The Take Five Report: 10/18/23

I

Markets:

I-I

Global Market Recap:

United States:

- S&P: -0.01%

- Dow: +0.04%

- Nasdaq: -0.25%

- Russell 2k: +1.09%

U.S. indexes saw a large influx of overnight volume come in at the opening bell, which boosted the opening losses for stocks. Indexes rallied through the first half of the day to just above the breakeven mark but beyond that, U.S. indexes remained stable and flat through the close.

Asia:

- Shanghai: -0.80%

- Hong Kong: -0.23%

- Japan: +0.01%

- India: -0.83%

Asian markets traded mostly lower in this morning's session following a stronger than expected GDP out of China. The report showed that Q3 GDP grew at 4.9%, compared to 4.4% expectations. They also posted higher than expected retail sales data for September, and an urban level unemployment rate that fell to its lowest level in nearly two years.

Europe:

- UK: +0.58%

- Germany: +0.01%

- France: +0.11%

- Italy: +0.02%

European markets closed relatively flat on Tuesday following the U.S.’ stronger than expected retail sales data, with the UK’s FTSE leading the day.

I-II

U.S. Sectors Snapshot:

- Communication Services: +0.43%

- Consumer Discretionary: +0.06%

- Consumer Staples: +0.51%

- Energy: +0.98%

- Financials: +0.55%

- Health Care: -0.13%

- Industrials: +0.31%

- Info Tech: -0.77%

- Materials: +1.01%

- Real Estate: -0.54%

- Utilities: -0.24%

II

Technicals:

II-I

Volatility Index: (VIX)

Monday Recap:

The VIX opened Tuesday’s session at $17.41 and would reach a low of $16.97. Prices would work to a high of $18.54 fairly early on, and ultimately close the day at $17.88.

Daily Chart:

Strength moved back in favor of the VIX bulls in yesterday’s session, but the VIX bears still managed to keep the indicator below the centerline, albeit not by much as they have very little hold so far in this cycle. Inertia continued to edge back in slight favor of the VIX bulls, but remained flat overall.

Despite the VIX bears’ best efforts, the VIX bulls have managed to keep prices higher, and above the $16 support level. Consolidation has shown that the VIX bears are weaker than they were in their previous cycle as we've hypothesized, despite some large price swings to the downside. The VIX bulls look to still have an edge and will likely continue rallying prices at some point in the future, but they need to show more strength at the $20 level.

