The Take Five Report: 10/20/23

I

Markets:

I-I

Global Market Recap:

United States:

- S&P: -0.77%

- Dow: -0.59%

- Nasdaq: -0.90%

- Russell 2k: -1.51%

U.S. markets opened the day a few points in the green. Prices would hover around breakeven for through the first half of the session, as market participants digested Powell’s remarks. In the second half however, bears won out the day and markets slid through the close.

Asia:

- Shanghai: -0.74%

- Hong Kong: -0.72%

- Japan: -0.54%

- India: -0.35%

Asian markets were all lower on Friday, extending their broad selloff from Thursday’s session. Japanese inflation came in at 3%, the 18th straight month above the BOJ’s 2% target, as well as China’s one-year and five-year loan prime rate.

Europe:

- UK: -1.17%

- Germany: -0.33%

- France: -0.64%

- Italy: -1.38%

European stocks traded lower on Thursday to extend losses from the previous session, as a slew of downbeat earnings updates added to jitters around the Middle East war and surging bond yields in the region.

I-II

U.S. Sectors Snapshot:

- Communication Services: +0.33%

- Consumer Discretionary: -2.20%

- Consumer Staples: -0.78%

- Energy: -0.13%

- Financials: -1.25%

- Health Care: -0.96%

- Industrials: -0.90%

- Info Tech: -0.44%

- Materials: -1.08%

- Real Estate: -2.44%

- Utilities: -0.93%

II

Technicals:

II-I

Volatility Index: (VIX)

Thursday Recap:

The VIX opened Thursday’s session higher than Wednesday’s close at $19.73 and worked to a low of $18.55. Prices in the second half rallied significantly however as the VIX bulls strongly took over and brought prices to a high of $21.40 which would also be the closing price.

Daily Chart:

Strength moved impressively in favor of the VIX bulls in yesterday’s session, as this latest move brought the indicator about halfway to its previous cycle’s high following the slight cross above the centerline in Wednesday’s session. Inertia shifted significantly more towards the upside following the price surge as the VIX bulls look to make their next move.

We said in yesterday’s report that if prices hit a certain support or resistance level four or more times, prices really want to move in that direction, and they are more likely to break out that way rather than the opposite. We got the breakout in yesterday’s session by the VIX bulls, now it’s a matter of if they can hold prices above that level going forward.

