The Take Five Report: 9/29/23

I

Markets:

I-I

Global Market Recap:

United States:

- S&P: +0.59%

- Dow: +0.35%

- Nasdaq: +0.83%

- Russell 2k: +0.87%

U.S. indexes opened Thursday around breakeven, and would hover there for a short while. Prices would rally shortly thereafter through the first half of the day until a point of resistance was hit, in which they would bounce up and down against for the remainder of the session and still finish in the green.

Europe:

- UK: +0.11%

- Germany: +0.70%

- France: +0.63%

- Italy: +0.54%

European stocks broke their five-session losing streak yesterday despite continued caution. Preliminary inflation figures from Germany showed inflation slowing more than forecasted, with a 4.3% year over year increase in CPI, its lowest level since Russia’s invasion of Ukraine.

I-II

U.S. Sectors Snapshot:

- Communication Services: +1.16%

- Consumer Discretionary: +0.97%

- Consumer Staples: +0.25%

- Energy: +0.01%

- Financials: +0.69%

- Health Care: +0.48%

- Industrials: +0.43%

- Info Tech: +0.69%

- Materials: +1.04%

- Real Estate: +0.85%

- Utilities: -2.19%

II

Technicals:

II-I

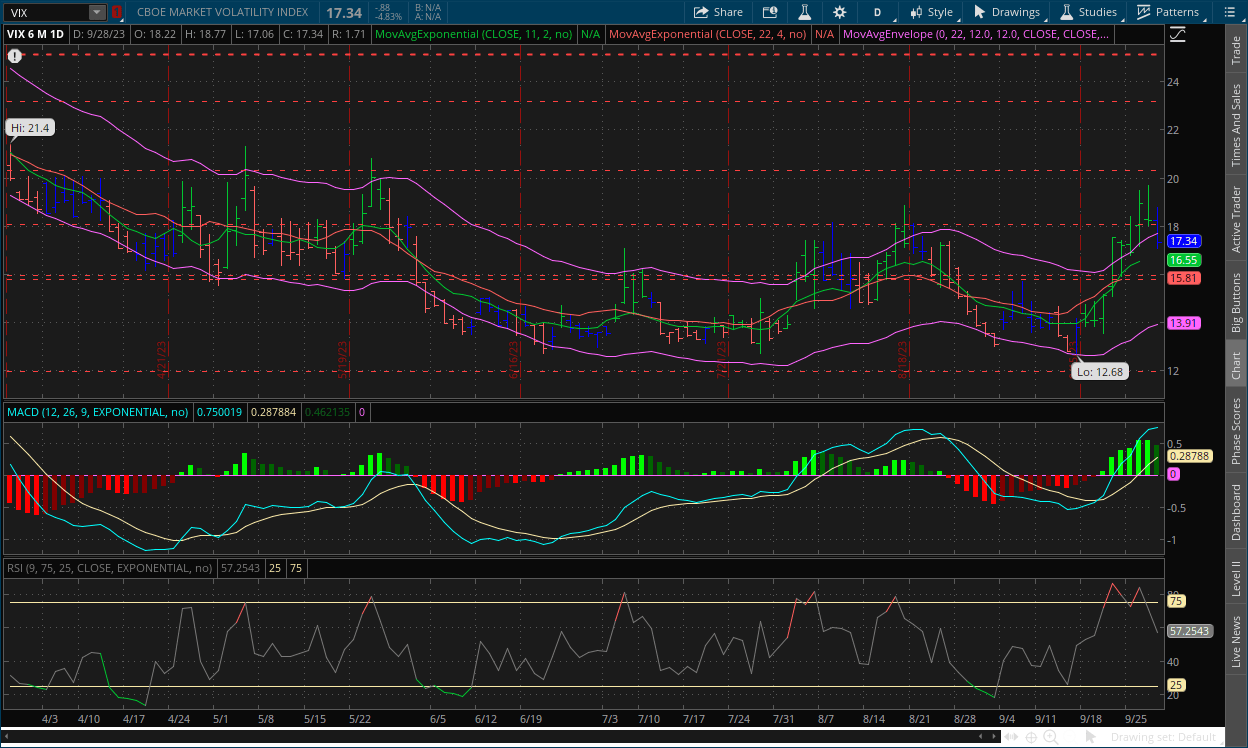

Volatility Index: (VIX)

Thursday Recap:

The VIX opened the session just around yesterday’s close at $18.22. Prices pushed to a high of $18.77 during premarket hours but would later slide to a low of $17.06 before closing higher at $17.34.

