The Take Five Report: 9/26/23

I

Markets:

I-I

Global Market Recap:

United States:

- S&P: +0.40%

- Dow: +0.13%

- Nasdaq: +0.45%

- Russell 2k: +0.44%

U.S. indexes would open the day in the red, as was expected based on premarket movements. However, prices managed to rally from their lows, and maintain steady momentum throughout the session, and manage to close the week’s opener with marginal gains, a breath of fresh air after last week’s slaughter.

Asia:

- Shanghai: -0.43%

- Hong Kong: -1.48%

- Japan: -1.11%

- India: -0.12%

Asian markets fell across the board in this morning’s session as fears of a potential U.S. government shutdown along with Moody’s saying it would be a “credit negative”, both had an effect. Japan’s wholesale inflation for its services sector climbed 2.1% year over year, its fastest rate of increase since September of 2022. Fears of China’s real estate market are also taking their toll.

Europe:

- UK: -0.78%

- Germany: -0.98%

- France: -0.85%

- Italy: -0.68%

European stocks closed lower to start the week and extended losses from last week amid the higher for longer panic. German business sentiment slightly worsened in September but came in above expectations. Concerns about China’s real estate market also resurfaced, which took a toll as well.

I-II

U.S. Sectors Snapshot:

- Communication Services: +0.38%

- Consumer Discretionary: +0.67%

- Consumer Staples: -0.43%

- Energy: +1.28%

- Financials: +0.15%

- Health Care: +0.54%

- Industrials: +0.46%

- Info Tech: +0.47%

- Materials: +0.80%

- Real Estate: -0.17%

- Utilities: -0.20%

II

Technicals:

II-I

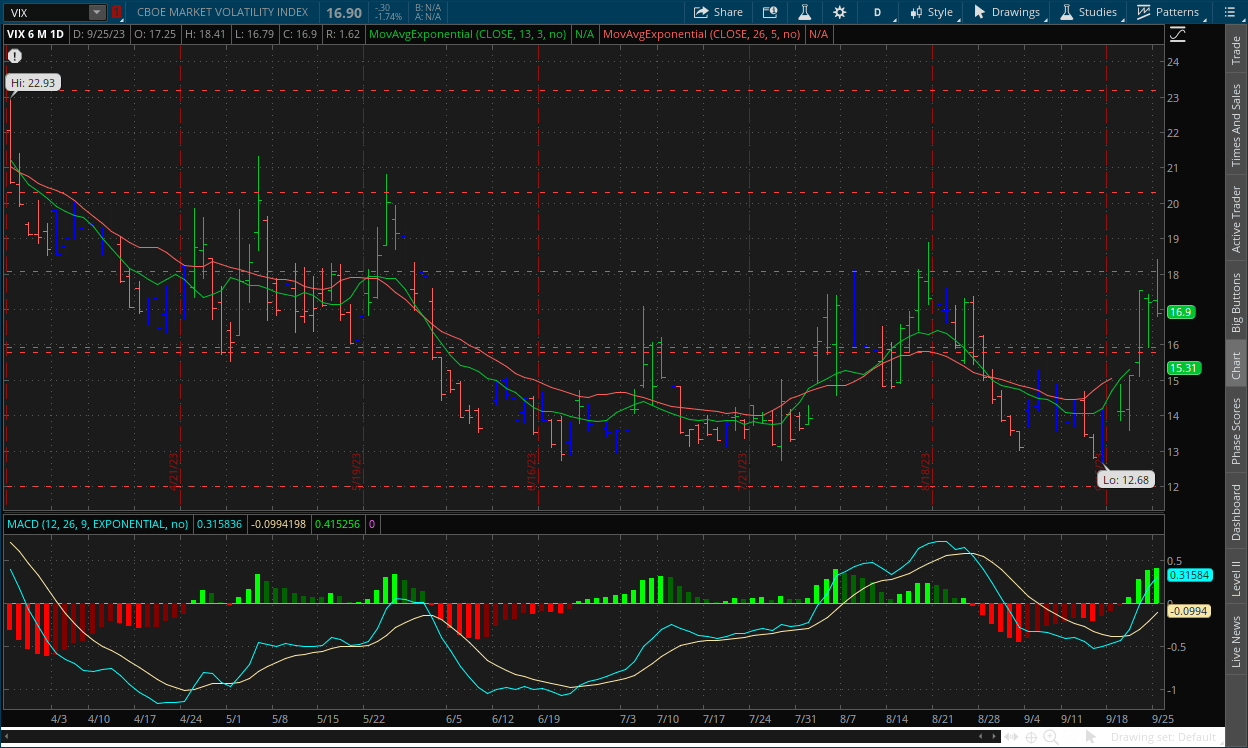

Volatility Index: (VIX)

Monday Recap:

The VIX would open the session slightly higher than Friday’s close at $17.25, and extend to a high of $18.41 during premarket hours before sliding throughout the rest of the day, reaching a low of $16.79 before closing at $16.90.

