The Take Five Report: 9/20/23

I

Markets:

I-I

Global Market Recap:

United States:

- S&P: -0.22%

- Dow: -0.31%

- Nasdaq: -0.23%

- Russell 2k: -0.42%

U.S. indexes opened the day in the red following a late premarket selloff. Markets would continue to slide through the first half of the day, and slowly begin to find a bottom. A steady rally would take markets through the close, but they would still finish down overall as participants brace for Fed Chair Powell this afternoon.

Asia:

- Shanghai: -0.52%

- Hong Kong: -0.62%

- Japan: -0.66%

- India: -1.18%

Asian markets fell across the board this morning as China left its one year and five year loan prime rates unchanged at 3.45% and 4.2% respectively. The region also saw August trade data for Japan, which showed the deficit narrow by two thirds year over year while imports recorded a smaller drop. Wholesale inflation in South Korea also jumped for the first time since July of 2022.

Europe:

- UK: +0.09%

- Germany: -0.40%

- France: +0.08%

- Italy: +0.60%

European markets closed mixed on Tuesday with participants continuing to brace for central bank week, with the US’ Fed kicking it off this afternoon. Participants are widely anticipating that the U.S. central bank will hold interest rates steady when they announce their latest policy decision on Wednesday, and will be assessing the move to get a better sense of the central bank’s stance on inflation.

I-II

U.S. Sectors Snapshot:

Communication Services: +0.01%

Consumer Discretionary: -0.65%

Consumer Staples: -0.25%

Energy: -0.83%

Financials: -0.11%

Health Care: +0.10%

Industrials: -0.46%

Info Tech: -0.08%

Materials: -0.10%

Real Estate: -0.56%

Utilities: -0.55%

II

Technicals:

II-I

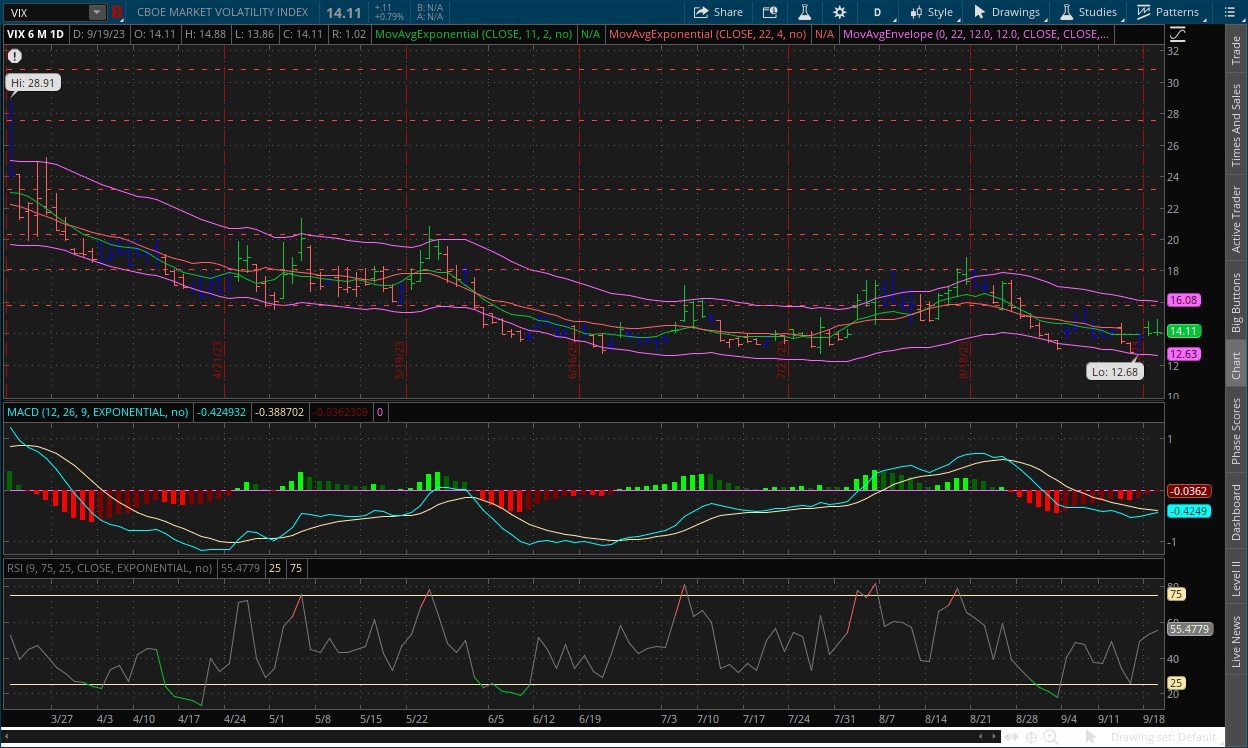

Volatility Index: (VIX)

Tuesday Recap:

The VIX opened the session slightly higher compared to Monday at $14.11. Prices would work their way to a low of $13.86, and a high of $14.88 before ultimately closing at the opening price of $14.11.

