The Take Five Report: 9/4/23

I

Markets:

I-I

Global Market Recap:

United States:

- S&P: +0.18%

- Dow: +0.33%

- Nasdaq: -0.02%

- Russell 2k: +1.11%

U.S. indexes would open Friday’s session overwhelmingly positive following the report on the labor market. The premarket rally wouldn’t last however as markets would swiftly decline through the first half of the session and flatten out for the remainder of the day. Interestingly, small caps (i.e. mostly speculative stocks) outpaced the general market on the day, with the Russell 2000 small cap index advancing 1.11% on the day compared to only marginal gains (or in the case of the Nasdaq a marginal loss) from the major indexes.

Asia:

- Shanghai: -0.71%

- Hong Kong: -2.06%

- Japan: +0.30%

- India: +0.23%

Asian markets on Monday finished up, with Shanghai and Hong Kong leading the region with a +1.40% and +2.51% advance respectively, after Hong Kong reopened trading after Typhoon Saola. Australia had a poor showing of economic data, with corporate profits sliding by -13.1% quarter over quarter in Q2, far deeper than overall expectations. In this morning’s session, Asian markets were mixed as the Australian Central Bank decided to hold its policy rate. Hong Kong and Shanghai would wipe away a large portion of yesterday’s gains after retreating in this morning’s session.

Europe:

- UK: -0.16%

- Germany: -0.10%

- France: -0.24%

- Italy: -0.01%

Major European markets finished mostly lower for the second straight session on Friday, as the region was unable to hold early gains. The first half showed stocks broadly higher but turned following the U.S.’ mixed labor market data, and reignited concerns about the health of the global economy. On Monday, Major European markets failed to hold gains once again and closed lower with investors turning cautious and lightening commitments towards the end of the day's session as investors looked ahead to monetary policy decisions of major central banks, including the Federal Reserve, Bank of England and the European Central Bank.

I-II

U.S. Sectors Snapshot:

- Communication Services: -0.54%

- Consumer Discretionary: -0.54%

- Consumer Staples: -0.83%

- Energy: +2.05%

- Financials: +0.80%

- Health Care: +0.23%

- Industrials: +0.51%

- Info Tech: +0.23%

- Materials: +1.01%

- Real Estate: -0.07%

- Utilities: -0.52%

II

Technicals:

II-I

Volatility Index: (VIX)