Daily Chart:

Strength finally moved in favor of the VIX bears after they were getting beat the hell down over the last nine sessions. Inertia continued to shift more to the upside however, as the two day lag is still catching up to prices.

The VIX bears managed to strongly bring prices below the $18 level as the VIX bulls catch their breath. What we may see is a decline back to $16, and consolidation around that point. It’s hard to say (especially for the VIX) if prices will keep trending upwards in the shorter term, as its rises are extremely sharp, followed by more steady declines in comparison. But if the VIX bulls can manage to keep prices above $16, expect the next jump to surpass this latest peak.

II-II

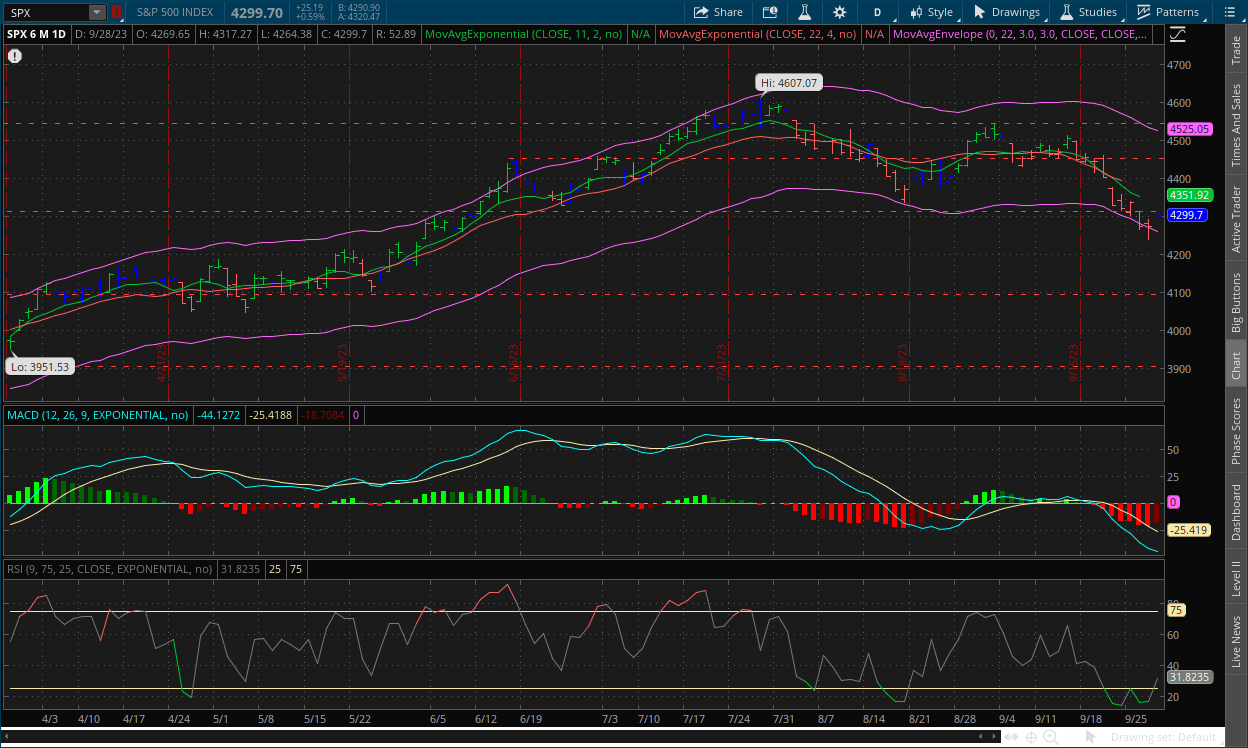

S&P 500: (SPX)

Thursday Recap:

The S&P opened the day at $4,269, and would only move to a low of $4,264. Prices would rally and reach a high of $4,317 in the first half, but remain flatlined for the remainder and ultimately close at $4,299.

