.) it doesn’t make sense for businesses to take on that risk and put capital into them when they could just place it into a money market fund (see 8/21/23 report).

When you have the supply growing as much as it is combined with this low of an amount of demand, it creates a bubble in the treasury markets with yields rising to the highest they’ve been since 2006, and the prices for them being as low as they are. Bond yields (or bond rates) rise with the Fed rate, and if the Fed were to pause, the logical conclusion would be for yields to cap where they are and people can feel safe buying treasuries again. Yes and no. No because money markets are still too hot. So, you could see these higher and higher yields persist for a long time, at least until people stop buying money markets. Yes, because a cap on interest rates does give investors a license to buy treasuries again, and a natural shift in the market would likely occur into them again as this will be the point where they're at their most value. So, investors would get the benefit of a safe security with a high yield that will likely appreciate even more over time but the higher for longer is not just the Fed rate, but it’s the going rates for the market as well, and it's too early to say when a shift like this will inevitably occur.

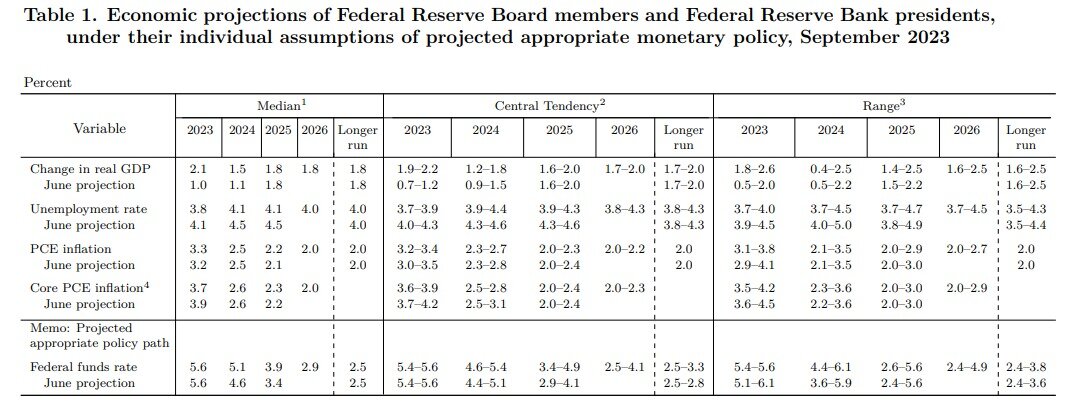

Summary of Economic Projections (SEP):

Change in Real GDP:

The June projection showed only a 1.0% growth in real GDP, and the Fed’s new projections show that GDP for 2023 will grow by 2.1% which was much stronger than our own expectations. Projections were also raised for 2024, going from 1.1% forecasted in June to now 1.5%, meaning the Fed believes the economy will stay stronger for longer, which was surprising. As a side note, Powell clarified again that inflation and GDP are mostly not correlated with each other. The Fed’s dual mandate isn’t GDP and price stability (i.e. low inflation), it’s maximum employment and price stability. They only care about inflation to the extent that it affects GDP, e.g. 2021 with supply chain issues and insane amounts of money printing fueled GDP growth, which is not the case anymore. We wanted to include that because it is an important distinction to remember.

Unemployment Rate:

Projections were actually improved for the labor market in the SEP, which was another thing that was surprising (which is the theme of this entire meeting). The June projections showed a 4.5% unemployment rate projection, but this has now shifted and has been revised down to 4.1% for 2023 and 2024. When those projections were made (i.e. June), unemployment was sitting at 3.5%. Historically, when the unemployment rate rises 1%, it usually will rise by another 1%. So the revision down to this degree is an indication that they’re outlook again has greatly improved without them actually coming out and saying it.

The Fed Dot Plot:

The Federal Funds Rate projections through 2024 indicate the higher for longer scenario. With June projections being at 3.6% at the low end of the range (which was the market pricing in rate cuts by the end of the year, which was ludicrous) and 5.9% at the high end. New projections show a range of 4.4%-6.1%, with markets factoring in a 62.1% chance of rates staying put the rest of the year, and a 37.9% chance of there being one more hike. Another thing to note: market projections and Fed projections through 2024 and beyond. Fed projections for rates show that rates won’t be lowered for a long time, if at all through 2024. Markets are projecting rates to remain near current levels through 2024 but do expect at least a small cut at some point at the end of next year. We expect rate cuts to happen at some point in 2024, but we won't even begin to speculate on when that could be yet.

Other Key Highlights:

Fed’s Stance on Higher Oil Prices:

Powell said the Fed will be “looking through” higher oil prices, which was surprising but something that can be logically understood. Since energy prices are so volatile, the Fed is deciding that they’re going to essentially ignore it for now but keep a cautious and nimble stance on it in case it does start to affect broader inflation to a greater degree.

Soft Landing Scenario:

Powell said that while a soft landing is their primary goal, and that it’s what they’re hoping for, it isn’t their base case scenario. Essentially meaning that a soft landing is possible, but there is also still the possibility of a recession. And when asked about a recession, he said that one could happen based on things that are outside of their control.

IV

Market Psychology & Final Thoughts:

Futures are plummeting as we head towards the open, with VIX up over $16.30 at the current point in time. Crude futures are up over 1.25% in the premarket, with bond yields rising fast and overseas markets plummeting as well. Markets despite the Fed’s optimism on their outlook were spooked by two things: a.) higher for longer, and b.) a soft landing is not the Fed’s base case scenario. As we said yesterday, a hawkish Fed or a rate hike will likely be the straw that breaks the camel's back, or the bulls' back in this case. As always, we hope you found this helpful, learned at least two things, and have a respectable day.