The Take Five Report: 11/6/23

I

Markets:

I-I

Global Market Recap:

United States:

- S&P: +0.94%

- Dow: +0.66%

- Nasdaq: +1.38%

- Russell 2k: +2.71%

U.S. markets opened Friday’s session well into the green, and stocks would steadily rally throughout the day to cap off the week on a positive note following the labor market data. Small caps out-performed the broader market and have been over the last few days as more euphoria sprinkles in.

Asia:

- Shanghai: +0.91%

- Hong Kong: +1.71%

- Japan: +2.37%

- India: +0.92%

Asian markets had a significant rally in this morning’s session, as South Korean stocks surged 5.66% after the country re-imposed a ban on shorting. Financial authorities said that short selling will be banned until the end of June 2024.

Europe:

- UK: -0.39%

- Germany: +0.30%

- France: -0.19%

- Italy: +0.69%

European markets mostly gained in Friday’s session as solid earnings and a perceived dovish tilt by central banks helped boost gains. German exports once again fell more than expected.

I-II

U.S. Sectors Snapshot:

- Communication Services: +1.53%

- Consumer Discretionary: +1.41%

- Consumer Staples: +0.12%

- Energy: -1.01%

- Financials: +1.32%

- Health Care: +0.50%

- Industrials: +0.88%

- Info Tech: +1.03%

- Materials: +1.57%

- Real Estate: +2.36%

- Utilities: +0.59%

II

Technicals:

II-I

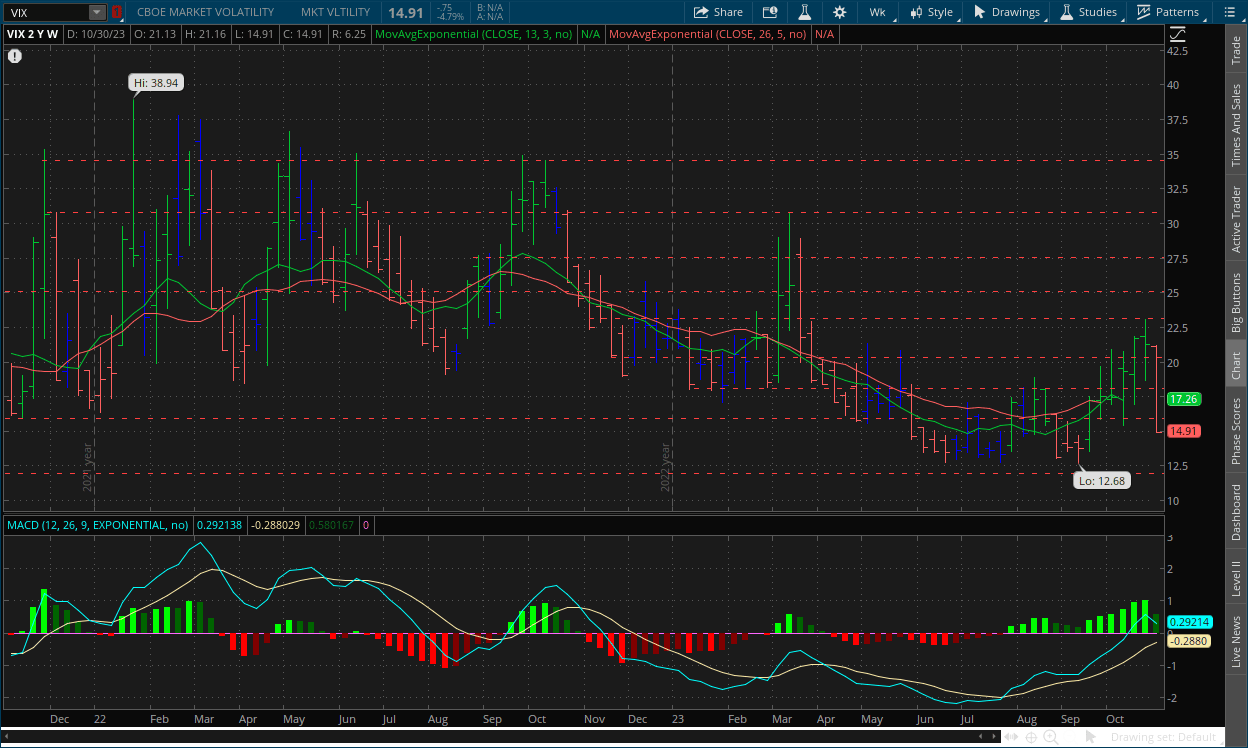

Volatility Index: (VIX)

Weekly Chart:

The VIX opened the week at $21.13, and only managed to work to a high three cents above the opening mark. Prices plummeted all week, reaching a low of $14.91 which also turned out to be the closing price.

