The Take Five Report: 8/25/23

I

Markets:

I-I

Global Market Recap:

United States:

- S&P: -1.35%

- Dow: -1.08%

- Nasdaq: -1.87%

- Russell 2k: -1.27%

U.S. indexes would open just above the breakeven mark, and prices would teeter on the ledge before falling off the cliff shortly after, as markets sold off through the entirety of the session. The only explanation we can think of is a mixture of traders taking positions on profits from Nvidia’s earnings hype, and poor expectations regarding Powell’s Jackson Hole speech shortly after today’s open. Tech stocks would take the brunt of the blow, as Magnificent Seven stocks along with the Tech, Comm. Services, and Consumer Discretionary sectors led market declines.

Asia:

- Shanghai: -0.59%

- Hong Kong: -1.40%

- Japan: -2.05%

- India: -0.56%

Asian markets finished largely lower following the subsequent declines in the other global regions yesterday. Japan’s Nikkei 225 led major indexes in declines after Core CPI of the Ku-area came in at 2.8% y/y compared to 3% in July, while the corporate services price index came in at 1.7% y/y compared to 1.3% expected.

Europe:

- UK: +0.18%

- Germany: -0.68%

- France: -0.44%

- Italy: -0.57%

European markets would sell off in yesterday’s session as early boosts from traders waned as the session went on, with poor expectations for Jackson Hole likely taking over. The UK managed to gain enough early on and fend off incoming bears to notch a positive day, the only major market in the region to do so. European equities are rallying through the first portion of their session this morning.

I-II

U.S. Sectors Snapshot:

- Communication Services: -2.04%

- Consumer Discretionary: -2.01%

- Consumer Staples: -0.77%

- Energy: -0.74%

- Financials: -0.24%

- Health Care: -0.76%

- Industrials: -1.22%

- Info Tech: -2.15%

- Materials: -0.43%

- Real Estate: -0.41%

- Utilities: -0.63%

II

Technicals:

II-I

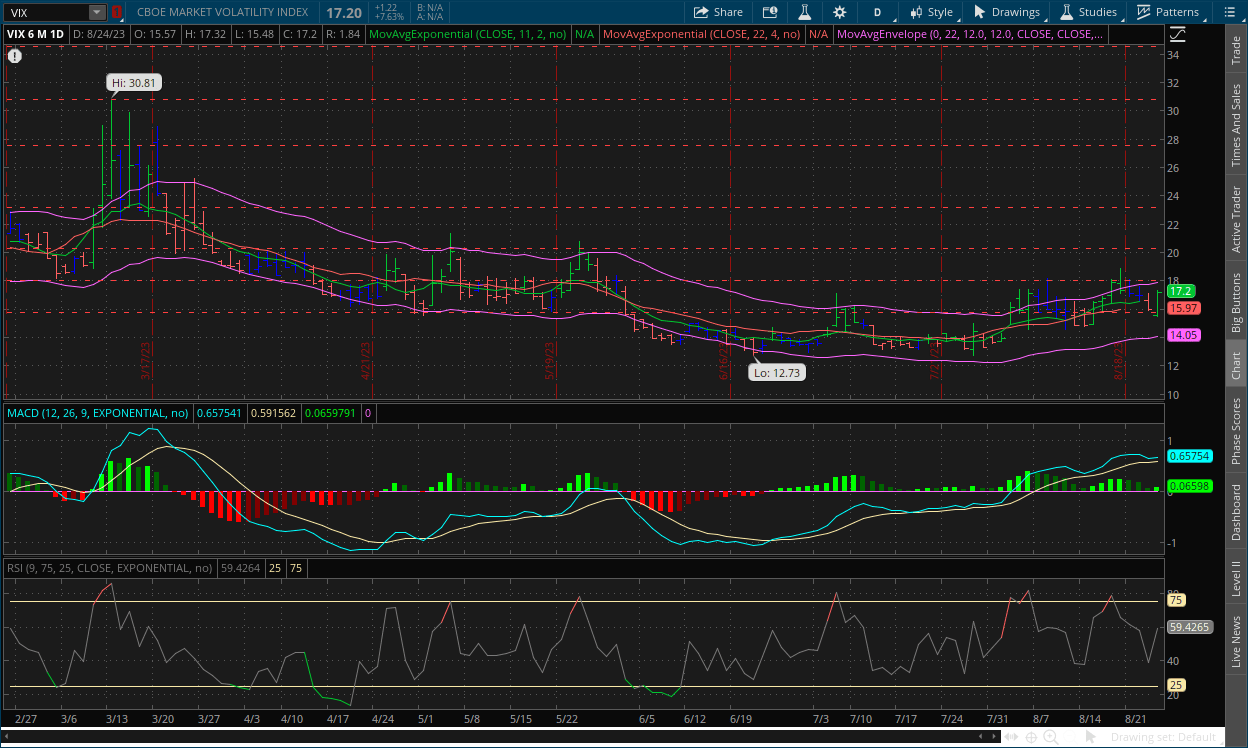

Volatility Index: (VIX)

Thursday Recap:

The VIX would open Thursday’s session at $15.57, just below the support level and reach a low of $15.48 early on. Prices would then skyrocket towards the open and rally throughout the day, bringing the market's fear gauge to a high of $17.32 before closing at $17.20.