Daily Chart:

Strength would move in favor of the VIX bulls once again and just fail in making a cross above the centerline, but if the trend continues, it will likely cross back above today. Inertia remained in favor of the VIX bulls but is still favoring downward pressure overall.

The VIX’s price action will largely depend on the Fed meeting this afternoon. If markets don’t like what they hear from Powell, and especially if we get a rate hike, the VIX will likely jump in reaction and break above $15. As for the extent, as we've said before it would likely retest the $18 level and potentially higher depending on price action at that point. If Powell is more dovish, then the VIX will likely fall back towards the end of its trading range.

II-II

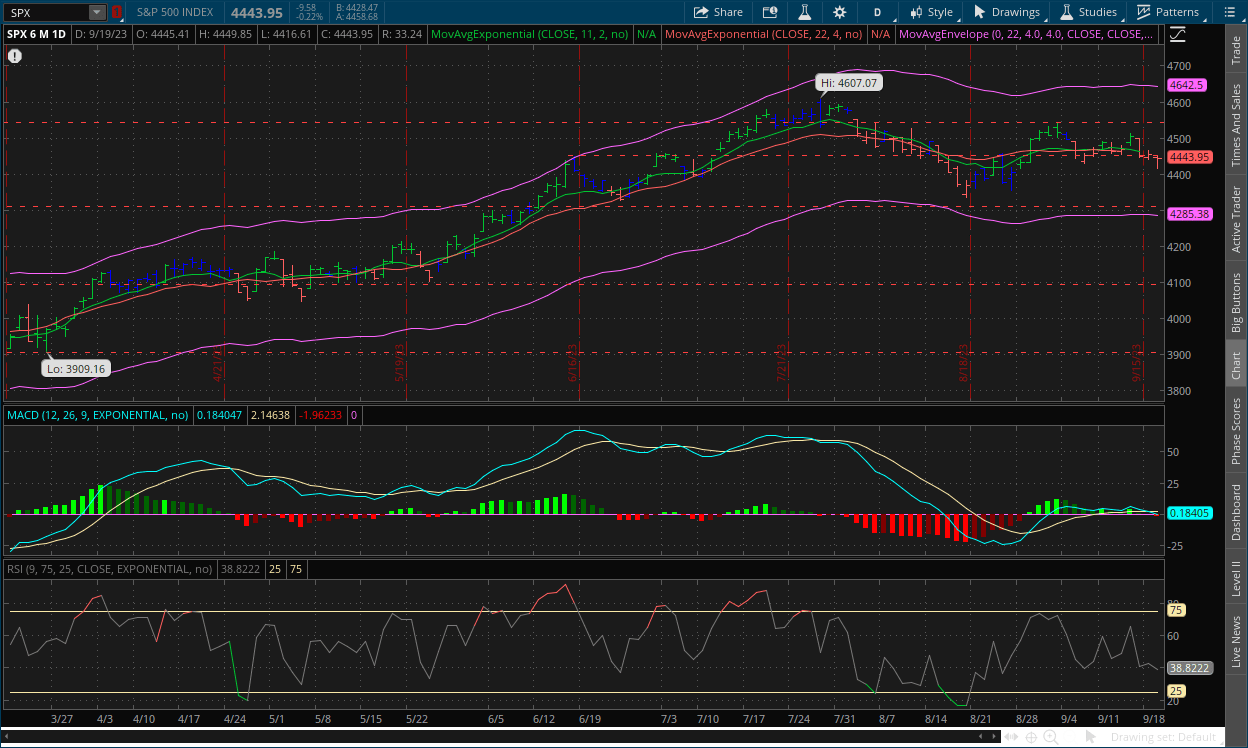

S&P 500: (SPX)

Tuesday Recap:

The S&P opened slightly lower on Tuesday at $4,445. Prices would slide through the first half of the session, reaching a low point of $4,416 before climbing back to a high of $4,449. The benchmark index would ultimately close just below the opening price at $4,444.

Daily Chart:

Strength moved in favor of the bears once again, with this push accompanied by a downside breakout below the strong $4,450 support level. Inertia would shift slightly more in favor of the bears as well but is still overall flat as of right now.

