The Historical Context of the Steepening Inverted Yield Curve Signal

October 2, 2023

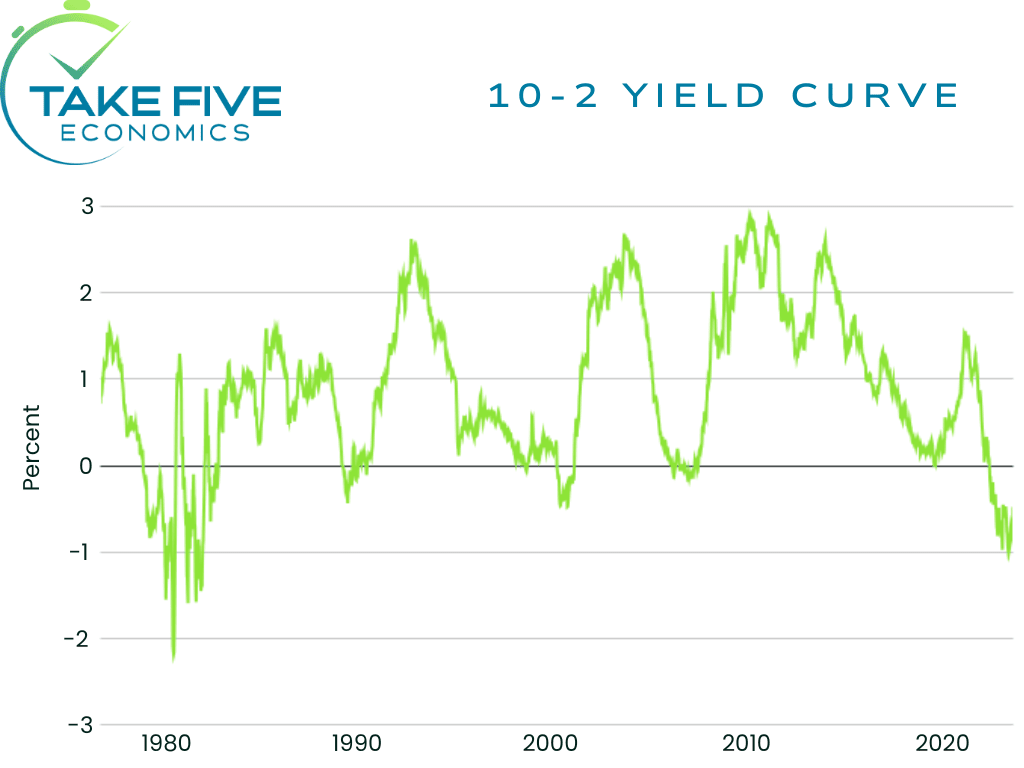

The 10-2 inverted yield curve has happened throughout history and has preceded every great recession the U.S. has had, and many use it as a warning signal that tougher times are likely ahead. The true pain however has never come from the inversion itself, only warning signs (e.g. Bear Stearns in 2008, SVB in 2023). The true pain comes from the steepening, which is when the yield curve un-inverts and goes back to normal.