Daily Chart:

Strength would move in favor of the VIX bulls just before the VIX bears could move the MACD-H back into their control, as the opposing party remained resilient following the breakout below the $15.78 support level upon the open. Inertia after moving in favor of the VIX bears in Wednesday’s session, shifted back in favor of the VIX bulls yesterday, as they remain dominant over the market’s fear gauge.

The VIX is holding steady in the premarket, trading just below yesterday’s close at $17.02. In a normal circumstance, a false breakout combined with a pull back in the opposite direction would insinuate prices will more than likely continue in that direction. But the direction of the VIX will largely depend on Powell today, so we will not try and predict what will likely happen as it could go either way. The same thing can be said for the S&P down below, false breakout and all.

II-II

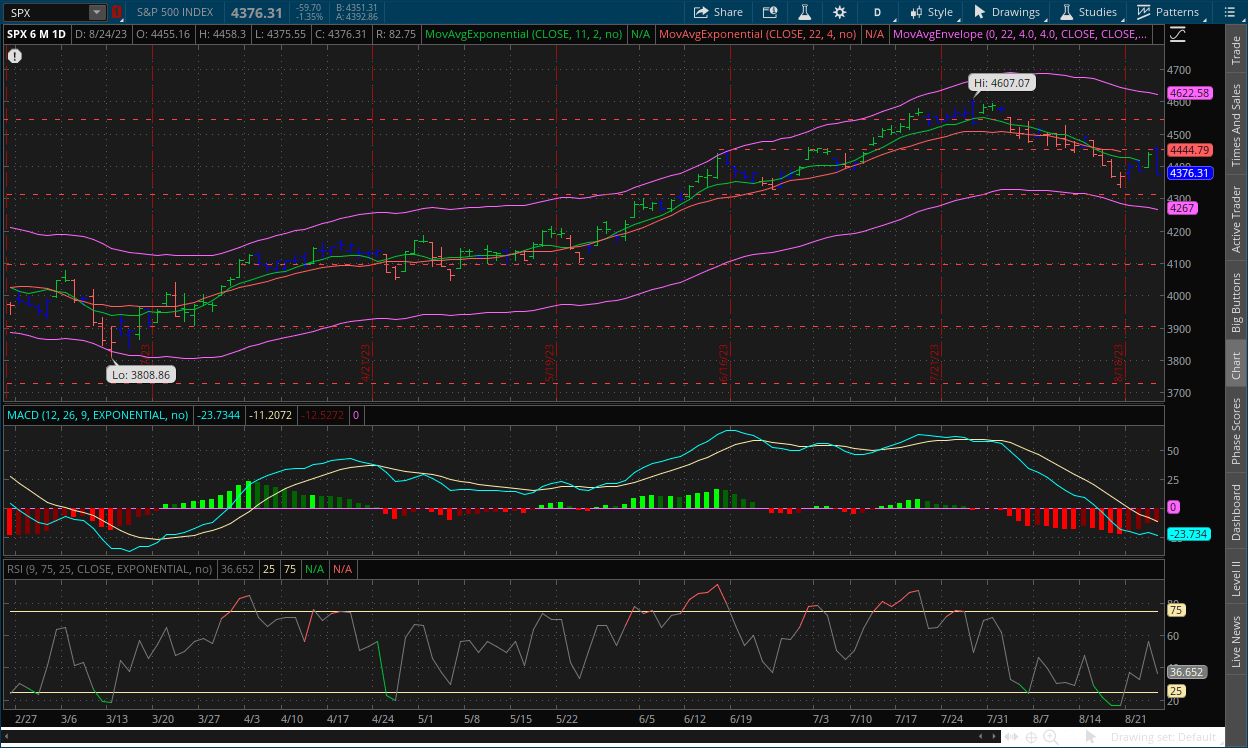

S&P 500: (SPX)

Thursday Recap:

The S&P opened the day on a positive note at $4,455, just narrowly breaking out above the $4,450 support level and would reach a high of $4,458 shortly thereafter. Prices would then slide throughout the session, reaching a low of $4,375 before closing at $4,376.