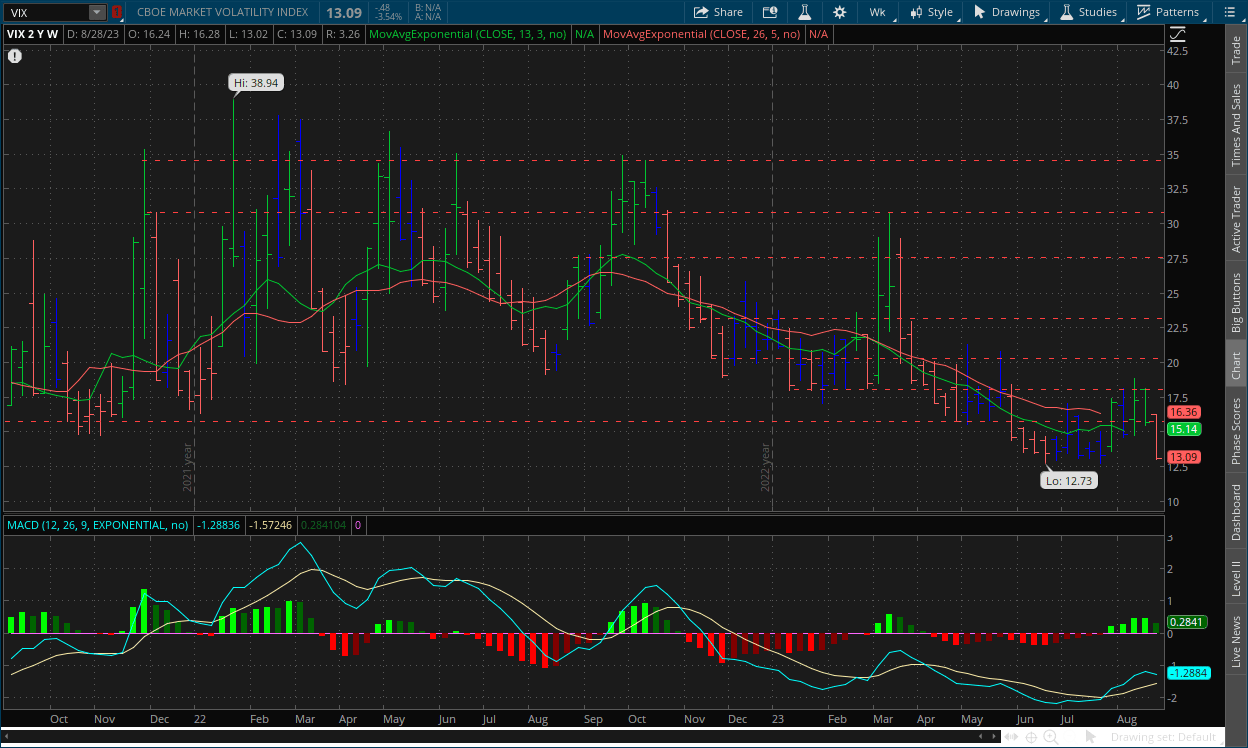

Weekly Chart:

The VIX would open Monday's session at $16.24 and only advance a few ticks higher as prices slid for the remainder of the week, reaching a low of $13.02 in Friday’s session and closing the week at $13.09. Strength would move in favor of the VIX bears for the first time since the week of June 19, while inertia would shift back in favor of the bears.

The VIX over the last two weeks has wiped away any gains the VIX bulls made over the preceding month, and prices have fallen back down to their previous consolidation range of $13-$15 following a week filled with important reports and other catalysts. Even though the reports were largely bearish in our opinion, markets still reacted positively, and in turn, the VIX declined, as it measures implied volatility moving forward. The VIX has moved in a similar path throughout the overall downtrend every time prices rise, and strength breaks above the centerline. The VIX bears have made a strong move, but they aren't out of the woods yet as the VIX bulls still have the technical and fundamental forces working in their favor from a purely objective perspective. It's just the speculative fallacy of market psychology is dominating short-term price action at this point.