Daily Chart:

Strength would swing back in favor of the bulls for the first time in almost two weeks, as they were finally able to gain some ground back on the full steam ahead bears while inertia continued to shift more to the downside.

Bulls will likely try to continue their push in today’s session, as they’re goal will be to bring prices back above the $4,300 resistance level. Bears are catching their breath, allowing bulls to make a move. The bears will need to be strong enough to keep prices at bay if a retaking of the level were to occur. What we think is likely to happen is that this first break below $4,300 will be false, and consolidation at that level will more than likely occur for a short time, probably a few days before either the bulls or bears significantly move prices again. Our bets would be placed on bears though, as this looks like a typical reloading point.

III

Fundamentals:

III-I

Headlines:

1.) MarketWatch: Consumer spending rises again, but it’s not all great. Gas prices play a role

2.) MarketWatch: U.S. trade deficit in goods shrinks 7.3%

3.) MarketWatch: Eurozone inflation falls sharply in September

4.) MarketWatch: U.S. stocks at risk of volatility as billions in options expire Friday

5.) Financial Times: European bond market hit by Italy’s plans for higher borrowing

6.) Wall Street Journal: Standoff in Congress brings government to brink of shutdown

7.) Wall Street Journal: UAW expected to expand auto strikes Friday

III-II

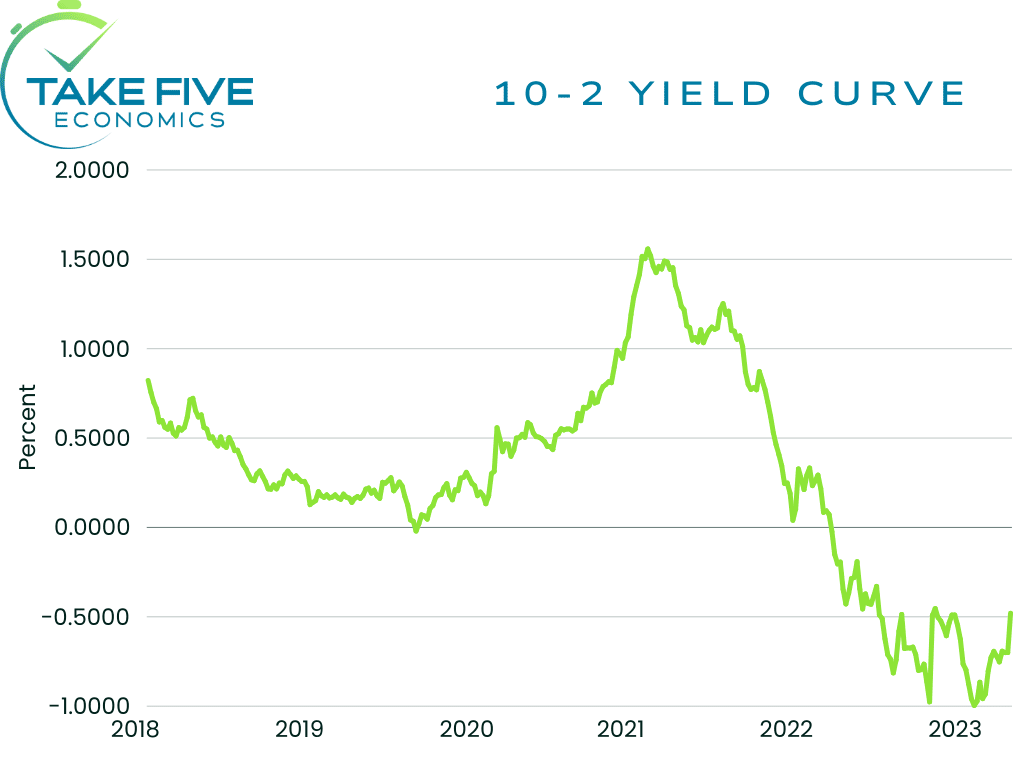

The Yield Curve is Steepening:

The famous inverted yield curve (i.e. when short term yields are higher than long term yields) between the 10-year and 2-year treasury bonds is steepening, and no it doesn’t mean the difference between the two is getting wider, it’s actually closing. But, is that a good thing? History says it depends.

