The Take Five Report: 8/28/23

I

Markets:

I-I

Global Market Recap:

United States:

- S&P: +0.67%

- Dow: +0.73%

- Nasdaq: +0.94%

- Russell 2k: +0.40%

U.S. indexes would open on a positive note in Friday’s session, and would sell off leading into and through Powell’s Jackson Hole Speech, bringing them marginally into the red. After the speech concluded, markets would rally for the remainder of the session and ultimately cap the week off with a day in the green.

Asia:

- Shanghai: +1.13%

- Hong Kong: +0.97%

- Japan: +1.73%

- India: +0.17%

Asian markets kicked off the final week of August on a positive note. Chinese authorities announced new measures to support its struggling markets, which include halving stamp duty on stock trading in order to boost equity prices.

Europe:

- UK: +0.07%

- Germany: +0.07%

- France: +0.21%

- Italy: +0.49%

European markets closed up on Friday, but earlier gains were washed away following Jackson Hole, with many different sectors and industries moving in completely separate directions. To be fair however, U.S. markets rallied following the speech, but European markets closed just after the speech concluded, so they likely would have had room to run if there were more time.

I-II

U.S. Sectors Snapshot:

- Communication Services: +0.17%

- Consumer Discretionary: +1.10%

- Consumer Staples: +0.56%

- Energy: +1.07%

- Financials: +0.34%

- Health Care: +0.60%

- Industrials: +0.86%

- Info Tech: +0.82%

- Materials: +0.27%

- Real Estate: +0.27%

- Utilities: +0.78%

II

Technicals:

II-I

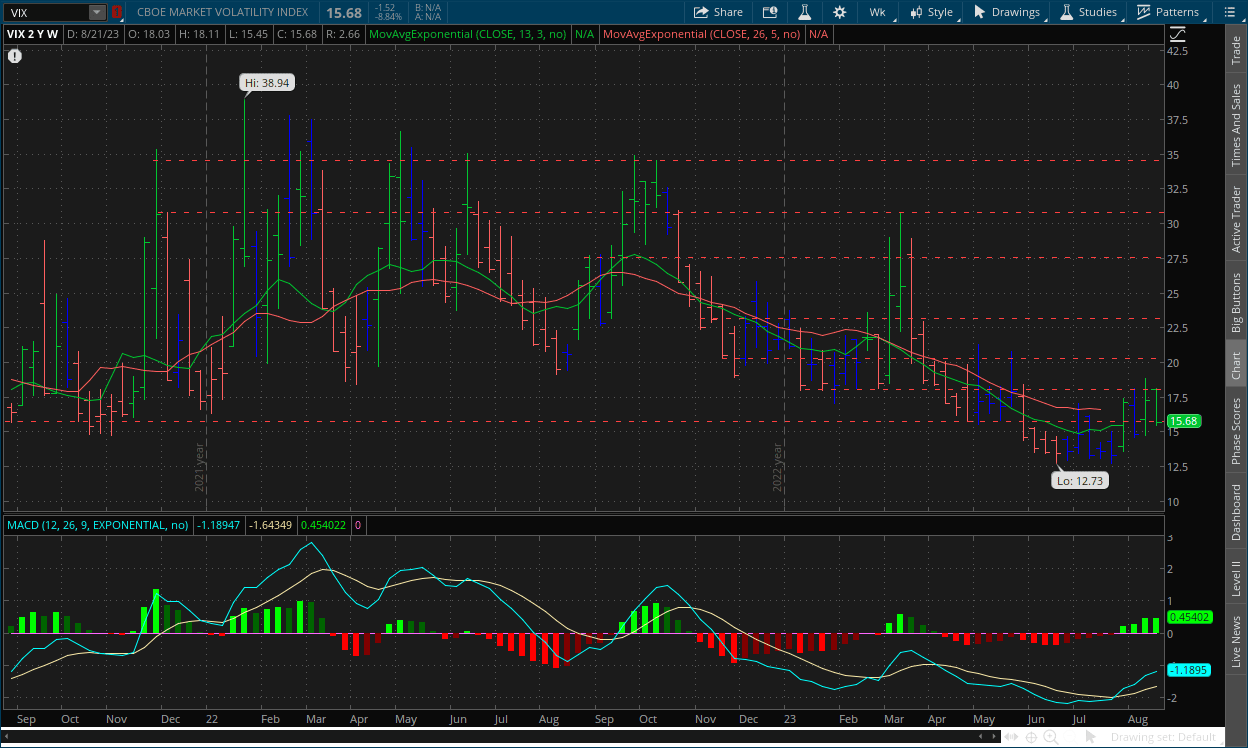

Volatility Index: (VIX)