Daily Chart:

Strength continued to move in favor of the VIX bulls, albeit more tempered than previous jumps but that’s to be expected following a meteoric rise. Inertia continued to shift strongly towards the upside as it tries to catch up with prices.

Prices have reached resistance at the $18 level, which is where the previous rally was halted before returning to its trading range. The VIX is having more dramatic price swings after being dormant for a while. The VIX bulls are starting to gain a significant grip on implied volatility. The VIX is tethered to S&P 500 options contracts, and rises in the VIX mean more implied volatility in the future. With more spikes in the VIX prices, this is the likely outcome. Prices will need to be held above $16 for the VIX bulls to continue to move prices even higher, or else they’ll be halted at $18 every time. But a true breakout above $18 would obviously be even better for them, which may end up being the case if fear persists.

II-II

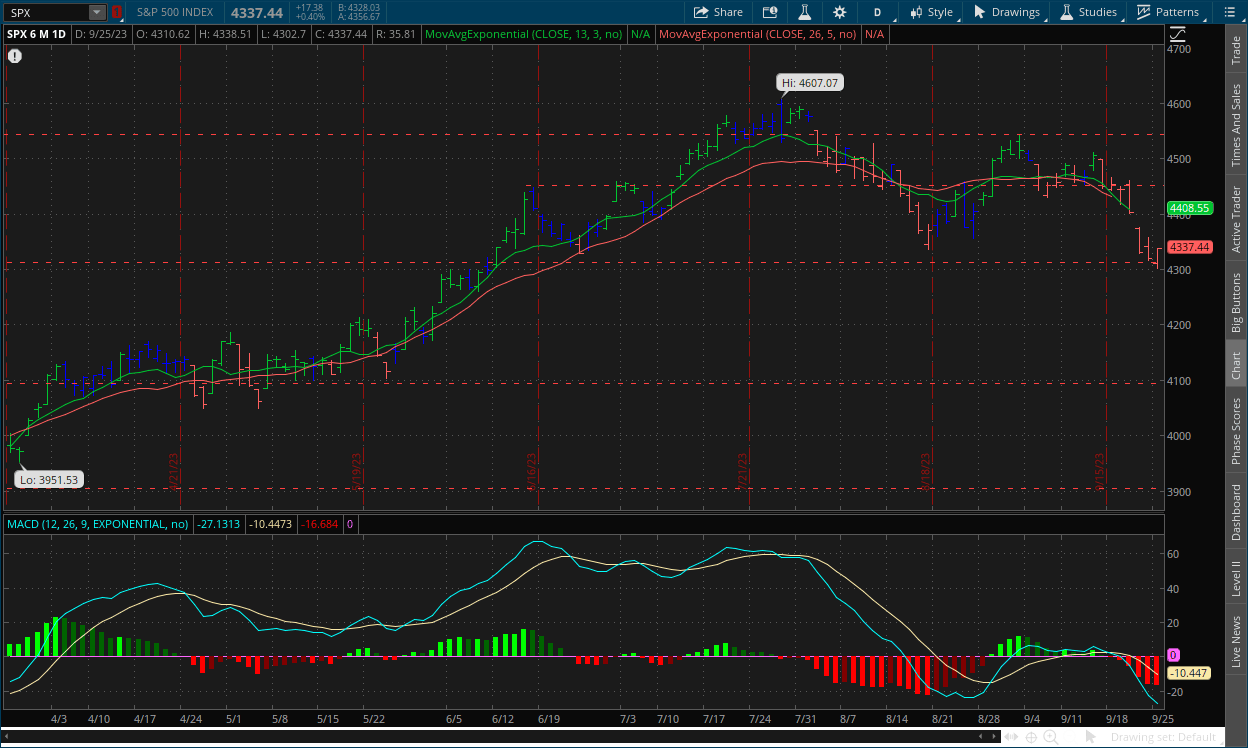

S&P 500: (SPX)

Monday Recap:

The S&P would open the week at $4,310, and reach a low of $4,302 in the opening minutes. Prices would steadily rise throughout the day, reaching a high of $4,338 in the final minutes before closing just below that mark at $4,337.

Daily Chart:

Strength continued to move in favor of the bears and like the VIX, it was tempered but again, that’s to be expected after a sharp drop. Inertia continued to shift towards the downside as bears look to add more downward pressure to prices.

The S&P is at its lowest point since early June, and bears face their next crucial test at the $4,300 support level. Given the fear that’s spreading, the reasoning behind it (i.e. fundamentals), and the technical signals’ backing, a downside breakout is the most likely outcome.

III

Fundamentals:

III-I

Headlines:

1.) MarketWatch: Jamie Dimon on Interest Rates: ‘I am not sure the world is prepared for 7%’

2.) MarketWatch: ‘It’s pretty dire’, John Hancock strategist says of sentiment on Wall Street as bond yields march higher

3.) MarketWatch: Ford pauses work on $3.5 billion EV battery plant in Michigan

4.) Bloomberg: Private equity is piling debt on itself like never before

5.) Wall Street Journal: Shutdown would blindfold Fed in piloting course on rates

T5 note: They’re already blindfolded. “We’re navigating by the stars under cloudy skies.” Straight from the horse's mouth at Jackson Hole.

