Berkshire Hathaway Becomes Net Sellers, Michael Burry Bets the House Against Stocks

August 16, 2023

The bears have finally begun to get an edge over the bulls, and the 13f filings of Berkshire Hathaway and Scion Asset Management for Q2 support this shift in market psychology.

Fed Minutes Show Commitee Members Are Still Hawkish, Another Rate Hike Ahead?

August 17, 2023

Inflationary pressures still persist in both CPI and PPI, but are they enough to warrant another hike? The latest Fed minutes help shed light on that very question.

Industrial Production Data for July Comes in Much Higher Than Expected

August 18, 2023

July's industrial production data came in more than twice as high as Wall Street forecasts, as it gets a boost from certain sectors, but should expectations be adjust going forward, or should they be tempered?

Will Money Market Yields Help Cause an Even More Significant Stock and Bond Market Shift?

August 21, 2023

Most money market funds are offering higher yields than short term treasuries. This begs the question of; what is the point of investing in treasuries or stocks if a potential downtrend is on the horizon when you can have 100% liquidity that is risk free inside of a money market fund?

BRICS Summit Begins in Johannesburg, But Not All Members Are on Board with Expansion Talks

August 22, 2023

Brazil and South Africa are relatively skeptical of the idea of expansion on the terms that it would “dilute their influence” in the alliance and embellish China’s claim to lead the developing world. India, however, is much more riled, and doesn't want the alliance to turn into an exclusively anti-western group.

Is Economic Stagnation the Best-Case Scenario for the U.S. in the Coming Years?

August 24, 2023

A scenario where the U.S. experiences extremely low and remains very stagnant in terms of economic and market growth isn't a matter of if, it's a matter of when. We are not the exception to this universal law, every empire has its rise, its time, and its fall.

BRICS Expansion is Official - Saudi Arabia, Iran & Others Invited to Join the Bloc

August 25, 2023

The new members will increase the BRICS’ share of global GDP from 32% to 37% based on current data, but this will inevitably grow as new countries are admitted, as well as the existing members continuing to grow.

Are Markets Headed for a Consolidation Stage Before They Move Any Further?

August 28, 2023

The daily chart of the S&P is favoring momentum to the upside, but the weekly chart is favoring momentum to the downside. This dynamic in the balance of power between bulls and bears shows that markets will likely pullback following this short dip, which is then usually followed by consolidation before the true move is made.