U.S. Government Shutdown Averted, but a New Battle is Just Beginning

October 3, 2023

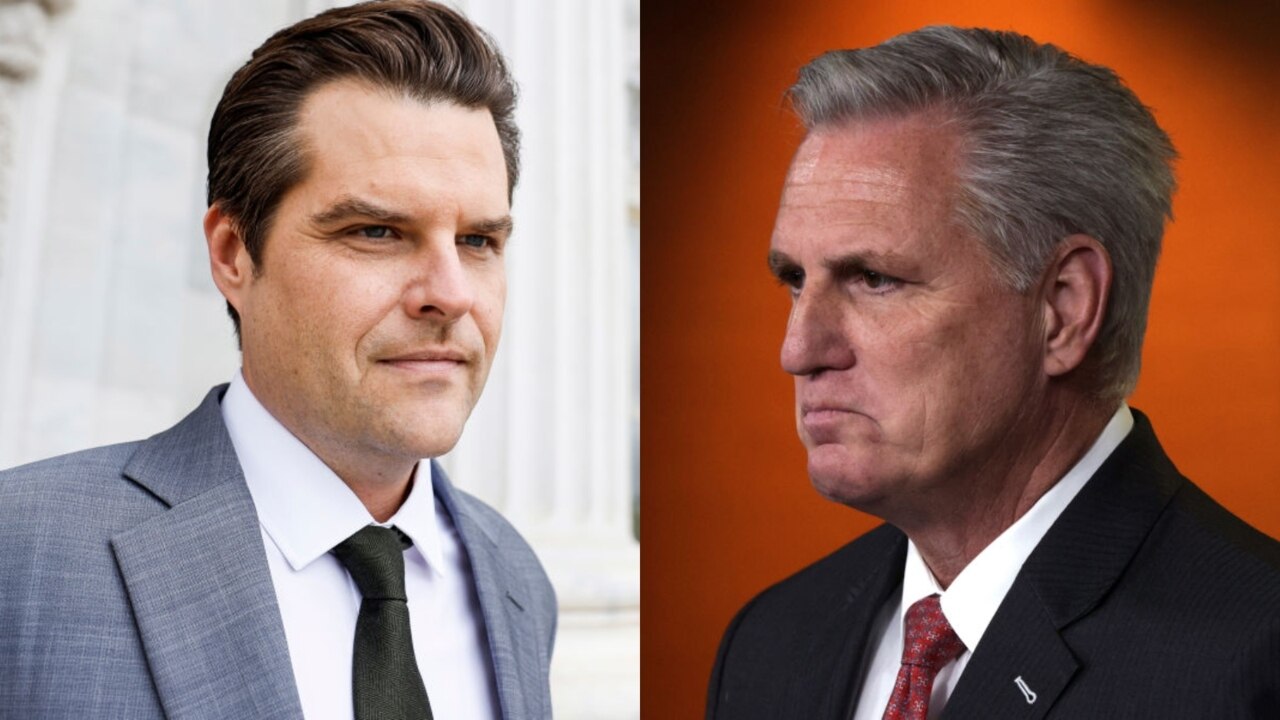

Matt Gaetz has now filed a motion to oust McCarthy as speaker of the House because he hasn’t fulfilled his promises that he made when he took the position. Democratic members of Congress “erupted in laughter” as Gaetz left the floor, and he said that if the motion fails, he will continue filing until McCarthy is out.

Bad News is Bad News, But Good News is Also Bad News, What the Hell is Going On?

October 4, 2023

We thought we might see prices consolidate for a short time but if a breakout were to occur, then expect it to the upside, which is what we ended up seeing here but it was a little sooner than expected and the likely catalysts were Kevin McCarthy's ousting and the dysfunction going on in Washington as well as the strong JOLTS data.

The Private Sector Slows Dramatically, Markets Panic

October 5, 2023

The chief economist Nela Richardson at ADP said, “We are seeing a steepening decline in jobs this month. Additionally, we are seeing a steady decline in wages in the past 12 months.” A steepening decline means that companies are not hiring, and this could be for a million different reasons, but the key point is that the labor market, at least in the private sector, is tightening to a greater degree, which is concerning.

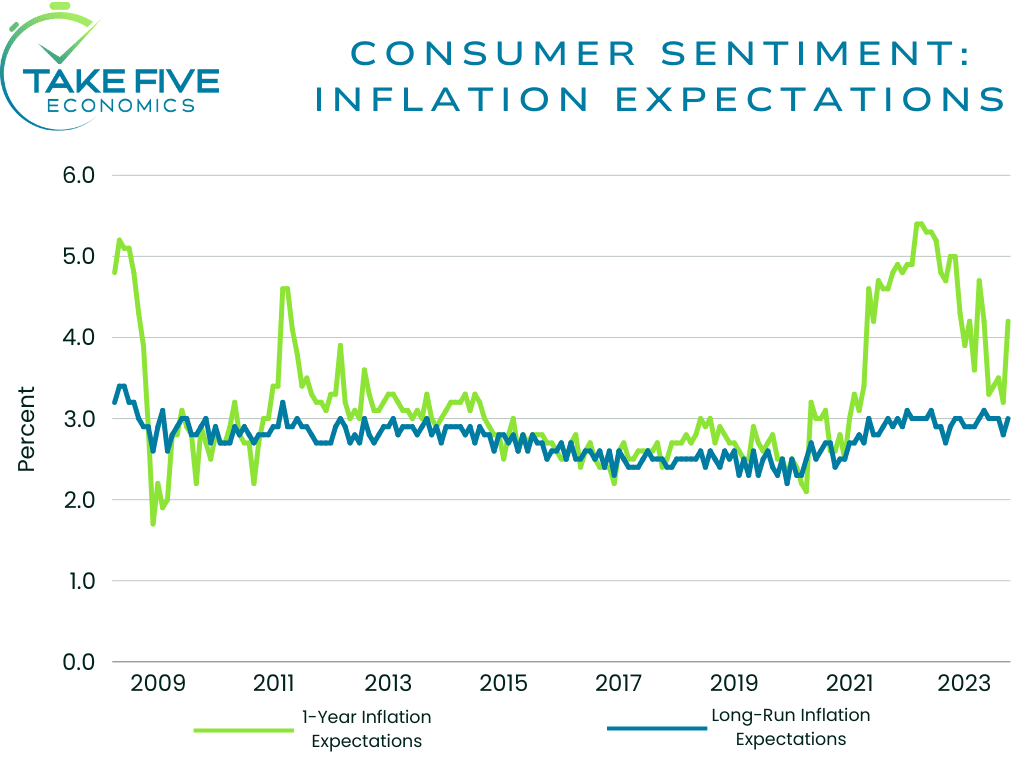

Inflation Expectations Rise

October 16, 2023

If people are expecting inflation to rise, they buy more supply of whatever they need in order to avoid paying more for it later. When you have people doing this en masse, it creates a self-fulfilling prophecy, and contributes to rising inflation as demand rises against the supply. This is what happened in the UK and most of Europe earlier this year. Given everything that is going on in the world right now, it has people worried about supply chains, especially for oil.