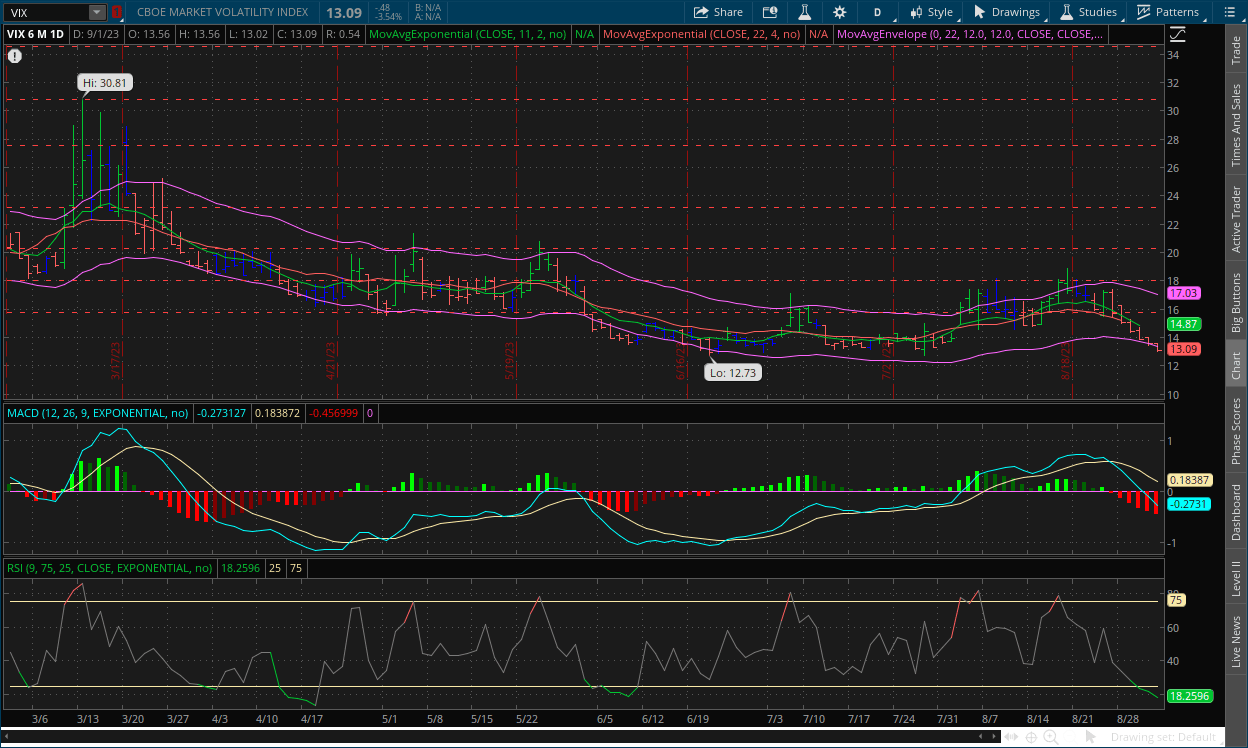

Daily Chart:

Strength would move in favor of the VIX bears for the sixth straight session as their momentum remained strong and didn’t waiver. Inertia would shift further back in favor of the VIX bears as prices continue to slide.

The VIX bears made a strong push back to the previous consolidation range of $13-$15 with little pushback from their opposition. It is hard to say whether this will amount to anything and market sentiment has fully flip flopped again (in the span of five days) following Friday’s job report. The $13 support level is the next test.

II-II

S&P 500: (SPX)