Strength obviously moved heavily back in favor of the VIX bears while inertia took a sharp turn back to the downside as well. As I said last week, historically the MACD-H struggles to break above the level it was previously at (i.e. there’s a resistance point). The move to the downside was something we anticipated, but the extent of it was definitely a surprise. The extent of the drop can be linked to the fundamental force, as a string of extremely positive catalysts came in one after the other and added more downward pressure in the VIX.

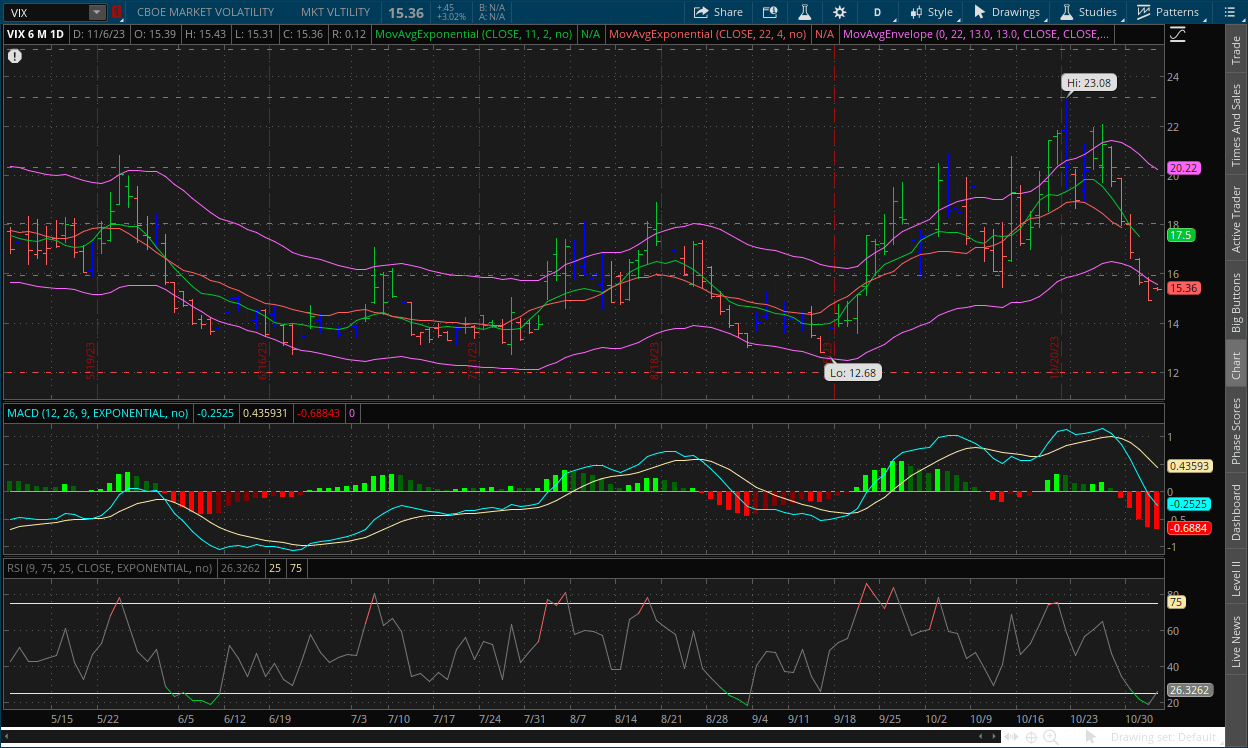

Daily Chart:

T5 Note: Newest bar is this morning’s premarket (we apologize)

Strength moved in favor of the VIX bears once again in Friday’s session as they continued to make new lows with the indicator while inertia continued pushing sharply downwards. Momentum seems to have stalled a touch after breaking below the $16 level. This is where I originally thought prices would break below before entering a consolidation period around this point. That analysis may turn out to be correct, but the sharp drop last week has me questioning whether or not the VIX bears have more in the tank in the near term, but the more likely case is consolidation.