II-II

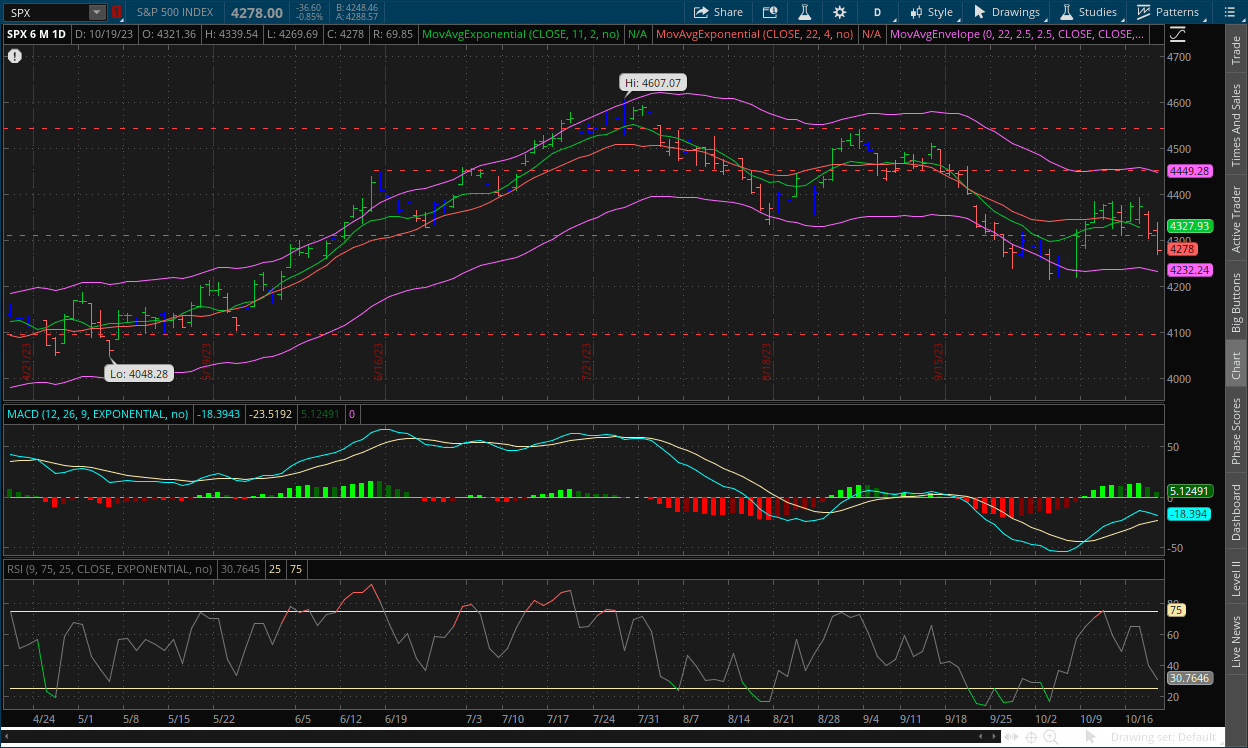

S&P 500: (SPX)

Thursday Recap:

The S&P opened Thursday’s session a few points into the green at $4,321 and worked to a high of $4,339 on the day. Prices slipped in the second half, and would decline through the close, reaching a low of $4,269 before officially closing at $4,278.

Daily Chart:

Strength moved in favor of the bears for the second consecutive session as they make their bid back towards the centerline while inertia shifted strongly towards the downside on the front end as we see if the bears can manage to keep shifting it more in their favor to close the week today.

The S&P broke below the $4,300 level in yesterday’s session, which was the next key support that the bears had to break through. The bears have a lot more room to maneuver, as the MACD-H has limited upside at this point in the cycle while the opportunity to the downside (i.e. for the bears to start a new cycle) is a lot vaster.

III

Fundamentals:

III-I

Headlines:

1.) MarketWatch: Microsoft’s acquisition of Activision makes Big Tech even bigger - and harder to rein in

2.) MarketWatch: Biden says Israel and Ukraine support is vital for U.S. security, will ask Congress for billions in aid

3.) Wall Street Journal: Hong Kong’s financial-sector feast turns to famine

4.) Bloomberg: China stocks erase all reopening gains as property woes persist

5.) Bloomberg: Nvidia dip-buyers burned by US chip battle with China

III-II

Jerome Powell's Speech Breakdown:

Inflation Highlights:

Inflation readings turned lower over the summer, a very favorable development. The September inflation data continued the downward trend but were somewhat less encouraging. Shorter-term measures of core inflation over the most recent three and six months are now running below 3%. But these shorter-term measures are often volatile. In any case, inflation is still too high, and a few months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal.

We cannot yet know how long these lower readings will persist, or where inflation will settle over coming quarters. While the path is likely to be bumpy and take some time, my colleagues and I are united in our commitment to bringing inflation down sustainably to 2%.

Take Five Takeaway:

Powell and the rest of the Fed essentially haven’t changed their stance on inflation, and this is a reiteration of what he’s said at the last few FOMC meetings, i.e. “A few good months of data doesn’t make a trend.” The theme of this speech just so you all know is ‘higher for longer’.

Labor Market Highlights:

Many indicators suggest that, while conditions remain tight, the labor market is gradually cooling. Job openings have moved well down from their highs and are now only modestly above pre-pandemic levels. Quits are back to pre-pandemic levels, and the same is true of the wage premium earned by those who change jobs. Surveys of workers and employers show a return to pre-pandemic levels of tightness. And indicators of wage growth show a gradual decline toward levels that would be consistent with 2% inflation over time.

Take Five Takeaway:

Powell has previously said that he wants job openings for every unemployed person to be at a 1:1 ratio. Here based on our interpretation, he’s flip flopping, and is now kind of downplaying it in a way (which is a good thing) because if he still thought the way he used to he would say something along the lines of ‘there’s still progress to be made’.