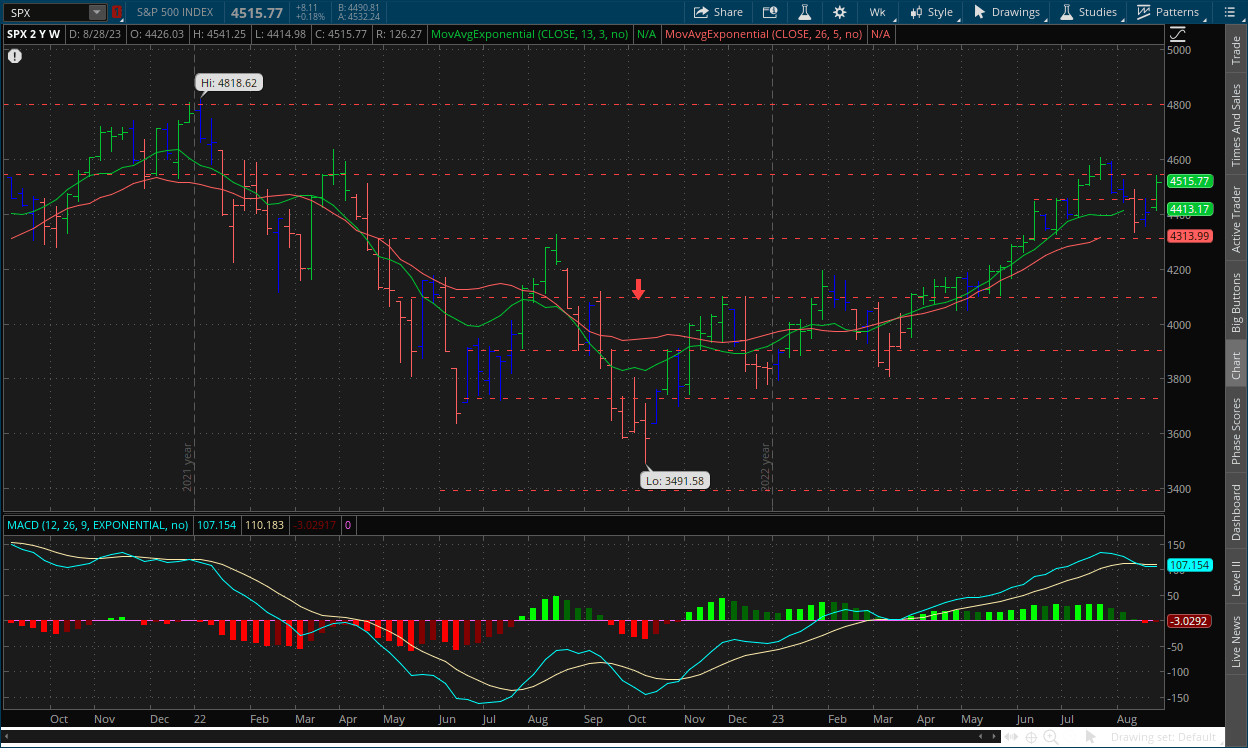

Weekly Chart:

The S&P would open the week at $4,426, and only reach a low of $4,414 before the rallying began. Prices worked through the week, reaching a high of $4,541 and ultimately close at $4,515, advancing 110 points on the week, the benchmark index’s biggest weekly gain since early July. Strength would move back in favor of the bulls after falling below the centerline and in favor of the bears last week. Inertia would edge back in favor of the bulls as well, as bears failed to make any significant shift in momentum on the weekly chart.

The bulls retook the $4,450 and $4,500 levels with relative ease last week following the change in sentiment after the job market data released earlier in the week. The bears in the grand scheme of things barely made a dent in the bulls’ rally that began in mid March, and they have much more work to do if they want to break this run. Technical signals are working in their favor, as is the fundamental data as said above, but again, they still have a lot of work to do.

