The Take Five Report: 10/5/23

I

Markets:

I-I

Global Market Recap:

United States:

- S&P: +0.81%

- Dow: +0.39%

- Nasdaq: +1.35%

- Russell 2k: +0.11%

U.S. indexes managed to have a comeback session following Tuesday’s drop. Stocks were bouncing up and down all day, but ultimately would finish in the green. The Nasdaq managed to rally further than the rest as tech led gains. The Russell 2000 small cap index notched its first win in over a week, but only marginally and greatly outperformed the larger market.

Asia:

- Shanghai: closed

- Hong Kong: +0.10%

- Japan: +1.80%

- India: +0.62%

Asian markets rose this morning following another steep decline in yesterday’s session. Shanghai remained closed, while Hong Kong managed to squeeze out a marginal gain. The day was quiet in terms of data, as nothing too noteworthy was released and all eyes focused on U.S. treasuries.

Europe:

- UK: -0.77%

- Germany: +0.10%

- France: -0.00%

- Italy: -0.17%

European markets closed slightly lower in yesterday’s session as U.S. bond yields relaxed for the first time in weeks. Stocks in the region have broadly failed since August, with the Stoxx declining after data revealed an outgoing downturn in manufacturing output, as new orders fell by a near record level.

I-II

U.S. Sectors Snapshot:

- Communication Services: +1.28%

- Consumer Discretionary: +1.97%

- Consumer Staples: +0.73%

- Energy: -3.36%

- Financials: +0.83%

- Health Care: +0.45%

- Industrials: +0.38%

- Info Tech: +1.25%

- Materials: +1.19%

- Real Estate: +1.13%

- Utilities: -0.09%

II

Technicals:

II-I

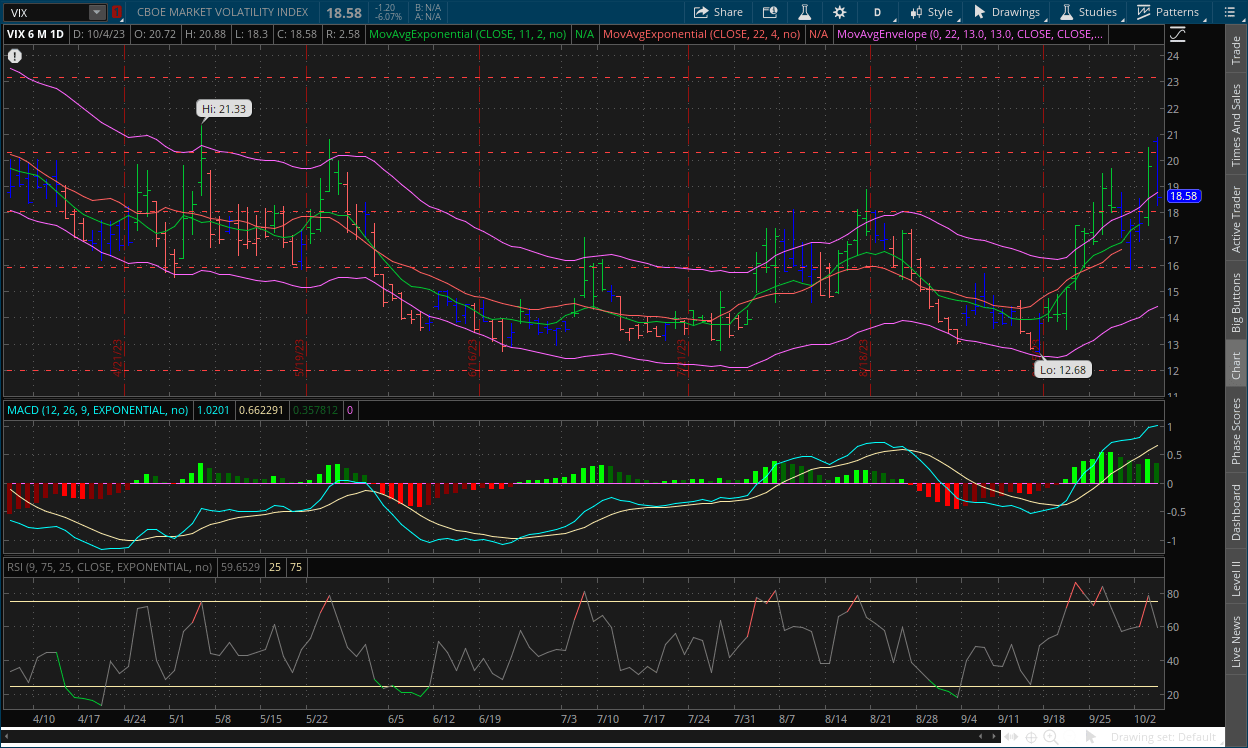

Volatility Index: (VIX)

Wednesday Recap:

The VIX opened Wednesday’s session higher than Tuesday’s at $20.72 and reached a new high of $20.88 early on. Prices would drop throughout the day as markets rallied, reaching a low of $18.30 before closing at $18.58.