II-II

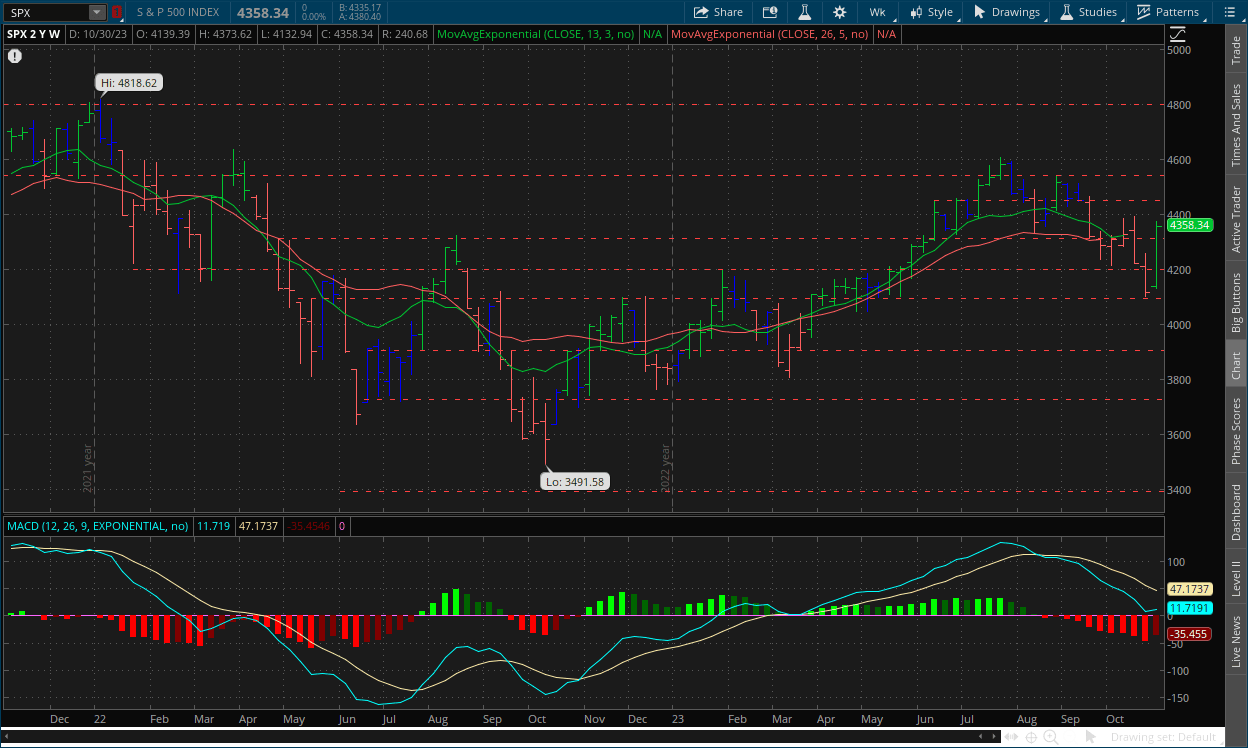

S&P 500: (SPX)

Weekly Chart:

The S&P opened the week at $4,139, and the bears only mustered a low of $4,132. Prices rallied throughout the week and would reach a high of $4,373 before closing at $4,358.

Strength swung back in favor of the bulls by a significant amount while inertia shifted back towards the upside on the front end, but is overall flat.

The $4,100 support level proved to be too strong for the bears to break below. This along with the divergence on the daily chart, the point of resistance on the MACD-H, the signals on the VIX, as well as the string of positive fundamental catalysts, the bears just didn’t have enough to hang on anymore and the bulls took full advantage of that.