II-II

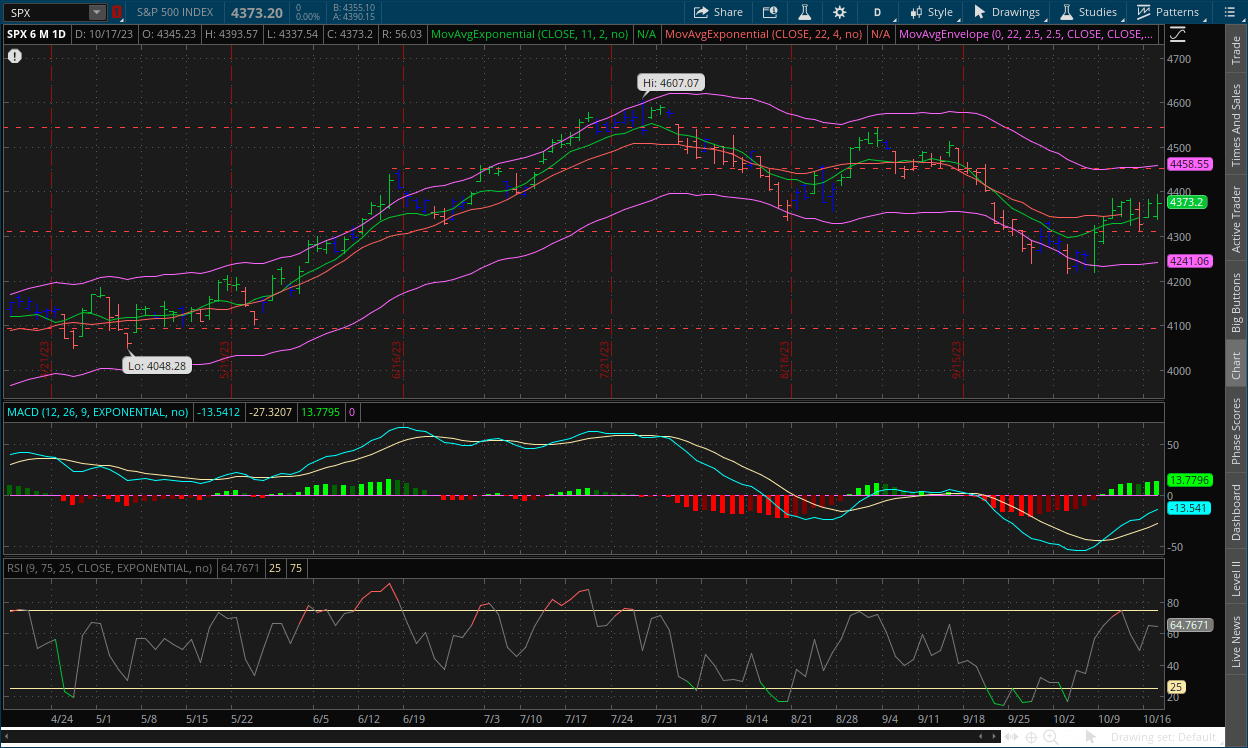

S&P 500: (SPX)

Monday Recap:

The S&P opened Tuesday’s session lower at $4,345 and moved to a low of just $4,337 shortly after. Prices worked to a high of $4,393 around midday, and would ultimately close the session at $4,373.

Daily Chart:

Strength moved back in favor of the bulls in yesterday’s session, but the indicator is still struggling to break into new highs. Inertia edged in favor of the bulls, but is overall starting to flatten out as prices consolidate.

As we've said about the VIX and S&P, prices were likely to start consolidating after breaks above/below their respective resistance and support levels. The bulls on the S&P are struggling to break prices back above $4,400 and have yet to break that mark as selling pressure has been strong in that area from the bears. The bears still have the edge from what we can see, although the bulls do have more control of the S&P than the VIX bears do on the VIX. But that should be an indication that the rally in stocks is weaker regardless.

III

Fundamentals:

III-I

Headlines:

1.) MarketWatch: Oil prices surge after deadly Gaza hospital blast, as Iran reportedly calls for Israel oil embargo

T5 Note: See section III-II

2.) MarketWatch: Bridgewater chief investment officers say the market has entered the second stage of tightening

3.) MarketWatch: Long-term U.S. Treasury yields may resume their march higher despite recent bond-market swings, BlackRock says

4.) Wall Street Journal: New U.S. sanctions target Hamas funding

5.) Wall Street Journal: Nvidia and other chip stocks remain under pressure after U.S. export curbs

6.) Bloomberg: Morgan Stanley’s profit slides on investment bank slowdown

7.) Bloomberg: Goldman joins post-earnings bank bond spree with debt sale

8.) Financial Times: Xi Jinping hails ‘deep friendship’ with Vladimir Putin as leaders meet in Beijing

III-II

Geopolitics - Another Step Closer to WWIII:

What’s happening between Israel and Hamas, like what happened and is happening with Russia and Ukraine, should concern just about everyone who is truly tuned into what is actually going on and the dynamics that are at play. While Israel, Hamas/Gaza, Ukraine and Russia are in hot wars, thankfully so far, the major powers (US and China) are not, but they are on the brink of one and that much is clear. We’re at a critical juncture in which we’ll see how far the Israel-Hamas war spreads, and whether or not the major powers will push for peace, or for war. Today will be a more theoretical discussion as to what may happen if the major powers use this as another push closer towards a potential WWIII.