Weekly Chart:

The VIX would finish lower this week compared to last week. Prices would close at $15.68 following Friday’s session, falling just below the $15.78 support level after hitting the $18.07 resistance level the day prior.

Strength would move in favor of the VIX bulls this week despite the decline overall while inertia would flatten slightly as a result but is still favoring bullish momentum in the shorter term. The MACD-H’s momentum also waned compared to previous weeks, as the gain in strength was minimal compared to the rest. MACD Lines have gained more separation from each other as well.

However, as we’ve seen historically as it pertains to this data chart during this downtrend, this is the point where the VIX and its technical indicators would start to turn, and edge back down. VIX bulls have shown good enough support at the $15.78 level but have struggled to break past the $18.07 resistance point, as VIX bears have held strong there. We may be headed for another period of price consolidation and war of attrition between the two opposing parties, as Powell’s Jackson Hole speech left markets split (see below; section III-II).

If the VIX bulls manage to keep this trend alive, they must break above the $18.07 level, and create enough support at that point to deter the bulls. If the VIX bears want a shot at a reversal, then they must push prices below the $15.78 level and create enough resistance at that point to deter the bulls. However, we continue to stand by our analysis that any resulting move by the VIX bears will more than likely be a pullback rather than a reversal, and it will allow the VIX bulls to catch their breath.