Daily Chart:

Strength moved back in favor of the VIX bears in yesterday’s session as they continued their push back towards the centerline. Inertia kept shifting more to the upside, and hasn’t shown any signs of easing quite yet.

The VIX has been bouncing all over the place as prices have risen, and this is to be expected in times of high volatility. As prices rise, the key for the VIX bulls will be their ability to hold prices above support (previous resistance) levels and break through resistance levels. If either of these become weaker, a consolidation period or reversal of some kind would be in store. However, we're still of the belief that the VIX still has more gas left in the tank.

II-II

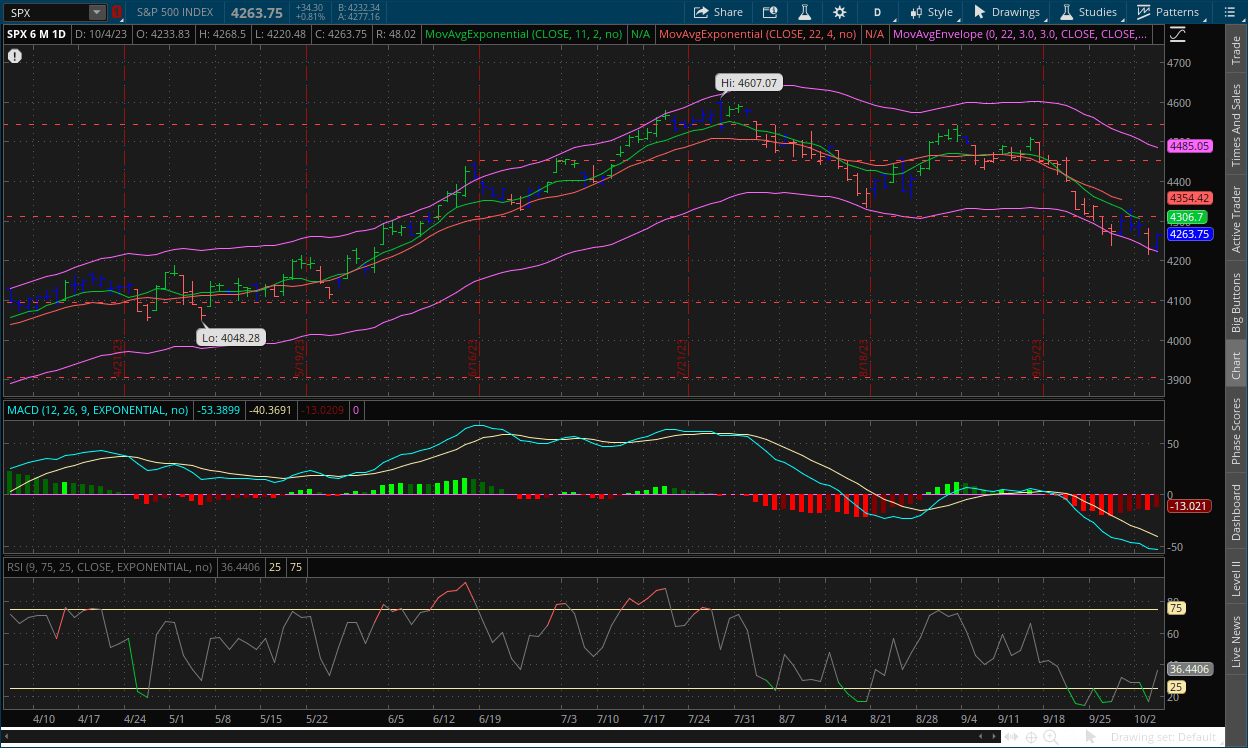

S&P 500: (SPX)

Wednesday Recap:

The S&P opened the day at $4,233, and reached a low of $4,220 in the opening hour. Prices worked their way to a high of $4,268 before closing just below that mark at $4,263.

