The Take Five Report: 8/24/23

I

Markets:

I-I

Global Market Recap:

United States:

- S&P: +1.10%

- Dow: +0.54%

- Nasdaq: +1.59%

- Russell 2k: +1.04%

U.S. markets would open on a positive note despite the selloff heading towards the bell. Markets would rally throughout the session, with bears showing little resistance as the Nvidia hype propelled markets upward along with the other Magnificent Seven stocks, as all major indexes would close in the green.

Asia:

- Shanghai: +0.12%

- Hong Kong: +2.05%

- Japan: +0.87%

- India: -0.28%

Asian markets were mostly up in this morning’s session, with China and India lagging comparatively as the region mostly followed a similar path to U.S. equities the day prior. Korea and Sri Lanka held their benchmark interest rates, which also helped give the region a boost.

Europe:

- UK: +0.68%

- Germany: +0.15%

- France: +0.08%

- Italy: +0.24%

European markets moved slightly higher overall in yesterday’s session on the back of positive manufacturing PMI reads from France, Germany and Eurozone while services PMI reads came in negative across the board.

I-II

U.S. Sectors Snapshot:

- Communication Services: +1.90%

- Consumer Discretionary: +0.83%

- Consumer Staples: +0.63%

- Energy: -0.30%

- Financials: +0.93%

- Health Care: +0.29%

- Industrials: +0.99%

- Info Tech: +1.92%

- Materials: +0.18%

- Real Estate: +1.46%

- Utilities: +0.45%

II

Technicals:

II-I

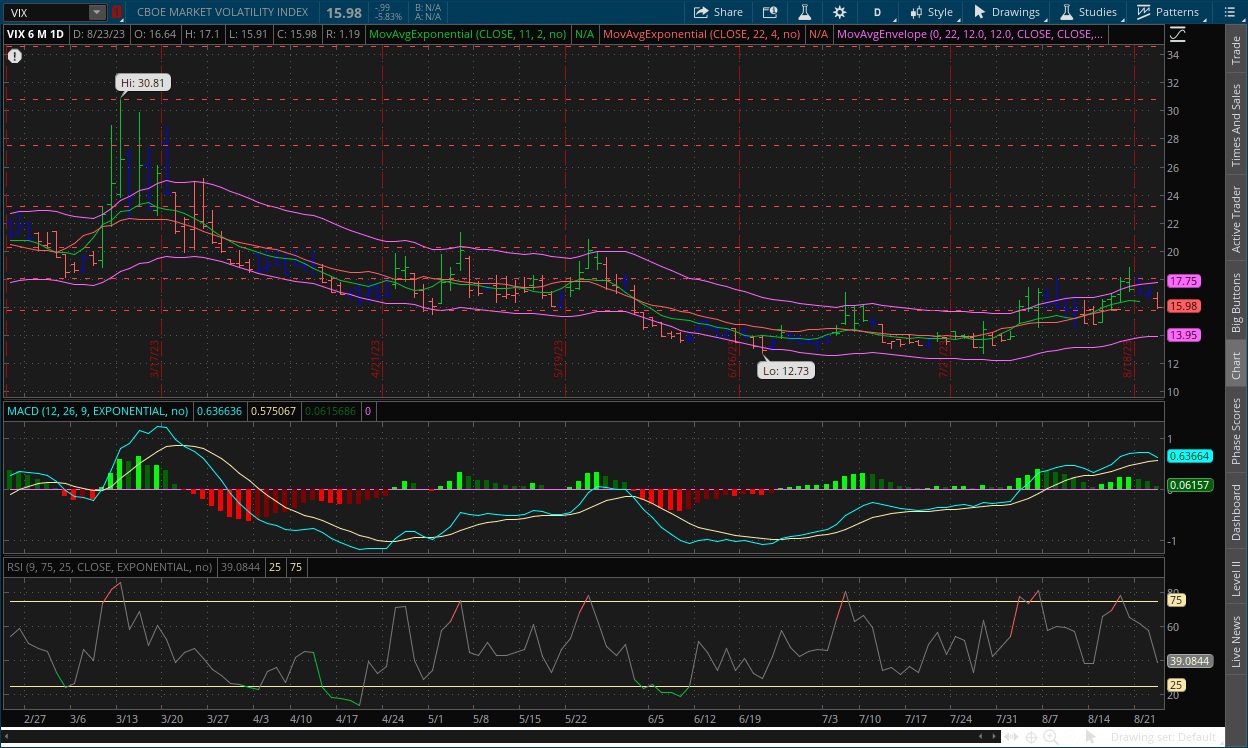

Volatility Index: (VIX)

Wednesday Recap:

The VIX would open the session lower at $16.64, and work its way to a high of $17.10 early on. Prices would slide throughout the day, bringing them to a low of $15.91 before closing at $15.98.

Daily Chart:

Strength would move in favor of the VIX bears once again for the third straight session, bringing the MACD-H just above the centerline, and is now a few days' worth of declines away from crossing below it. Inertia edged back in favor of the VIX bears but is still favoring upward momentum overall.