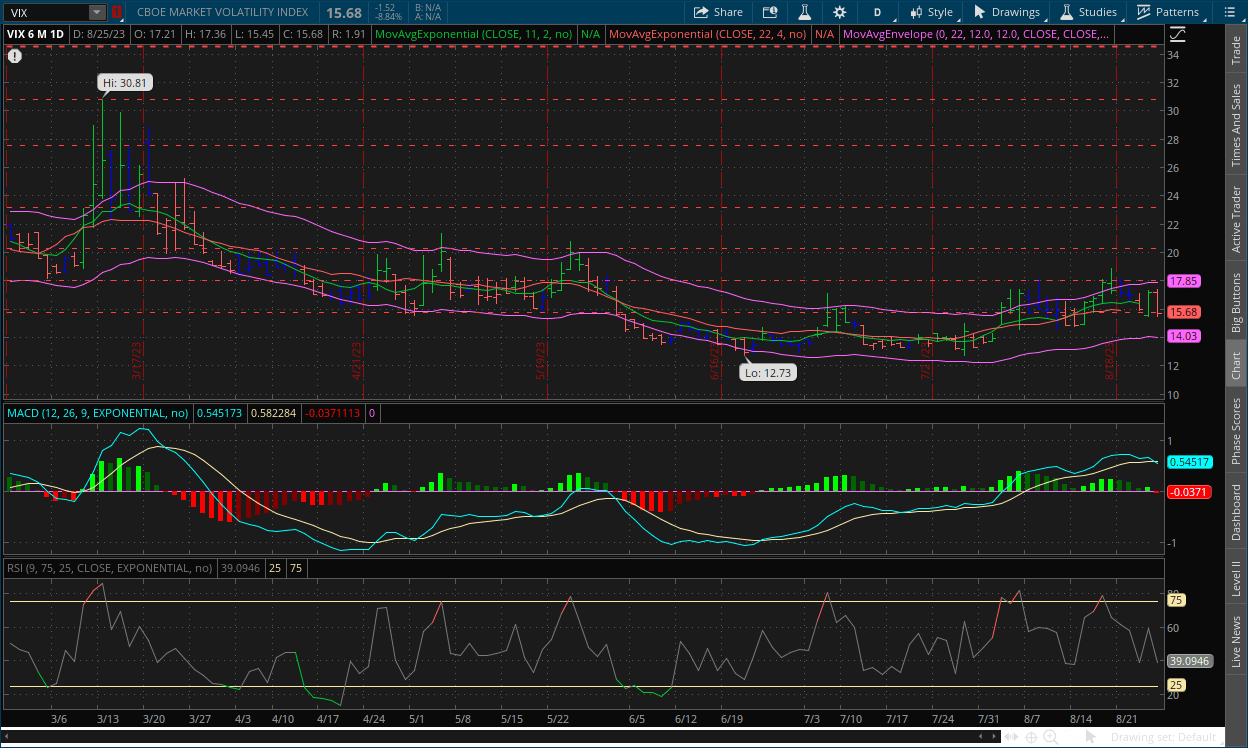

Daily Chart:

Strength would move in favor of the VIX bears following Friday’s session, and would break below the centerline for the first time since June 23 while inertia would move in favor of the VIX bears as well.

We’ve previously discussed our expectations for the MACD-H, and the likelihood of the VIX bears bringing it back in their favor, whether that would be sooner or later. We favored the former, and were correct in that assumption, and also assumed that prices will likely consolidate for a short time following this. We also said that prices would likely consolidate at the $18.07 level if the VIX bulls manage to break above it (which they didn’t) or the $15.78 level but we're neutral at that point, as it could extend beyond it given the close proximity it is to the current trend. The $13 level may be the more likely point, again all depending on potentially bullish catalysts for stocks.

II-II

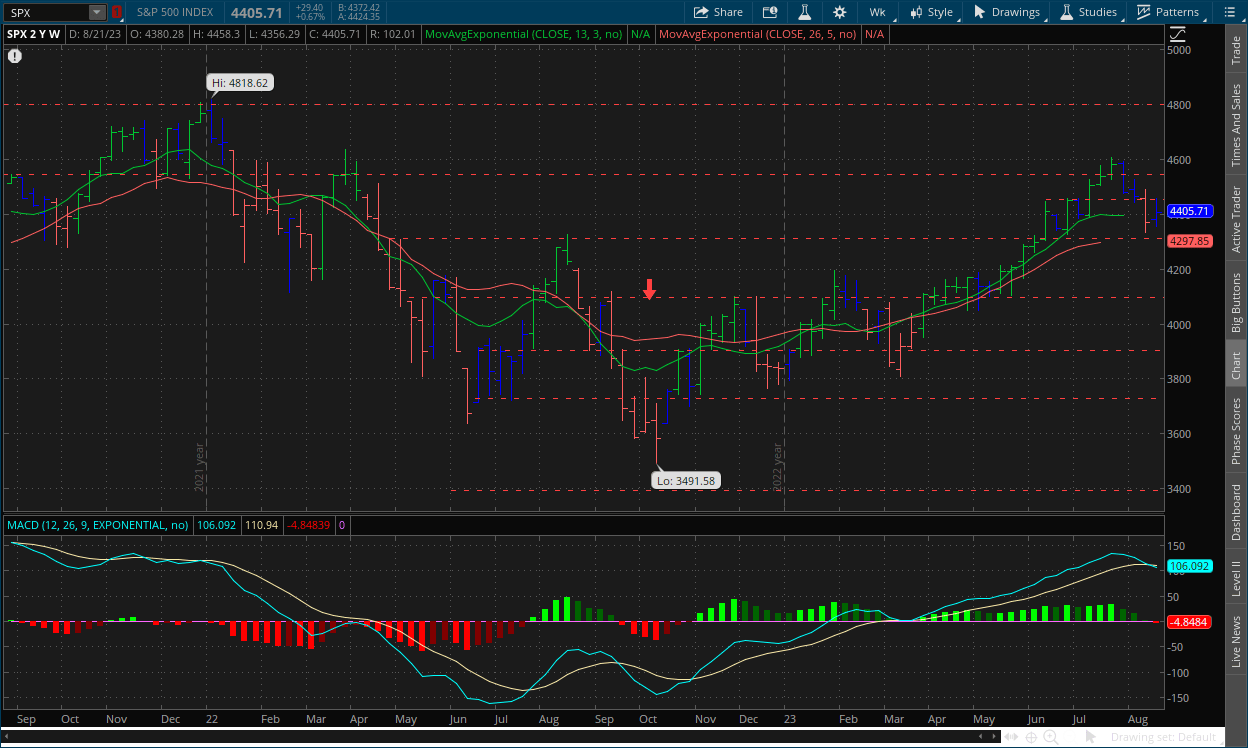

S&P 500: (SPX)