The key takeaway however is his comments on wage growth. This is Powell’s number one concern. Rapid wage growth affects services ex-housing in CPI (i.e. supercore inflation), and this is where we don’t want to see wage growth because it leads to higher costs for services. These are your doctors, insurance reps, veterinarians, dentists, cleaners, funerals, the tax guy, etc. Businesses, if they have to pay higher wages, will increase the prices of their service in order to protect their margins, and this is what Powell doesn't want to see. So the fact that Powell came out and said this is very good news.

Growth Highlights:

Forecasters generally expect gross domestic product to come in very strong for the third quarter before cooling off in the fourth quarter and next year. Still, the record suggests that a sustainable return to our 2% inflation goal is likely to require a period of below-trend growth and some further softening in labor market conditions.

Take Five Takeaway:

This part was interesting. In the section below, Powell says that the economy is running ‘above trend growth’ as of right now. Here, he tells us that GDP will likely need a period of time for growth to run below trend. That doesn’t mean negative, it essentially means GDP will likely need to be below expectations for a time, in order to get 2% inflation.

Monetary Policy Highlights:

The stance of policy is restrictive, meaning that tight policy is putting downward pressure on economic activity and inflation. Given the fast pace of the tightening, there may still be meaningful tightening in the pipeline. *My colleagues and I are committed to achieving a stance of policy that is sufficiently restrictive to bring inflation sustainably down to 2% over time, and to keeping policy restrictive until we are confident that inflation is on a path to that objective.*

We are attentive to recent data showing the resilience of economic growth and demand for labor. Additional evidence of persistently above-trend growth, or that tightness in the labor market is no longer easing, could put further progress on inflation at risk and could warrant further tightening of monetary policy.

Along with many other factors, actual and expected changes in the stance of monetary policy affect broader financial conditions, which in turn affect economic activity, employment and inflation. Financial conditions have tightened significantly in recent months, and longer-term bond yields have been an important driving factor in this tightening. We remain attentive to these developments because persistent changes in financial conditions can have implications for the path of monetary policy.

Take Five Takeaway:

The highlighted portion in this section was something that went over many people’s heads from what we've seen through many different outlets. Our interpretation of what Powell is saying here is essentially this: “If people seriously expect that we won’t stop until we get to 2% inflation, then we’ll get to 2% inflation, and if people didn’t believe us we would never get there.” To us, this is Powell telling us his hand. He’s essentially saying that if they came out and told people that they’re done and not trying to get to 2% anymore, bond yields would plummet (which higher bond yields have helped the tightening of financial conditions) and bond prices would rally, and financial conditions would loosen rapidly, causing inflation to not get to 2%.

Even though inflation is going away as of right now and despite the volatile data that he mentions, the Fed will not budge on their policy until inflation is meaningfully down to 2% inflation. By this we mean that actual rate cuts won't start for some time, but talks of them could happen at any time, nobody knows that. He even says this objective will take some time (as he’s said in the past). The way we see it, this confirms a limited upside for the stock market while rates are high, unless there is some kind of psychological shift back to euphoria. Tighter financial conditions for longer suggests more sideways growth in stocks than upside, and the reason why we've been highlighting why there’s more downside risk than upside potential, is because stocks are essentially gridlocked due to how tight financial conditions are currently. But at the same time, there’s still the potential that something could break, war breaking out, etc., i.e. there are a limited number of positive catalysts compared to negative ones.

IV

Market Psychology & Final Thoughts:

Psychology:

Our word of the day: Fud. Fud stands for fear, uncertainty, and doubt. And that’s where market participants’ heads are at right now. Earnings haven’t been what markets wanted, and that’s playing a role. Powell’s speech yesterday also rattled markets, despite it being overall positive. The speech was cryptic though, and a lot of the positivity was hard to miss I will admit. But, markets take what they take and all we can do about that is what they leave us.

Final Thoughts:

Market index futures are sliding as we head towards the open, with crude futures rallying once again and European markets dropping heavily. Bond yields are pulling back however as well as the VIX, making the outlook somewhat murky to cap off the week. In any case, we hope you all found this helpful, got some insight on the Fed's plan and have a fun (but not too much fun) weekend.