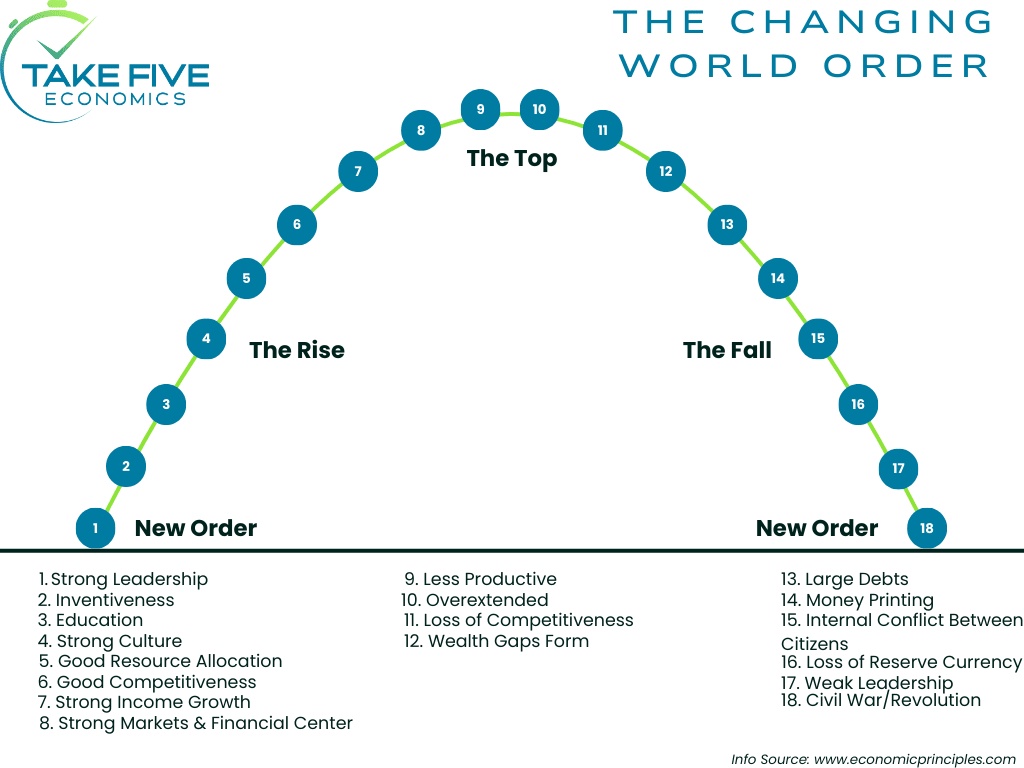

The Changing World Order & The Big Cycle:

The world order is changing in ways that haven’t happened in our lifetimes but have happened throughout history in what is known as the Big Cycle, or the Changing World Order. Just like our formula that uses the forces that shapes markets (i.e. Technical + Fundamental = Psychological), there are forces that also shape the global order. They are a.) debt/money/economic force, most importantly when they're high levels of debt and debt growth, b.) internal conflict within countries due to large wealth and ideological gaps, c.) geopolitical conflicts between countries due to changes in who has wealth and power, d.) acts of nature (e.g. droughts, floods and pandemics), and e.) humanity’s inventiveness.

In the Big Cycle, as was the case with most, if not all great empires throughout history, when you have a.) a weakening economy in the current global power that is fueled by debt, b.) growing internal disorder within the current global power (i.e. wealth and value gaps), c.) growing geopolitical conflicts, and d.) all of this is happening at the same time that another global power is emerging (in this case China), you have typically reached the end of the current global powers’ reign. The U.S. is somewhere in between stage 14 and stage 15 of the Big Cycle.