Bear Steepening vs. Bull Steepening:

The difference between the 2-year and 10-year treasury yields narrowed to -47.8 basis points (10 BP’s = 0.1%) as of Thursday over the last two weeks. This has narrowed significantly from its March and late summer high of -120 basis points and -110 basis points respectively. For most of the year, the yield curve has sat in between -70 and -90 basis points.

The steepening however hasn’t come from people buying short term treasuries and driving yields down. In that scenario, investors would be buying 2-year (or shorter) treasuries because they believe that the Fed is done hiking rates or will start to cut. Thus, capping the short-term treasury yields, in which people would rush to buy to lock in higher rates. This is called bull-steepening, but this isn’t the case. What we’re seeing is actually a rapid selloff in long term treasuries. Most notably, the 10-year and 30-year treasuries, while the shorter-term ones have barely budged. This is called bear-steepening and is what we saw leading into the GFC in 2008.

Supply and Demand Aspects:

The large issuance of U.S. treasuries from the government to the tune of over $1 trillion through the end of this year (as a part of the debt ceiling agreement in June), which is adding to the supply of treasuries. But since demand is still so low for them, and isn’t keeping pace with the increase in supply, this is another reason for yields pushing higher, as well as the Fed’s quantitative tightening (QT) policy which has them raising interest rates while simultaneously dumping treasury bonds off their balance sheet, thus increasing the supply even further. This is what we were most concerned with following the agreement (i.e. the supply and demand aspects of bonds), as well as Ray Dalio, which is who brought the idea to our attention.

The Cause:

This time around, the yield curve is shrinking as a reflection of rising financing costs that will and has begun to affect everyone (e.g. real estate, either typical home buyers or investors, corporations and small businesses, banks, etc.), rather than there being an improved outlook on the economy, as well as the supply and demand aspects of course. The statement of higher for longer from the Fed has finally burned in the brain of market participants, thus what’s causing the rapid selloff specifically of 10-year and 30-year treasuries. The longer the Fed rates are higher, the less they’re worth at current levels and the more value they lose as time goes on, which makes them a riskier asset. Whereas short term treasuries are safer given that their current levels are capped near the Fed’s terminal rate.

Why Short-Term Yields are Staying Put:

Shorter term yields haven’t budged as much because their holders see no point in selling them given that the Fed likely won’t raise rates too much more and higher rates for longer. But nobody wants to buy them because money market funds (as we’ve discussed many times before) offer a.) higher yields, b.) more liquidity (i.e. ability to pull capital quickly), and c.) no risk of principal (i.e. won’t lose original investment amount, because an MMF is basically a deposit account) compared to short term treasuries. In Monday or Tuesday’s report, we'll discuss where the most pain will be felt with the steepening, and what our outlook for the situation is. The areas that will be the most affected are real estate, banks, certain financial institutions as well as certain types of companies e.g. growth companies fueled by low interest rates, smaller companies, and heavily indebted companies.

IV

Market Psychology & Final Thoughts:

The VIX opened the day lower, while markets opened higher. Bond yields have tempered so far this morning along with crude futures, while European markets are trading higher once again. Bulls will likely make another push in today’s session. The PCE released this morning had mixed results, and we’ll discuss it on Monday or Tuesday (we haven't decided yet). Billions worth of options contracts also expire today, so expect some volatility moving forward. We hope you found this helpful, learned something about the exciting world of bonds, and have a rockin’ weekend.