Weekly Chart:

The S&P would close the week slightly higher than last week and notch a weekly gain, with Friday’s session closing at $4,405. Strength would move in favor of the bears for the fourth straight week and cross below the centerline for the first time since the week of March 20, while inertia turned flatter, and more in favor of the bulls compared to last week. MACD Lines also crossed over one another for the first time since March 20.

Depending on the way markets take Powell’s speech, that will be the short-term direction until we meet our next set of catalysts later this week, all of which could cause whipsaws in our analysis. By looking at the weekly chart, we’re getting a longer-term view of the market trend. The bears still haven’t done enough to bring the markets fully in their control, as this has only been a four-week pullback so far, and strength is barely in their favor. Given the catalysts, this week will show whether or not the bears can push prices lower and will give us a better long-term idea of where markets are likely to go over the next few weeks.

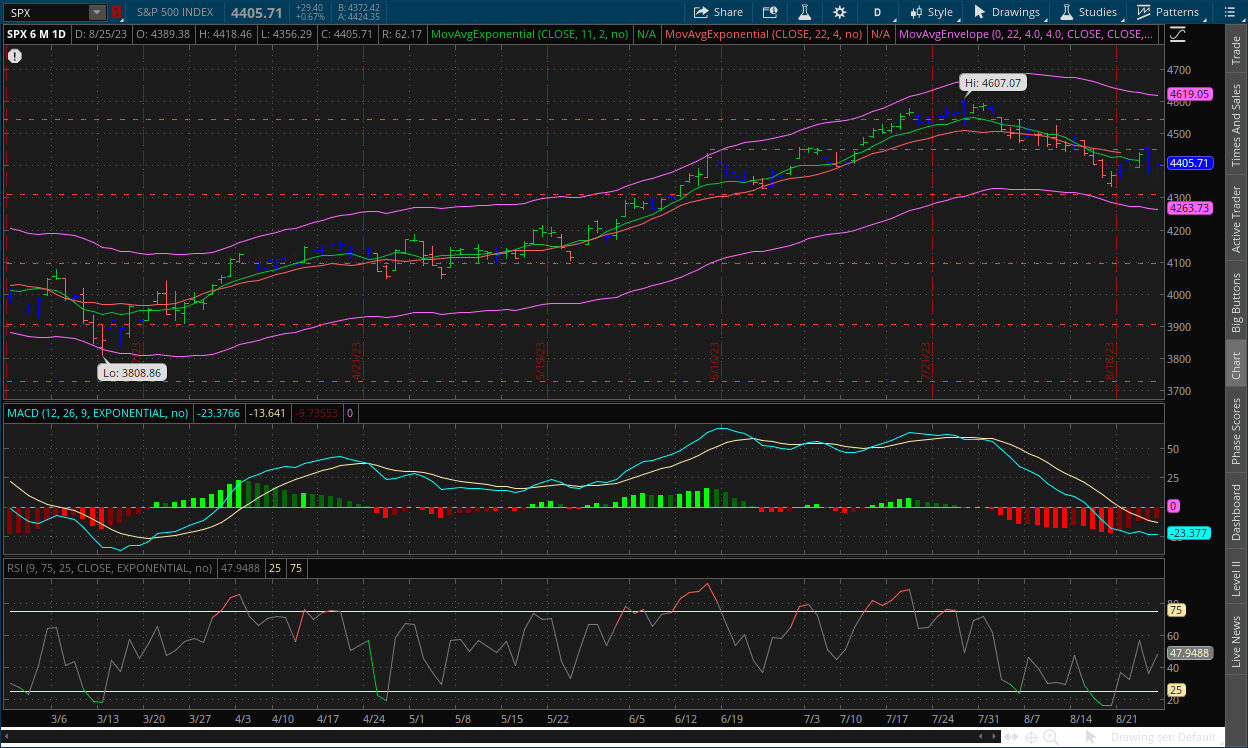

Daily Chart:

Strength would move in favor of the bulls for the fifth straight session following Friday’s close as the bulls’ continue their momentum in bringing the indicator back towards the centerline. Inertia on the other hand would change very little, and remain in favor of the bears. Prices were pushed down to a low of $4,356 in Friday’s session, but reached a high of $4,418. We still believe however that prices will be met with resistance at or near the $4,450 level and consolidate for a short time but again, depending on the catalysts this week.

III

Fundamentals:

III-I

Headlines:

1.) MarketWatch: Fed’s Powell left investors with a cloud of uncertainty, and the U.S. stock market faces a difficult week ahead

2.) MarketWatch: ‘This is a no rules market’. Goldman strategist explains why recent stock moves have confounded traders

3.) MarketWatch: Tech stock rally faces trouble as tightening by central banks overshadows AI, says BofA

4.) Bloomberg: Markets show China needs a stimulus bazooka to woo investors

5.) Wall Street Journal: Evergrande stock falls 87% as trading resumes for first time in 17 months

6.) Financial Times: Eurozone money supply shrinks for the first time in 13 years as lending slows

III-II

Jerome Powell's 2023 Jackson Hole Speech:

Introduction:

We have tightened policy significantly over the past year. Although inflation has moved down from its peak—a welcome development—it remains too high. We are prepared to raise rates further if appropriate and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.

The Decline in Inflation So Far:

It was clear that bringing down inflation would depend on both the unwinding of the unprecedented pandemic-related demand and supply distortions and on our tightening of monetary policy, which would slow the growth of aggregate demand, allowing supply time to catch up. While these two forces are now working together to bring down inflation, the process still has a long way to go, even with the more favorable recent readings.

On a 12-month basis, U.S. total, or “headline,” PCE (personal consumption expenditures) inflation peaked at 7 percent in June 2022 and declined to 3.3 percent as of July, following a trajectory roughly in line with global trends… But food and energy prices are influenced by global factors that remain volatile, and can provide a misleading signal of where inflation is headed. In my remaining comments, I will focus on core PCE inflation, which omits the food and energy components.

On a 12-month basis, core PCE inflation peaked at 5.4 percent in February 2022 and declined gradually to 4.3 percent in July. The lower monthly readings for core inflation in June and July were welcome, but two months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal. We can’t yet know the extent to which these lower readings will continue or where underlying inflation will settle over coming quarters. Twelve-month core inflation is still elevated, and there is substantial further ground to cover to get back to price stability.

Core Goods:

Core goods inflation has fallen sharply, particularly for durable goods, as both tighter monetary policy and the slow unwinding of supply and demand dislocations are bringing it down. As the pandemic and its effects have waned, production and inventories have grown, and supply has improved. At the same time, higher interest rates have weighed on demand. On a 12-month basis, core goods inflation remains well above its pre-pandemic level. Sustained progress is needed, and restrictive monetary policy is called for to achieve that progress.

Housing Services:

Measured housing services inflation lagged these changes, as is typical, but has recently begun to fall. Because leases turn over slowly, it takes time for a decline in market rent growth to work its way into the overall inflation measure. The market rent slowdown has only recently begun to show through to that measure. The slowing growth in rents for new leases over roughly the past year can be thought of as “in the pipeline” and will affect measured housing services inflation over the coming year. Going forward, if market rent growth settles near pre-pandemic levels, housing services inflation should decline toward its pre-pandemic level as well.

Non-Housing Services:

Non-housing services, accounts for over half of the core PCE index… Twelve-month inflation in this sector has moved sideways since liftoff. Inflation measured over the past three and six months has declined, however, which is encouraging. Part of the reason for the modest decline of non-housing services inflation so far is that many of these services were less affected by global supply chain bottlenecks and are generally thought to be less interest sensitive… Production of these services is also relatively labor intensive, and the labor market remains tight. Given the size of this sector, some further progress here will be essential to restoring price stability.