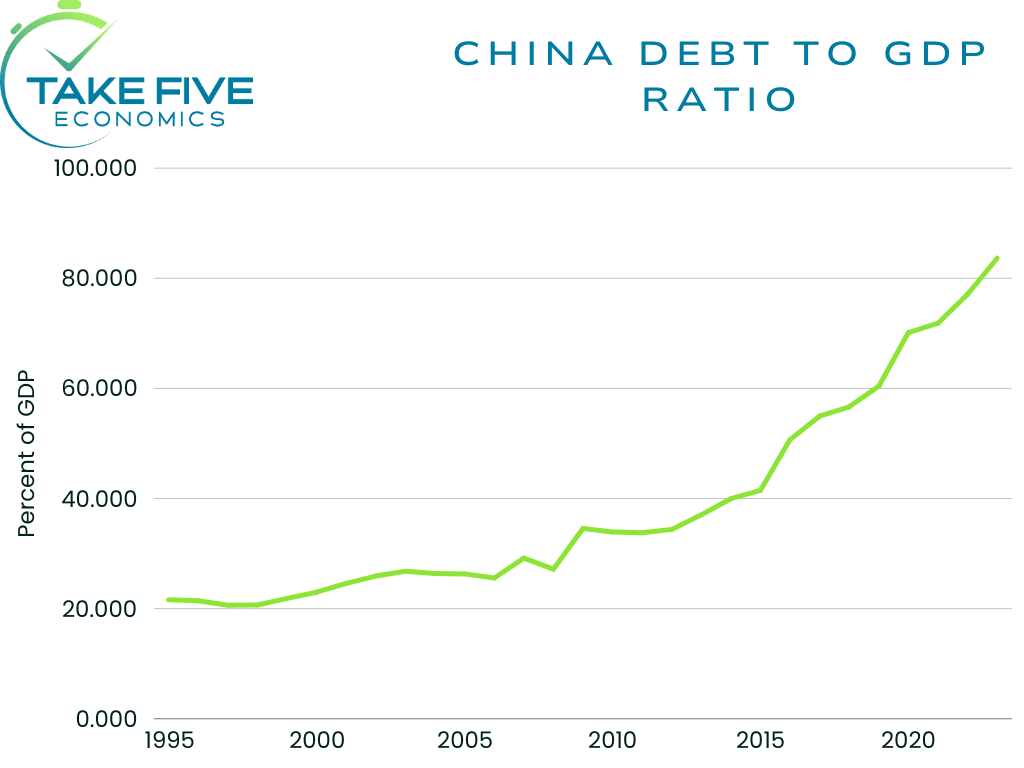

Will China's Debt Issues Finally Catch Up to Them?

August 29, 2023

Until recently, China has managed debt and different crises exceptionally well. But the significant slowdowns in growth combined with accelerating debt levels within local governments and real estate along with possible deflationary trends, it creates a potential headwind that may wind up being unavoidable.

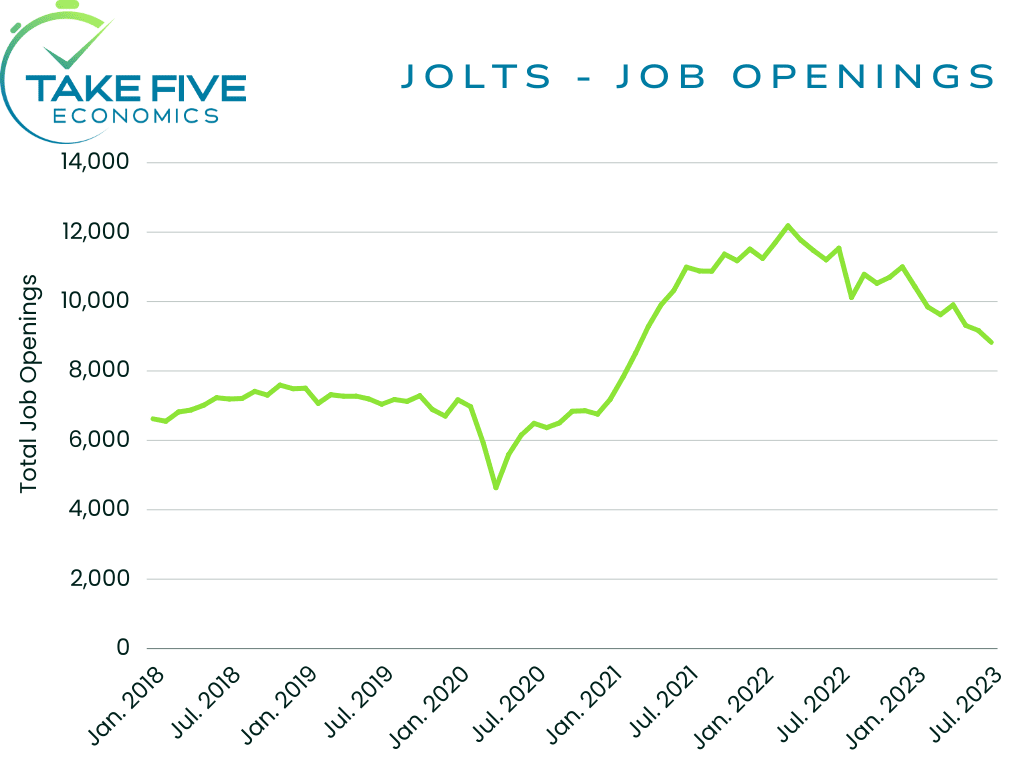

JOLTS Data Comes in Well Below Analysts' Expectations

August 30, 2023

These are figures that the Fed will be pleased to see, as this is the direction they want the labor market to be heading in, i.e. tightening. Our outlook for the labor market, and for the rest of the economy for that matter, is much more bearish than most, but we stand by it nonetheless. We’ll likely see the number of job openings continue to wane in the coming months.

ADP Employment Report Follows Similar Path to JOLTS Data

August 31, 2023

The trend in the private sector is consistent with the notion that the labor market is tightening. Markets also took this as a bullish signal, as it gives the Fed less justification to hike interest rates again. But again, as we have said before, they’re ignoring the larger picture, a key characteristic of a speculative market.