Daily Chart:

Strength moved back in favor of the bulls following the ground they gave up in Tuesday’s session while inertia continued to shift more to the downside as it still hasn’t caught up to prices.

The bears face a similar test to the VIX bulls, i.e. the strength of the trend will be defined by their ability to hold prices below resistance levels (previous support) and break through support levels. This is another measure of strength and inertia, and a reason why we focus on it so much in these reports. The labor market report tomorrow will be a key point in the road to figure out the markets next move.

III

Fundamentals:

III-I

Headlines:

1.) MarketWatch: Exxon expects profit bump from oil prices of around $1 billion in Q3

2.) Bloomberg: UK households have probably run down pandemic savings, BOE says

3.) Bloomberg: Foreign investors dump Japanese stocks for second straight week

4.) Wall Street Journal: UAW Strike Strategy: Lots of attention, muted financial pain for now

5.) Financial Times: The US may no longer avoid a recession

III-II

ADP Employment Report for September:

Highlights:

|

Month/Index: |

Private Employment Change: |

Pay Growth Job Changers Y/Y: |

Pay Growth Job Stayers Y/Y: |

|---|---|---|---|

|

August 2023: |

180,000 (r) |

9.7% |

5.9% |

|

September 2023: |

89,000 |

9.0% |

5.9% |

Private sector employment increased by 89,000 jobs in September which was vastly below economists expectations of 150,000. This followed an upwardly revised August report from 177,000 to 180,000. This month showed the slowest pace of growth since January of 2021.

Job Stayers saw a 5.9% increase in annual pay, marking the 12th straight month of slowing growth. Pay gains also shrank for job changers to 9%, down from 9.7% in August.

Finer Details:

Goods Producing Sector:

The goods producing sector gained 8,000 jobs in aggregate, with gains seen in natural resources and mining (4,000) and construction (16,000). Most of these gains were offset by a decrease in manufacturing (-12,000).

Service Providing Sector:

The services sector gained 81,000 jobs in aggregate, providing the bulk of the overall report, with notable gains in Leisure/hospitality (92,000), financial activities (17,000), and Education/Health Services (10,000). These were offset by declines seen in Professional/Business services (-32,000) and trade/transportation/utilities (-13,000).

By Establishment:

Small businesses led gains with 95,000 total, which hasn’t been the case in prior reports. Medium establishments saw a 72,000 total increase, while large businesses of 500 or more employees declined by -83,000 which negated the gains of 83,000 in the prior report, and offset most of the report this month.

By Region:

The South remains the hardest private sector job market, showing a -16,000 drop in aggregate, but the bulk of the fall came from the West South Central sub-region which saw a drop of -74,000. The West remained the hottest job market with gains of 66,000. The Northeast saw gains of 34,000 while the Midwest only saw aggregate gains of 2,000.

Putting It Together:

This report was the poorest that we’ve gotten in a long time. The gains of 89,000 were sharply below expectations and payroll gains are declining more and more rapidly. The chief economist Nela Richardson at ADP said, “We are seeing a steepening decline in jobs this month. Additionally, we are seeing a steady decline in wages in the past 12 months.” A steepening decline means that companies are not hiring, and this could be for a million different reasons, but the key point is that the labor market at least in the private sector is tightening to a greater degree, which is concerning. It was again interesting to see the market's reaction however. This time, a poor piece of news for the economy, but bullish for stocks. What a strange time to be living in.

IV

Market Psychology & Final Thoughts:

Futures and the VIX are fairly flat heading towards the open. Crude futures are down substantially as labor market data rolls in, with U.S. crude down to $83 per barrel compared to its $93 high. Bond yields are tempering as well, with European markets on the rise following Asian markets’ rally this morning so it looks like the bulls may have an edge at the opening bell.

If the ADP report is any inclination to what will happen on Friday with the broader labor market release, then we could be in for a bumpy ride. However, the JOLTS numbers came in hotter than expected, so Friday’s outlook is a bit murky. If the report comes in soft like the ADP, there could be an unwinding of treasuries because of how many investors are shorting them right now, i.e. yields falling. But if the report were to come in hot, treasuries will likely be shorted and sold off even more. Either way you look at it, a hot report definitely means higher for longer, while a soft report is a glaring red flag. Let’s hope we get a happy medium. We hope you found this helpful, maybe learned just one thing (one can hope), and have a stupendous Thursday.