III-II

What You Need to Know About a Potential Government Shutdown:

Political Backdrop:

On September 30 the government needs to pass new spending bills or a “continuing resolution” bill that extends government funding and spending through the fiscal year. If they don’t, it leads to a lack of congressionally authorized funding and forces certain functions of government to shut down. This tends to occur when there are disagreements over budget allocations, which is the case today.

Putting an End to Omnibus and Continuing Resolution Bills:

The previous spending bill, the Omnibus Bill, was massively controversial not just within Congress, but with normal everyday people as well. The goal of the potential stoppage is to put an end to the omnibus and continuing resolution type bills, and to return to multiple, and more specific subject spending bills that require more programmatic analysis of what’s working and not working, more review of individual subjects, the ability to isolate some of the more weaponized and useless programs in order to get them removed, and more bipartisanship and negotiation between Congress rather than division. The reason why omnibus and continuing resolution bills get passed is because they wait until the last minute, type up a 5,000-page bill, and say vote up or down. This proposition puts an end to this lazy way of governing. This idea was deflected by House Speaker McCarthy, certain moderate republicans, and most left-wing members at first. But the idea has started to gain more traction on both sides of the aisle.

Continuing resolution and omnibus opposer Rep. Matt Gaetz and his constituents have proposed in their first few single subject bills, a.) more funding of the Department of Defense (DOD) but with gating built in to keep spending away from the non-useful areas; b.) more spending on border control, i.e. increase spending in the areas of Homeland Security that funds border patrol, ICE and TSA agents; c.) deep cuts to the department of state and foreign aid (i.e. Ukraine). “If we’re out of money, then maybe we should stop borrowing it (i.e. increasing debt levels) and giving it to other countries,” said Matt Gaetz; d.) cuts within the Agriculture Appropriations Bill, citing waste in the food stamps program, and more opportunities for savings in work requirements.

However, there is still division amongst congressional members, and a shutdown is looking like the more likely outcome as time goes on. The good news is that shutdowns have typically been reasonably short, with an average of 8 days. The most recent lengthy shutdown in 2019 is misleading, given that only 25% of the government was closed during the period.

Economic and Market Impact:

As for treasury bonds, interest payments on them will not be impacted. In addition, social security payments will still be made without interruption. National security personnel and Federal employees must work but won’t be paid. In addition to possibly straining household finances of government employees, some economic data collection would be suspended. A shutdown means the employment report, inflation readings like CPI, and GDP measurement could be impacted. The length of shutdown would determine if some of these reports are just delayed or skipped entirely. Since it is a private company, the ADP employment report is not impacted. In addition, economic releases from the Federal Reserve and the Department of Labor’s weekly unemployment claims would be produced without interruption. If a lengthy shutdown were to occur and these reports were affected, the Fed will likely be forced to pause rate hikes no matter what for the time being.

A partial government shutdown would be “credit negative”, Moody's credit agency said Monday. “A shutdown would demonstrate the significant constraints that intensifying political polarization put on fiscal policy making at a time of declining fiscal strength, driven by widening fiscal deficits and deteriorating debt affordability,” said Moody’s, which has a AAA rating for the U.S. government, and recently downgraded U.S. Treasuries from AAA to AA. Moody’s said the economic impact of a shutdown would likely be short-lived, but added, “the longer the shutdown persists, the more negative the potential impact on the broader economy. A prolonged shutdown would likely be disruptive both to the U.S. economy and financial markets.”

While some political rhetoric has stated that a shutdown risks sending the country into an economic downturn, history says that just isn’t the case. JPMorgan estimates that each week of government shutdown reduces GDP growth by 0.1 percentage point. Because federal employees receive retroactive salaries after the shutdown ends, any GDP growth lost is typically made back. According to Strategas, stocks have not been significantly impacted by government shutdowns in the past, and it’s been pretty much an even split between gains and losses for the S&P 500 during these periods. However, we’re in a particularly strange market environment, and with fear already dripping more and more into the markets, this may only put gas on the fire if it persists.

IV

Market Psychology & Final Thoughts:

The VIX is trading higher as we head towards the open, currently sitting at $17.69 and climbing while futures are edging down roughly -0.60%. European markets are edging down even more through the first half of their session, with bond yields mixed overall and crude futures continuing to sell off from their $90 plateau, but only slightly.

It seems it is one after another for markets right now, and they can’t catch a break. The last two sessions have been quieter, but as the shutdown deadline moves closer, as more key reports are released and higher for longer sets in even more, the more selling pressure will be added. As always, we hope you found this insightful, learned one, two, or even three things, and if you didn’t have a kick ass Monday, have a bounce back Tuesday.