Daily Chart:

Strength would move in favor of the bulls despite the slide in prices, albeit very slightly. Inertia would shift back in favor of the bears however as they showed strong momentum in yesterday’s session. The same analysis applies to the S&P as it does for the VIX above. The minor breakout above the $4,450 level would usually mean prices would continue in the opposite direction of the breakout. But given the fundamental catalyst in Powell's Jackson Hole speech, that analysis is subject to whipsaw if his speech is interpreted as bullish.

III

Fundamentals:

III-I

Headlines:

1.) MarketWatch: U.S. central bank has earned the right to take its time with interest rate decisions, Boston Fed’s Collins tells MarketWatch at Jackson Hole

2.) Market Insider: Dick’s CEO blames alarming retail theft for profit drops, ‘It’s a problem for our entire country’

3.) Bloomberg: China eases home purchasing rules in new push to boost economy

4.) Financial Times: China imports record amount of chip making equipment

III-II

BRICS Invites Six New Nations to Join the Bloc:

New Guys on the Bloc:

Expansion was the main topic of discussion at this year's BRICS summit. We believed nothing of note would come out of the event regarding expansion due to India, Brazil, and South Africa’s hesitation towards the idea. However, we were wrong, as six new nations were formally invited to join the bloc and receive full admittance at the start of next year. The nations in question are most notably Saudi Arabia and Iran, along with Argentina, Egypt, Ethiopia, and the United Arab Emirates (UAE).

The countries were offered membership alongside Brazil, Russia, India, China and South Africa, in a “new chapter” for the bloc of developing nations, South Africa’s president Cyril Ramaphosa said at the end of the summit. “We have consensus on the first phase of this expansion process, and further phases will follow,” he said, adding that the BRICS would also develop a partnership model for other countries.

The first expansion for the bloc since South Africa in 2010 represents a victory for China, who pushed for rapid expansion before the event took place as part of their ambitions to be the leader of the developing world. This, along with their Belt & Road Initiative, which is a program that China uses to lend money to developing countries in order to assist in building out their infrastructure (as well as gain political influence), have helped them achieve these ambitions.

Global Economic Implications:

Russia’s Vladimir Putin welcomed the new members and called on the bloc to deepen its economic ties, including creating a common currency. “I want to assure all my colleagues that we will continue what we started - expanding BRICS’ influence in the world,” Putin said. Russia’s economy has never been that of great significance, as it has always dealt with both internal and external disorder throughout its history, as is the case today as well. Due to the sanctions placed on Russia by the west, limited resources due to the war effort, and political isolation, as well as a slew of other factors, their economy and currency have seen better days to put it mildly. The BRICs expansion is a victory for them as well, as it helps strengthen economic ties throughout the globe, and reduce their political isolation.

The new members will increase the BRICS’ share of global GDP from 32% to 37% based on current data, but this will inevitably grow as new countries are admitted, as well as the existing members continuing to grow while rival nations in the west continue to stagnate and/or decline unless something is done to reverse or prolong that trend.

With the bloc’s admittance of the new nations, BRICS now has control of up to 80% of global oil production, with Saudi Arabia’s OPEC producing nearly 45%. This, combined with the BRICS’ plans to increase local currency borrowing by 30% starting next year, and future plans to trade amongst themselves using their own local currencies, this is a direct threat to the petrodollar, and the U.S. dollar as a whole. Not to mention the future plans of a BRICS currency that is backed by gold, which is why we’ve seen members heavily stocking their gold reserves while simultaneously offloading U.S. treasuries.

U.S. Implications:

The U.S., based on the data and history, are at a very concerning point within our Big Cycle. The decline of our economy due to rising debt levels, the over printing of money (which led to inflation), the lack of innovation as we turn to growth through consumption rather than production, among many other factors. This, along with the rise of internal disorder due to polarization and increasing wealth and ideological gaps between parties, as well as the rise in external disorder (i.e. geopolitical tensions) at the same time a new power threat emerges (i.e. BRICS but more specifically, China) to challenge the existing powers’ dominance. The next few years will be an interesting time to say the bare minimum, and it is important to keep a watchful eye as these situations unfold.

IV

Market Psychology & Final Thoughts:

Futures have started rallying even further as we head towards Powell’s Jackson Hole speech. The speech will outline the Fed’s roadmap over the next year, and Powell’s stance and rhetoric will be the key driver of markets going forward. If he remains hawkish, or even neutral, markets will likely continue to decline or at the bare minimum, turn flat as markets digest what he says. If he turns dovish however, the bulls have room to run as euphoria would likely take over as a result. We hope you all found this helpful, learned a thing or two, and have a great day.