Wars Would Have the U.S. Divided on Multiple Fronts:

Eastern Europe:

The Russia-Ukraine war was the first stage in fracturing the U.S. and bringing us closer to a global conflict. To put it simply: The U.S.’ interests in Ukraine isn’t about stopping Putin and his “war crimes”, it’s about trying to gain control of the black sea in order to import cheap energy into Europe. The U.S. was on the cusp of getting Ukraine into NATO (even though the U.S. under Trump promised no more NATO expansion) which would have given Russia the boot from their military base in Crimea, which gives them access to trade in the Black Sea. Putin saw this and decided to invade Ukraine in order to secure that port and create a land bridge into Russia, because losing it would be even more devastating to them economically and critically weaken them as a nation.

Looking at it from their point of view, you can rationally see why they decided to invade even from that short description. Morally, an invasion where the country being invaded didn't strike first is questionable to say the least, but from Putin's point of view, what other choice did he have since the U.S. and NATO under the current administration were so unwilling to negotiate? If the U.S. hadn’t been trying to force global dominance of the petrodollar, none of this would be happening, and it's only a matter of time before the U.S. and NATO officially put troops on the ground if Russia doesn't outright take control of the territory that they're after first. We have unofficial special forces and “volunteers” in Kyiv already, along with directly funding and supplying the war effort. The U.S. and NATO are already walking on a very fine line.

The Middle East:

The war between Israel and Hamas has already begun to spread into Lebanon, with Lebanese Hezbollah fighters (terrorist group) launching attacks on Israeli army posts and a northern border village on Sunday, and Israel retaliated with strikes on Lebanon as border clashes have begun to escalate. Once Israel launches their ground invasion into Gaza, Lebanon will likely strike Israel, with Syria not too far behind them from the looks of it as war in the northern part of the Middle East could break out on a mass scale. The key determinant as to whether this will end up forcing a much larger conflict is Iran. If Israel declares war on Iran and vice versa, or if the U.S. gets involved with Iran (looking at you Lindsey Graham), this will trigger U.S. intervention into the conflict in the Middle East, even though that may already be taking place as reports this morning show that the U.S. is deploying 2,000 marines into Israel along with a growing number of U.S. warships and forces converging in that area as the U.S. is seeking to send a message to Iran and the Lebanese terrorist group Hezbollah, just as President Biden visits.

GOP Senator Lindsey Graham has called for a preemptive strike on Iran’s oil fields, without any real evidence of Iran’s involvement, in what was the most irresponsible and idiotic things that has ever come out of a U.S. regulator’s mouth. If there are regulators (on both sides mind you) calling for something like this, what will happen if Iran is involved, or decides to get involved? Iranian lawmakers have already gathered and chanted “death to America” in a viral video that surfaced last week and calls for a preemptive strike will only stir them up even more into a “get us before we get them.” mentality.

Hamas has stated publicly that this attack has been planned for the last two years, all under the Biden administration. The left argues that the Abraham Accords are why this happened, because it sidelined Hamas. To that argument we'd push back and say that if the Biden Administration hadn’t completely neglected the Abraham Accords, Russia likely wouldn’t have had any incentive to invade Ukraine, and Saudi Arabia, the UAE, Qatar, etc. would have been more akin to align with Israel rather than oppose them if Hamas still would have attacked.

Will China Move on Taiwan?

With the U.S. fractured, and distracted in Eastern Europe and the Middle East, it creates an opportunity for China to move on Taiwan and split the U.S. even further. To be clear, the U.S. does not care about Taiwan because of humanitarian reasons. In actuality, they care about the small island nation because of what they produce for us, i.e. microchips. A whopping 92% of the globe's most advanced semiconductors are produced in Taiwan, one’s that are used for U.S. military equipment. China wants Taiwan mainly for the reason that if they control the microchips, it automatically boosts their own military and cripples our own, and gives them a competitive advantage not just militarily, but economically and geopolitically as they would now have full control of the trade routes in the South China sea, and the routes most valuable resource.