Prices are likely to hit or exceed below the $15.78 support level in today’s session. As you’ll see below, the direction of the VIX (and the S&P) following their respective breakouts today will largely depend upon the expectations, and the result of Fed Chair Jerome Powell’s Jackson Hole speech tomorrow morning, to which afterward we will be able to provide a better analysis as to the future direction these respective indexes will likely be heading in, and whether these inevitable breakouts past their support and resistance levels will be true or false.

II-II

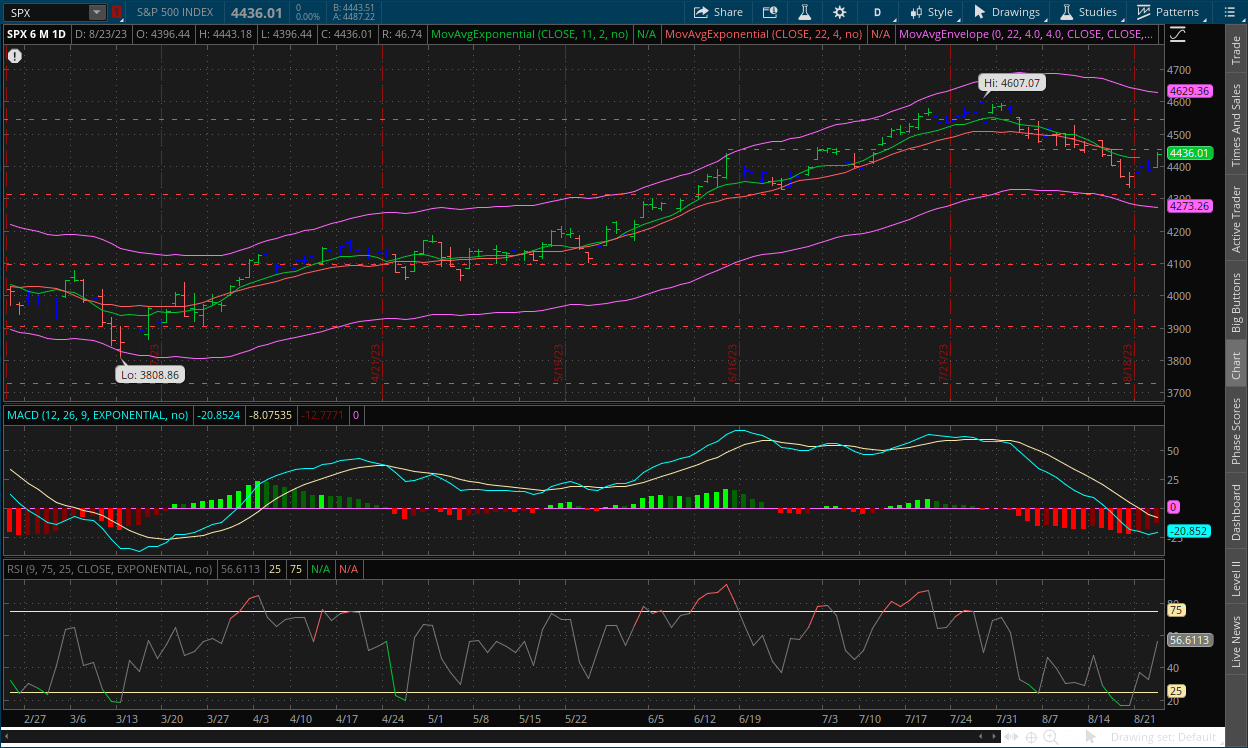

S&P 500: (SPX)

Wednesday Recap:

The S&P would open higher in yesterday’s session at $4,396, which also managed to be the low on the day. Prices would rally to a high of $4,443 at the end of the session before closing at $4,436.

Daily Chart:

Strength would gain in favor of the bulls for the third straight session as the pullback continues. Inertia would move in favor of the bulls as well, and has turned slightly flat as the party is shifting momentum more and more with little resistance from the bears so far.

Prices didn’t quite reach the $4,450 resistance level but will likely hit and exceed that point today based on premarket movements alone. However, Fed Chair Jerome Powell’s Jackson Hole speech is tomorrow at 10:05am, and the future direction of the S&P will largely depend on Powell’s rhetoric and outlook. If it were to be hawkish, this will likely overshadow the euphoria surrounding Nvidia earnings, but if he were to turn dovish, that will further fuel the euphoria within the markets over these last few days and give bulls another opportunity to run. In either case, we stand by our bearish analysis, but we also do expect a pullback of some kind first.

III

Fundamentals:

III-I

Headlines:

1.) MarketWatch: Iran and Saudi Arabia invited to join BRICS bloc

2.) MarketWatch: Nvidia stock jumps after blowout quarter, boosting AMD and Taiwan Semiconductor shares

3.) Bloomberg: Hong Kong’s exports fall again, weighing on economy’s outlook

4.) Market Insider: A 40% rout in Apple bonds is signaling trouble for bank balance sheets with big debt holdings

5.) Financial Times: Corporate pension buyouts reach record volumes in US and UK

III-II

Economic Outlook - Is Stagnation a Best-Case Scenario?