The Outlook:

Although further unwinding of pandemic-related distortions should continue to put some downward pressure on inflation, restrictive monetary policy will likely play an increasingly important role. Getting inflation sustainably back down to 2 percent is expected to require a period of below-trend economic growth as well as some softening in labor market conditions.

Economic Growth:

We are attentive to signs that the economy may not be cooling as expected. So far this year, GDP growth has come in above expectations and above its longer-run trend, and recent readings on consumer spending have been especially robust… After decelerating sharply over the past 18 months, the housing sector is showing signs of picking back up. Additional evidence of persistently above-trend growth could put further progress on inflation at risk and could warrant further tightening of monetary policy.

The Labor Market:

The rebalancing of the labor market has continued over the past year but remains incomplete. Labor supply has improved, driven by stronger participation among workers aged 25 to 54 and by an increase in immigration back toward pre-pandemic levels. Demand for labor has moderated as well. Job openings remain high but are trending lower. Payroll job growth has slowed significantly. Total hours worked has been flat over the past six months, and the average workweek has declined to the lower end of its pre-pandemic range, reflecting a gradual normalization in labor market conditions.

This rebalancing has eased wage pressures. Wage growth across a range of measures continues to slow, albeit gradually. While nominal wage growth must ultimately slow to a rate that is consistent with 2 percent inflation, what matters for households is real wage growth. Even as nominal wage growth has slowed, real wage growth has been increasing as inflation has fallen.

Uncertainty and Risk Management Going Forward:

Two percent is and will remain our inflation target… It is challenging, of course, to know in real time when such a stance has been achieved. We see the current stance of policy as restrictive, putting downward pressure on economic activity, hiring, and inflation. But we cannot identify with certainty the neutral rate of interest, and thus there is always uncertainty about the precise level of monetary policy restraint.

That assessment is further complicated by uncertainty about the duration of the lags with which monetary tightening affects economic activity and especially inflation. Since the symposium a year ago, the Committee has raised the policy rate by 300 basis points, including 100 basis points over the past seven months. And we have substantially reduced the size of our securities holdings. The wide range of estimates of these lags suggests that there may be significant further drag in the pipeline.

Beyond these traditional sources of policy uncertainty, the supply and demand dislocations unique to this cycle raise further complications through their effects on inflation and labor market dynamics. For example, so far, job openings have declined substantially without increasing unemployment—a highly welcome but historically unusual result that appears to reflect large excess demand for labor. In addition, there is evidence that inflation has become more responsive to labor market tightness than was the case in recent decades. These changing dynamics may or may not persist, and this uncertainty underscores the need for agile policymaking.

These uncertainties, both old and new, complicate our task of balancing the risk of tightening monetary policy too much against the risk of tightening too little. Doing too little could allow above-target inflation to become entrenched and ultimately require monetary policy to wring more persistent inflation from the economy at a high cost to employment. Doing too much could also do unnecessary harm to the economy.

Conclusion:

As is often the case, we are navigating by the stars under cloudy skies… We will proceed carefully as we decide whether to tighten further or, instead, to hold the policy rate constant and await further data. Restoring price stability is essential to achieving both sides of our dual mandate. We will need price stability to achieve a sustained period of strong labor market conditions that benefit all.

Take Five's Take:

Powell was extremely neutral in his rhetoric, not favoring the bulls nor the bears. His use of the word ‘could’ at key points and playing both sides shows that they are still in reactionary mode, and ultimately don’t know what is going to happen, which is summed up perfectly in the first sentence of his closing remark, “As is often the case, we are navigating by the stars under cloudy skies.”

IV

Market Psychology & Final Thoughts:

Markets have to deal with multiple catalysts this week. The Case Shiller Home Price Index, JOLTS’ job openings, consumer confidence, ADP employment change report, a second estimate of GDP for Q2, the PCE report, and the rest of the labor market data to close the week, i.e. payroll data, unemployment rate, average hourly earnings and average workweek, along with the ISM manufacturing index. As always, we hope you found this helpful, learned a thing or two, and have a great day.