The scary thing is that all China needs to do in order to take Taiwan is surround it, and essentially starve them of resources. 94% of Taiwan’s energy supply is imported, and if they were cut off from their energy supply, the entire island falls in about two weeks. The U.S. likely wouldn’t stand for this, and would rush to Taiwan’s aid, thus creating a hot war with China in the South Pacific.

The U.S. is already preparing for this, as a new naval base has been established in Australia, and military exercises are already underway as they expand their forces in the region. China, as we know, has been coming dangerously close to Taiwan in their own “military exercises”, flying low into Taiwanese airspace. A fight over Taiwan alone is not one that we think the U.S. is capable of winning, as they're located roughly 80 miles from China’s coast. Based on the geography alone, never mind the fact that the U.S. could be split into four separate fronts with rapidly declining military recruitment numbers, and the sheer numbers that China’s military has over ours, China would have little problems in in taking the small island nation and would be able to berate our navy from the mainland. Yes, we have naval bases in Japan, Okinawa, and Guam as well as have allies in some surrounding nations, but China still would have the advantage. So, the answer is yes, they most likely would if the U.S. is distracted on multiple fronts. If we’re not, then it will likely remain a game of postering.

The Fourth Possible Front - At Home:

There is a massive political divide within the U.S. from the left and the right, i.e. internal disorder due to large wealth and ideological gaps. Extremists on the left are supporting what Hamas has done, while extremists on the right (i.e. people like Lindsey Graham) are calling for war while people in the middle don’t want any of it. This issue will more than likely instigate more violence within the U.S.’ extremist factions, as protests and small riots have already begun over this matter and among many others, immigration being one of them as well.

There is also a growing fear that Hamas and other terrorist sleeper cells have crossed the border. Yesterday, keep in mind, there were reports that four Iranian men and two Lebanese men were arrested at the U.S. southern border. It makes you wonder who could have gotten in throughout the last year, if not more with the millions of others who have happily walked on in. A more philosophical question is why the U.S. is worried about defending other people’s borders and protecting them, but why is it the opposite for the American people? We're not going to pretend to have all the answers, but a wall that would have cost us about $11 billion sounds a lot better than the few hundred billion or so we’ve sent to Ukraine.

The porous southern border is growing to become an even more alarming issue by the day. The current administration is allowing people to cross over illegally and are providing them with more benefits and handouts than most American citizens. The intriguing thing is that most of the "asylum seekers" are fighting age males. There have been talks that one of the next moves is to grant them citizenship and voting rights if they volunteer for the armed forces. The writing on the wall for everything going on in the world today reminds us of ancient Rome. One of the ways that Rome fell was because of immigration. The Roman Empire at their core, were conquerors, and in order to maintain control of their territory's and maintain power, they needed numbers for their military since they were starting to drop because most Roman citizens grew accustomed to their life of leisure and distractions. Immigrants would be granted citizenship if they joined the army, so most of them did and eventually they all started coming to the great empire in droves. This ended up having the opposite effect than what was anticipated. Eventually, Roman culture was completely fractured and dispersed, as non-Romans eventually outnumbered the Romans not just in terms of everyday citizens, but in the army as well. The essentially non-Roman army eventually would turn on their own country as wealth and value gaps grew and the culture was fractured even further, and the great Roman Empire would end up falling as a result. Wealth and ideological gaps produced internal disorder and fractured the identity of the nation. Combine this with a growing external threat and faltering economy, the end result is the death of the world's greatest empire.

The U.S. is going through an eerily similar process, not just with this but with many other things as well. The growing internal disorder between the right and the left as well as non-U.S. citizens is becoming alarming and will likely get worse as we head into a critical election year. People have forgotten what has happened throughout history. Why would the U.S.' fate be any different to any other great empire throughout history? Most of the same determinants that caused the downfall of every other have either been here or are forming and growing even more by the day. It will take the right people in the right positions in order to reverse this trend and put us back on course. But our point stands that extreme internal disorder is closer than many people realize.