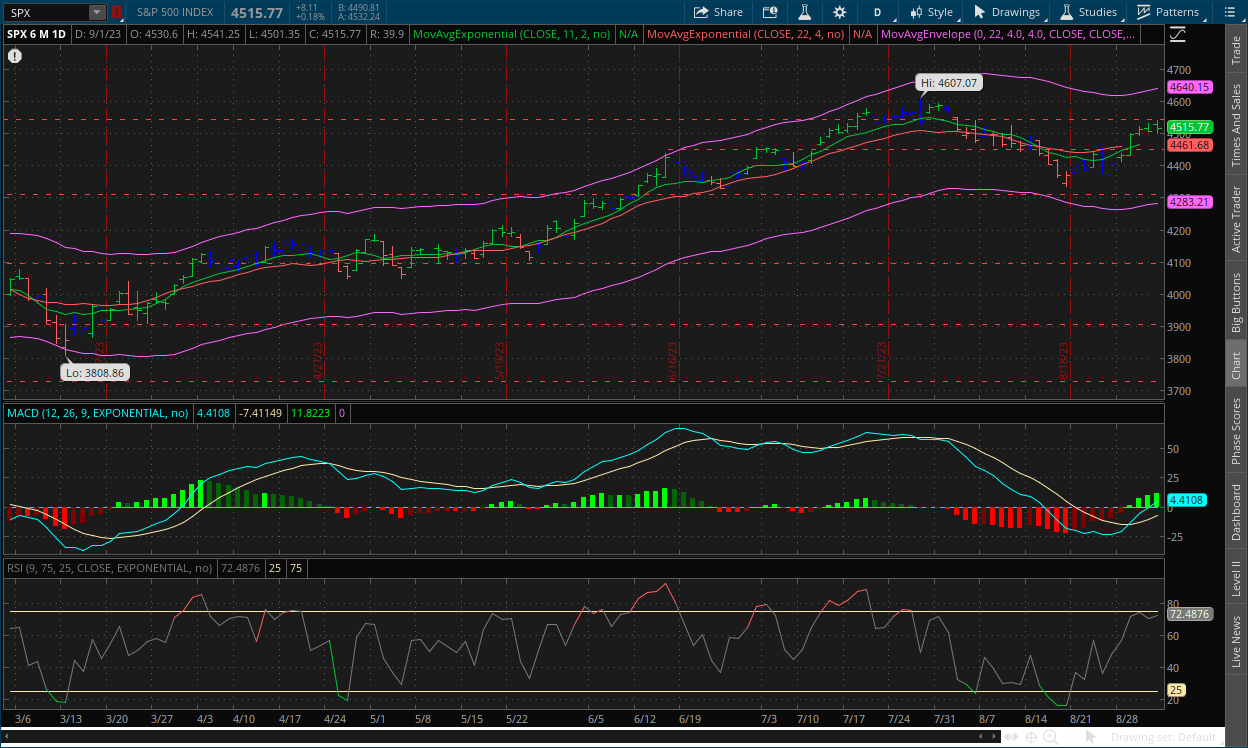

Daily Chart:

Strength would move with the bulls once again, but as price action has slowed, their momentum in strength has tempered compared to the initial stage. Inertia would continue to shift more in favor of the bulls as well, albeit slightly.

Bulls have managed a strong comeback following the multi week downtrend that started at the beginning of the month and have now brought prices back roughly to where they were, wiping away all of the bears’ progress. Prices have tempered since breaking the $4,500 resistance level, which followed a mixed PCE report and even more mixed jobs report. However, we do believe that given the results of those, that sentiment will likely be more mixed, which would result in more tempered price action in the short term.

III

Fundamentals:

III-I

Headlines:

1.) MarketWatch: Bad economic news is good news for stocks. When will that change?

T5 note: We ask ourselves this question every day

2.) MarketWatch: Strike deadline looms at General Motors, Ford and Stellantis given UAW’s “audacious” demands

3.) Bloomberg: Dollar climbs toward six month high amid rising yields

4.) Market Insider: Chinese property giant Country Garden pays its dollar bond interest within grace period, narrowly averting a default

5.) Financial Times: Global economic recovery ‘losing momentum’ as higher rates kick in

III-II

Payroll Data for August:

Highlights:

|

Index: |

July 2023: |

August 2023: |

Wall Street Expectations: |

Take Five Expectations: |

|---|---|---|---|---|

|

Unemployment Rate: |

3.5% |

3.8% |

3.6% |

3.7% |

|

Nonfarm Payrolls: |

157k(r) |

187k |

175k |

160k |

|

Private Nonfarm Payrolls: |

155k(r) |

179k |

160k |

150k |

|

Average Hourly Earnings: |

0.4% |

0.2% |

0.3% |

0.3% |

|

Average Workweek: |

34.3 |

34.4 |

34.3 |

34.3 |

|

Labor Force Participation Rate: |

62.6% |

62.8% |

N/A |

N/A |

Finer Details:

Unemployment Rate & Labor Force Participation Rate:

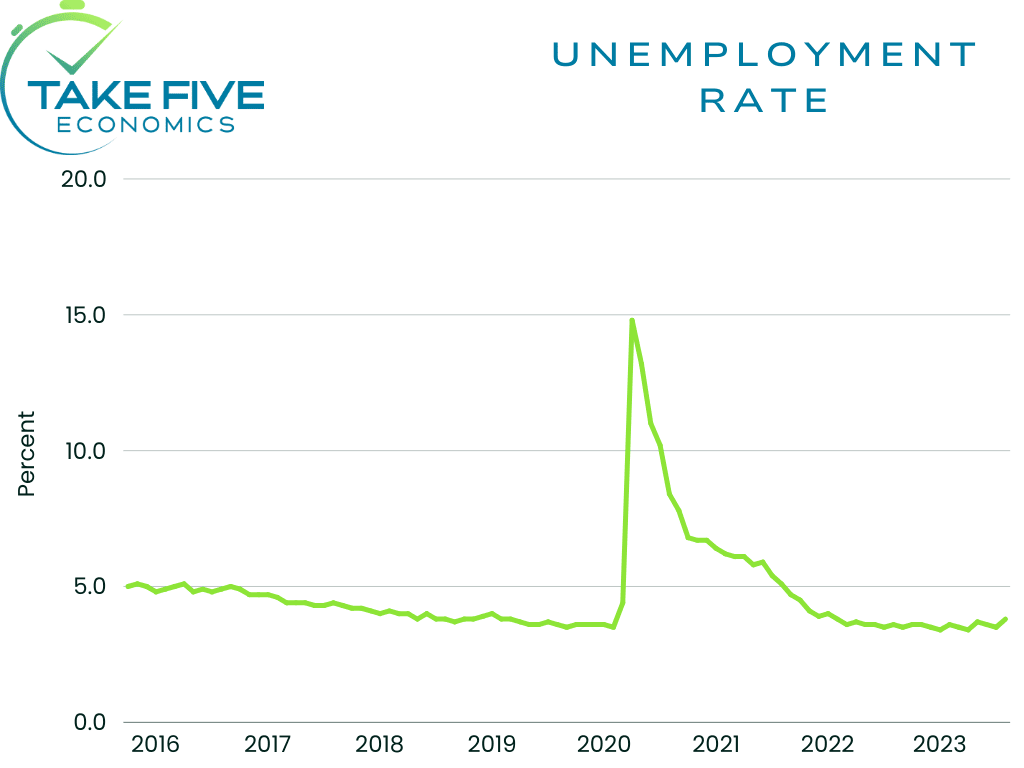

The unemployment rate rose by 0.3% in August to 3.8%, coming in higher than both Wall Street and our own expectations. The number of unemployed persons increased by 514,000 to 6.4m. Both measures are little different in terms of year over year, when the unemployment rate was 3.7% and 6.0m. Now, one report doesn’t make a trend, but this was a fairly large jump all else considered.

The labor force participation rate jumped to 62.8% from 62.6% in July, the first change in the rate in six months.