Is the U.S. headed for some form of economic stagnation? Or is that issue encapsulated within a block of many other issues? The answer is yes to both of those questions, and as for economic stagnation, this may be the best-case scenario. Before we present our case, it is worth noting that the Bureau of Labor Statistics revised down their year over year (March to March) total labor market additions by -306,000. Meaning less people contributing capital flow into the economy, and one of the only factors propping up our economy is labor. A slowdown in the labor market along with labor attrition (see 8/10/23 report for in depth analysis) will lead to an even weaker consumer and economic position.

Corporate earnings, specifically within goods and consumer focused industries (both consumer discretionary and consumer staples, but largely discretionary) are highlighting concerning trends as we’ve also discussed before. For example, Peloton saw another 25% decline in sales, Footlocker’s fiscal year guidance was 34% lower than expected, leading to a 30% sell off in their share price and blaming “softening consumer trends.” But allow us to explore further.

Corporate Earnings:

Adrian Mitchell, the COO and CFO of Macy’s had this to say, “What we did see is that the speed of those delinquencies across all age balances - or aged balances actually accelerated after Q1, and that occurred primarily in June and July.” This point specifically about June and July is driven furthermore from the earnings transcript of Capital One’s CEO Richard Fairbank, citing, “When you look at the spend per customer, this has moderated and is now generally flat from a year ago. And the moderation in spending appears to be broad based. We’ve observed it across income bands and card segments. We’ve also seen it across both discretionary and non-discretionary categories.” I.e. they’re seeing people across all income levels slow spending for things they both need (non-discretionary) and want (discretionary), which connects back to the labor market trends we’re seeing as well, i.e. broad-based layoffs beginning and layoffs by attrition, which is companies refusing to rehire once an employee leave a position, putting pressure on the consumer.

Returning to Macy’s and Adrian Mitchell, “There are things we cannot control, which I think gets very much into describing the health of the consumer, and that’s the macro environment… This is about credit card balances, student loans which we know will be coming into focus within the next month or two; auto loans and mortgages. So, we just believe that the consumer is coming under pressure, because of the new realities that they have to continue to deal with.” Another statement from Walmart, “There are reasons to be optimistic in areas like employment and wage inflation that’s happened (i.e. diminishing chances of wage price upward spiral)... there are other reasons to be concerned as consumer balance sheets potentially weaken over time.” This is a discussion Ray Dalio has had on many occasions and is his biggest concern going forward. Not just with consumers, but with the Fed and U.S. government’s balance sheets as well.

Furthermore, allow us to highlight a portion of our previous report regarding the earnings transcripts of job recruitment companies:

"ZipRecruiter is a job placement company (similar to Indeed). In their earnings call, CEO Ian Siegel had this to say, “Employers continue to respond to the enduring macroeconomic uncertainty with caution. The number of job openings and employers’ willingness to pay for those job openings has been declining significantly from peaks of 2021 and 2022. This trend is consistent among both small business and enterprise customers alike, across multiple different industries and geographies.”

Essentially what Siegel is saying is that everything is slowing down in labor. The report that we highlighted on August 7 on the surface seemed strong enough despite it coming in below expectations (and will likely fall further since the BLS has revised down every labor report this year). Looking back at the report, there were more underlying concerns that we failed to highlight. Job hirings weren’t coming from industries like retail, hospitality or tech anymore like it has been over the last few years. It has been from industries like healthcare and education, which is historically correlated to the late stage of the employment cycle.”

A final point driven home by Recruit.com CEO Hisayuki Idekoba, “The global HR matching business is heavily impacted by the economic environment… it is very important to continue investing for the future and improving the efficiency while conservatively assuming a downturn, followed by a period of economic stagnation.”

Putting It Together:

In our view, the issues found and cited within these transcripts are the enterprise leaders’ best-case scenario for the future outlook of the economy, i.e. economic stagflation, which comes with slowing labor market momentum, higher unemployment, a broad-based reduction in consumer spending, etc. (again, see 8/10/23 report for a more in-depth analysis on these topics.) This among many other factors combined with the lagging effects higher interest rates will have in the coming months and potentially years will continue to take hold of the economy. A scenario where the U.S. experiences extremely low and remains very stagnant in terms of economic and market growth isn't a matter of if, it's a matter of when. We are not the exception to this universal law, every empire has its rise, its time, and its fall.

IV

Market Psychology & Final Thoughts:

Futures are heavily selling off as we head towards the open for what we can only assume is from poor expectations for Powell’s speech tomorrow morning. If this is the market's true expectations, we’ll likely see markets sell off today in anticipation. But if it’s just a blip, then we’ll likely see a lower open followed by a subsequent rise in valuations. As always, we hope you found this helpful, learned a thing or two, and have a great day.