A Wartime Economy:

The U.S. since the debt ceiling agreement has added over $2 trillion in debt, as it is now up to $33.566 trillion compared to $31 trillion earlier this year, with an average of $1.2 billion added every hour over the last month. At this rate, the U.S. is set to add around $5 trillion over the next year, give or take. This is not sustainable by any stretch of the imagination. If a wartime economy does transpire, and we discount the problems our economy is currently facing, expect this number to be even higher. Inflation would likely come back as well, and the Fed will be torn with the decision of raising rates and cripple the economy further, or cut them in order to fund the war but risk hyperinflation and de-dollarization as a result, depending on the outcome and how long it persists, and gold would skyrocket as well.

The war in the middle east along with the war against the globe’s other top oil producer Russia, would send gas prices through the roof as sanctions and other forms of economic warfare such as the selling off of U.S. treasury holdings by opposing nations, sending yields higher would take place. Rationing for supplies and resources on the home front would likely take place as well, as it did in WWII and living conditions could deteriorate. Most people would argue that the labor market would be in good shape however, as it was during WWII. To that point we'd argue that it wouldn’t, given that the U.S. doesn’t produce much of its own goods anymore like it used to, therefore manufacturing jobs that helped fuel the wartime economy in WWII wouldn’t be available as we don't have that kind of infrastructure anymore.

Putting It Together:

I’m sure you all can put the pieces together as to how this could all transpire, and come up with your own theories, ideas and speculate for days as to how it could all happen. Our perspective, and what we're speculating on is based on all of the facts that we can see laid out on the table, and it's our interpretation of them based on the knowledge that we have.

Looking at this all through the lens of the Big Cycle and Changing World Order, we don’t see how the west can deescalate the situation from here unless there is some kind of dramatic flip. A dramatic flip would be some kind of bipartisan agreement of de-escalation between China and the U.S. over the two major wars going on right now, as well as a unified U.S. government but we don’t know how realistic that situation is.

The United States’ status in all of its major big cycle determinants, which are: a.) education, b.) innovation and technology, c.) cost competitiveness, d.) military strength, e.) trade, f.) economic output, g.) markets and financial center, and h.) reserve currency status - are on the decline or have begun to peak and have been for some time. And with the major forces of the big cycle (i.e. economy, external order/disorder, and internal order/disorder) heading in the direction we don’t want them to be moving in, our outlook for the U.S. isn't the greatest we will admit, especially given the rough estimates of where China is in terms of their position within their own big cycle. But that alone doesn't ward off the current and glaring problems that China themselves are facing as a nation going forward, which we have discussed and will discuss even further in future reports. The next U.S. election will decide whether or not this process is slowed down or if it will continue on its current course at least in terms of foreign policy and economics.

IV

Market Psychology & Final Thoughts:

Psychology:

Market participants are in a rather evenly split state of uncertainty due to the geopolitical situation, and not to mention our own economic problems, hence why we’re seeing a point of consolidation in markets and the VIX. Participants are still on the edge of their seat in reactionary mode in my opinion, and bears will be ready to swarm in at any moment if given the opportunity. The bulls have a lot of work ahead of them if they want to move prices, thus our conclusion to the state of the market environment at the moment in time is a very limited upside with a much vaster potential downside. But as we've said before, there are potential catalysts from the fundamental force that could break this bearish spell.

Final Thoughts:

U.S. indexes opened lower this morning, in excess of -0.50%, with European markets falling nearly double that mark. Gas prices/crude futures are surging (again due to geopolitical factors) and bond yields are on the rise again. We've also just seen a report that the U.S. embassy in Beirut was set on fire. We hope you genuinely found this helpful, and it shed some light on the situation at hand, learned something about what is actually happening right now and what’s at stake, and have a fan-freaking-tastic Wednesday.