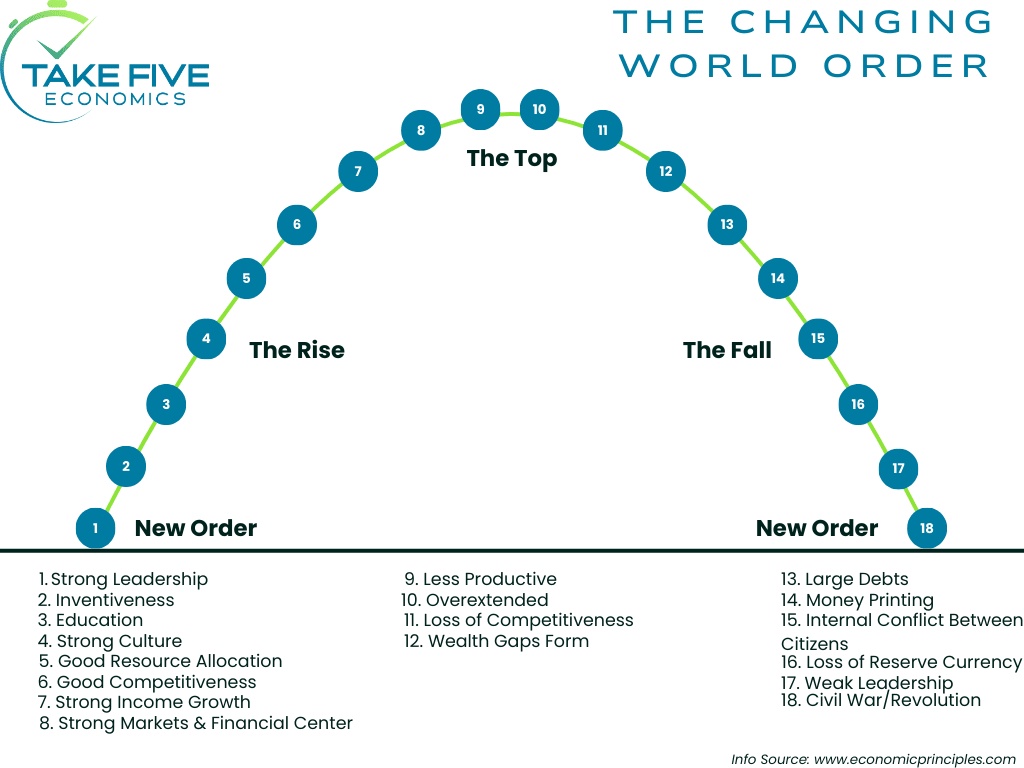

Another Step Closer Towards the Changing World Order

October 18, 2023

We’re at a critical juncture in which we’ll see how far the Israel-Hamas war spreads, and whether or not the major powers will push for peace, or for war. Today will be a more theoretical discussion as to what may happen if the major powers use this as another push towards a potential WWIII.

Gas Prices Weren't to Blame for the Hot Retail Sales Data This Time

October 19, 2023

In the prior retail sales report, which originally showed a 0.6% rise before the revision, market participants brushed it off due to most of the increase being attributable to the gas station index, which saw a gain of 6.7%. However, in this report, if you remove that index, retail sales still rose by 0.7%.

Did Powell and the Fed Just Show Their Hand?

October 20, 2023

The most cryptic man alive, Jerome Powell, just may have showed his hand in the Fed's battle against inflation. It was something that may have gone over a lot of people's heads as we haven't seen any other major outlets covering this small bit from the speech, but we dissected it all.

We May Have Overlooked Something...

October 23, 2023

Yes, this might sound like a flip-flop from us, but we've been hinting at the possibility for some time and we're now seeing some things that we may have overlooked, e.g. putting a bit more emphasis on the daily charts compared to the weekly's.

A Possible Trading Strategy Following Tech Earnings Forecasts Being Raised

October 24, 2023

It may be a safe bet to look for swing trades in the long direction. You’d likely be getting these companies at their short-term discount rate, and if they’re earnings prove better than expected (which seems like the likely case), you’ll likely be looking at an exceptional take.

U.S. Oil Giants Returning Home

October 26, 2024

The latest acquisitions in quick succession by Chevron and Exxon Mobil, the two largest producers in the west, are signaling that they're increasingly turning their attention closer to home as international investments are becoming more complicated by the threat of expanding regional conflicts in Ukraine and Middle East.

Consumers Spent a Shit Ton of Money in Q3

October 27, 2023

Personal consumption expenditures (PCE) grew at a whopping 4.0% compared to 0.8% in Q2, and contributed 2.69 percentage points to overall GDP, the most by far. PCE is basically just a fancy term for consumer spending, meaning consumers spent at a blockbuster rate that will likely be very difficult to maintain.

PCE Shows That Consumer Spending is Still Strong

October 30, 2023

This report didn’t really have any surprises from what we could see, as most of it was in line with the GDP report from Thursday. The key takeaway from it, like the GDP, was that the consumer was strong, and practically carried the economy on their back.