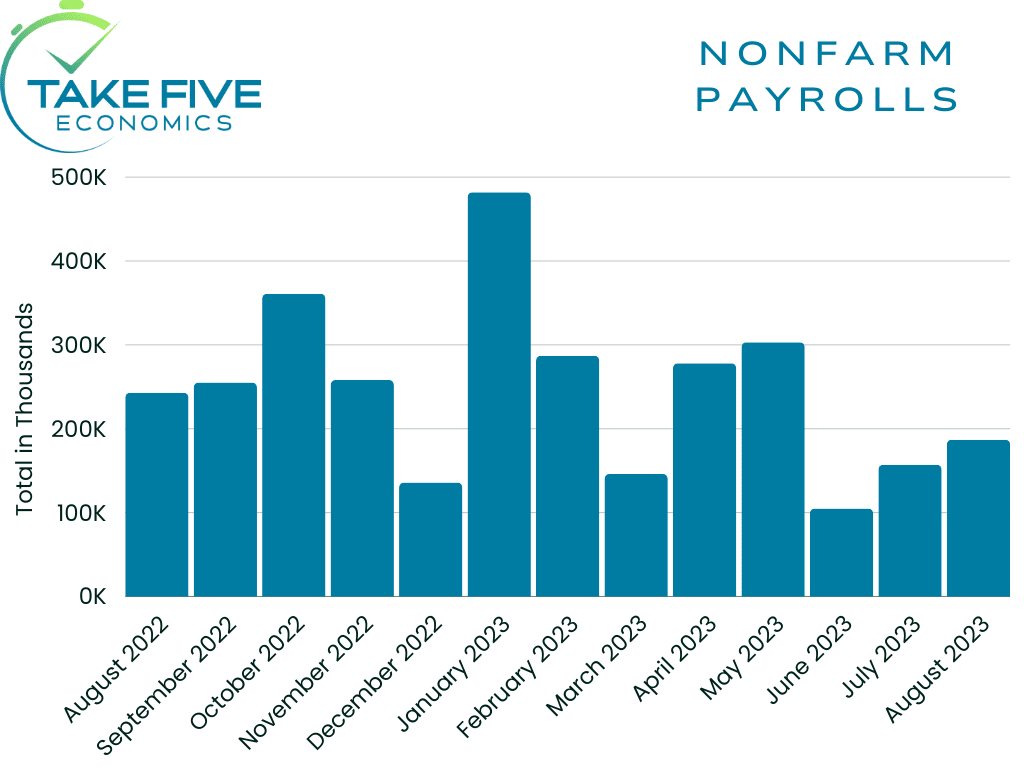

Nonfarm Payrolls:

Total nonfarm payroll employment increased by 187,000 in August, beating both our own and Wall Street expectations, and followed a downwardly revised July report from 187,000 to 157,000, which fell closer in line to our expectations, as we always include downward revisions into our predictions when it pertains to the labor market. June nonfarm payrolls were also revised down from 185,000 to 105,000. Private sector payrolls increased by 179,000, which again came in above both Wall Street and our own forecasts. The July report was revised down to 155,000 from 172,000. June was also revised down to 86,000 from 128,000.

Hollywood strikes and the Yellow corporate bankruptcy cut 54,000 jobs from the August report. Without that, nonfarm payrolls would have been closer to 240,000. The long-term trend for this measure is 187,000, the numbers need to be below this average in order to convince the Fed that they’ve reached a high enough level in their tightening campaign. But if you add these back in, the number is much higher than what’s reported. We expect downward revisions, but that’s besides the point. The point is, if you take away the nonrecurring or out of the ordinary circumstances with the strikes and the Yellow Corp. bankruptcy, these numbers are not where the Fed wants them to be in order to say they’re ending their tightening cycle, which is one of the reasons why bond yields started to rise and price action within equities started falling after market participants digested the data.

Average Hourly Earnings & Average Workweek:

Average hourly earnings were up 0.2% in August which came in below our own and Wall Street’s forecasts. In terms of year over year, wages are up 4.3% compared to 4.4% in July. The average workweek edged up by 0.1 hour to 34.4 hours in August.

Per Nick Timiraos of the Wall Street Journal, the so-called “mouth-piece” of the Fed; “The average hourly earnings decrease in August is likely temporary because there were fewer days in August, which took some of the benefit of the decline in pay in August.” The reason I highlight this quote is because of who it came from. Markets originally thought that the figure was favorable, as they should. But, they listen to him for a reason, and this isn’t what they were hoping to hear.

Putting It Together:

Originally this report looked to show some sort of easing in labor market conditions, but when you factor in the additional underlying details it wasn’t the case, and markets reacted accordingly, i.e. bond yields rose as they factor in the increased chance of an additional rate hike, with equities falling. The report will more than likely be revised by the time the next is released, whether it's revised up or down however is anyone's guess. But until then the Fed still has justification to at the very least hold rates.

IV

Market Psychology & Final Thoughts:

Futures are still edging down as we head towards the open as overseas markets are lower, yields are up, and market participants can’t seem to pick a direction. Our earlier prediction of the market beginning to drop and flatten through August and into September as fundamental data continued to get more and more questionable is so far on track, but if markets continue to react positively to poor data, then it stands in question. Market participants’ entire focus is on the Fed, and when they will stop their tightening cycle. The reason why we saw markets react so strongly last week is because the data that was being reported supported that notion, and participants had an overreaction. But the PCE data after it was digested didn’t support it, and following the labor market report on Friday, which was originally thought to support it, after digging deeper and factoring in certain things it didn’t either. Now this leaves participants in a state of uncertainty, which is where we think price action will likely head for a short time. As always, we hope you found this helpful, learned a thing or two, and have a great day.