The bears following the break below $4,450 managed to keep prices below the level despite the rally in the latter half of the day. As we said above, today will largely depend on Powell and the Fed's rate hike decision and outlook moving forward. All of the different fundamental data that has been released over the last few weeks has been mostly bearish, but the bulls have been doing their best to hold the line. However, you can't fight the Fed, that's rule #1 of the markets. If Powell and the Fed are more hawkish than anything else today and deliver a rate hike, it will likely be the straw that breaks the camel's back for bulls.

III

Fundamentals:

III-I

Headlines:

1.) MarketWatch: UAW strike is costing Big Three about $125 million in revenue, Goldman Sachs says

2.) MarketWatch: U.K. inflation surprisingly slips, making Bank of England decision a close call

3.) Bloomberg: FedEx wins over Wall Street with $6 billion cuts, gains on UPS

4.) Financial Times: Global debt pile hits record high of $307 trillion

- T5 Note: This absolutely blew our mind

III-II

UAW Strike - Potential Economic Impacts:

Potential Recessionary Impacts:

At this point only 13,000 of the 146,000 union workers are out on strike, but the impact to economic activity could be large if we see a full-scale strike that lasts for some time. The effect of the strike could be visible in industrial production of motor vehicles, nonfarm payrolls (if the strike extends to survey week), and GDP (if the strike lasts long enough).

The strike, depending on its size and length, could result in a noticeable Q4 drag on GDP, and result in a negative October payroll read that would be released November 3rd. Although at this point remember, there are only 13,000 workers on strike. If all 146,000 members were to strike (all UAW employees for Ford, Stelantis, and GM), which has been threatened multiple times already, that would impact roughly 55% of all motor vehicle production employment.

In 2019, 48,000 workers (24% of motor vehicle production employment at the time) started to strike in mid-September, and it lasted through October. The decline in motor vehicle production took away 0.4% at an annualized rate from real Q4 GDP growth in that year. If the strike lasts as long and extends to the full 146,000 members, the impact would be roughly a full 1.0% against GDP growth.

The lower end of GDP forecasts for Q4 are slated in the range of 0.1%-1.2%. Our own forecast is similar as of right now due to certain trends we’re seeing, as well as some historical precedence. If the full-scale strike were to occur and last as long as it did in 2019 (which based on the current situation this is an increasingly likely scenario), and the lower end of estimates turn out to be the more accurate than the average consensus, GDP growth could end up moving negative in Q4 of this year. Which would also drag down Q1 of 2024 as well. Granted this is the worst-case scenario, but it’s important to still take it into consideration.

Potential Inflationary Impacts:

Many economists and institutions have argued this would have a minimal impact on inflation. This would all depend again on the size and length of the strike. In terms of pay, if all of the total members were to receive the desired 40% pay increase, estimates show that it would only contribute roughly a 0.05% increase in average hourly earnings if it was given at once. But since they want it spread out over four years, it’s even less than that, a little more than 0.01% per year. Looking at it like this, you’ll realize that the bill to pay all of these workers, even with a 40% increase, is almost nothing when looking at it in aggregate, i.e. in total.

There could be a small impact on inflation in Q4, however. We’ve already seen new vehicle prices accelerate in the latest CPI, most likely because dealers expect a limited supply. In 2019, the CPI index for new autos and trucks swung from -0.13% per month earlier in the year to 0.4% in Q4. Vehicles account for 4.25% of the CPI, so a similar swing could add 0.02% per month to future CPI, which again is minimal. A lower supply of new autos could also boost used car prices however as consumers could potentially shift in that direction.

Potential Impact on the Federal Reserve:

At the very least, the situation regarding the strike will more than likely make the Fed think twice about raising rates again. As this strokes more labor market and recessionary concerns than it does inflationary. There would be a massive amount of uncertainty (more than there already is), and due to the potential of an unemployment spike, plummets in payroll gains, and a fairly large hit to GDP, they would be better off pausing to wait and see what the lagged effects of monetary policy will do, and the outcome and aftereffects the strike will have.

IV

Market Psychology & Final Thoughts:

Futures are still edging up but have flattened out as we head towards the open. Brent Crude has fallen from its $95 plus high and is trading in the mid $93 range, while West Texas crude is still hovering just over $90 per barrel. Bond yields are slipping this morning as well, with European markets up massively. So, it looks like the markets are set up positively for the open so far. But today is where the real market week starts. The Federal Reserve has its policy meeting later on today, while the UK, Bank of Japan, Switzerland, Turkey, and more central bank decisions are due this week. The ECB hiked rates by 25 basis points last week, which took markets by surprise. China decided to hold its own policy rate this morning, and the Australian Central Banks’ minutes showed more concern over inflation. Market psychology is focused all on central banks as of right now, and their mood going forward will reflect what their outlook is. As always, we hope you found this helpful, learned a couple of things, and have an unreal day.