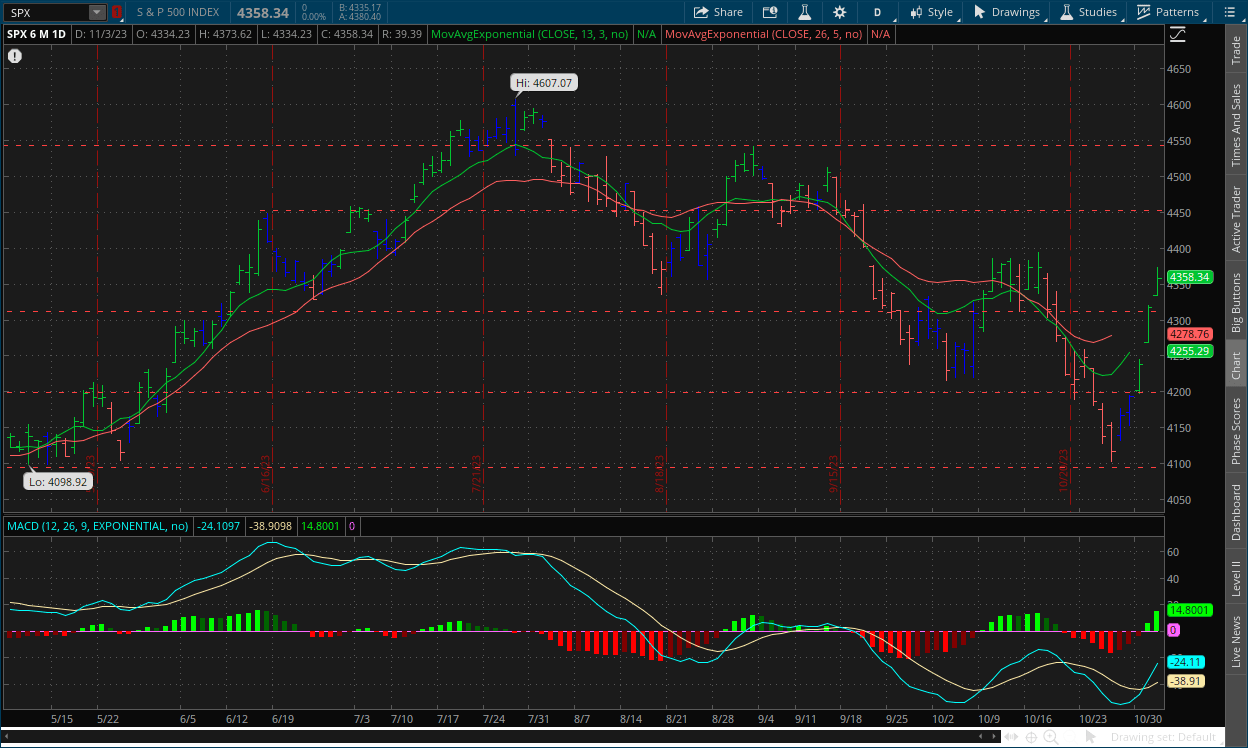

Daily Chart:

Strength continued to jump significantly in favor of the bulls while inertia is shifting rapidly back towards the upside. I originally thought prices would consolidate near the $4,300 level but the bulls’ rally may blow that analysis straight out of the water if it continues for another few days. I still believe consolidation is the likely bet however.

III

Fundamentals:

III-I

Headlines:

1.) MarketWatch: Oil prices rise after Saudi Arabia and Russia extend production cuts

2.) Wall Street Journal: Call-options trading surged during recent rally

3.) Wall Street Journal: Warren Buffett’s Berkshire Hathaway sits on record $157 billion cash pile

4.) Bloomberg: War-risk premium in oil’s options markets is virtually gone

5.) Bloomberg: Korea slams banks, hedge funds with ban on short selling ahead of elections

6.) Financial Times: Over 100 British companies admit to breaching sanctions on Russia

III-II

October Labor Market Data:

|

Index: |

Sep: |

Oct: |

Wall Street Expectations: |

Take Five Expectations: |

|---|---|---|---|---|

|

Nonfarm Payrolls: |

297k(r) |

150k |

175k |

160k |

|

Nonfarm Private Payrolls: |

246k(r) |

99k |

143k |

130k |

|

Unemployment Rate: |

3.8% |

3.9% |

3.8% |

3.9% |

|

Average Hourly Earnings: |

0.3%(r) |

0.2% |

0.3% |

0.3% |

|

Average Workweek: |

34.4 |

34.3 |

34.3 |

34.3 |

Payrolls:

October nonfarm payrolls gained 150,000, which was below both Wall Street’s and my own expectations, and followed a downwardly revised 297,000 from 336,000 in the prior report. The 3 month average decreased to 204,000 from 233,000. Nonfarm private payrolls increased by 99,000, and was below Wall Street’s and my own expectations. This followed another downwardly revised 114,000 from 177,000.

Job gains were seen in health care (+58,000), government (+51,000), social assistance (+19,000), and construction (+23,000) while job losses were most evident in manufacturing, but this was due to strike activity. The job gains seen in these specific sectors are historically linked to the final phase of an unemployment cycle, which is when unemployment begins to rise at a more rapid pace.

Unemployment Rate & Labor Force Participation:

The October unemployment rate came in at 3.9% which was in line with my expectations and was a tick above Wall Street’s, and followed a 3.8% unemployment rate from the prior report. People unemployed for 27 weeks or more accounted for 19.8% of total unemployment compared to 19.1% in September. The labor force participation rate decreased from 62.7% from 62.8%, but has started to gain momentum and the trend is still heading overall upwards.

Average Hourly Earnings & Average Workweek:

The average workweek decreased to 34.3 compared to 34.4 in the prior report, and has held steady in between these two numbers for a few months now. The average hourly earnings for October increased by 0.2%, and was below my own and Wall Street’s expectations by a hair. This came after an upwardly revised 0.3% from 0.2% in the prior report. Average hourly earnings were up 4.1% year over year compared to 4.3% last month. This falls in line with what we saw in the employment cost index (ECI). The ECI was 1.1% quarter over quarter, or 4.4% year over in Q3 (which ends in September), and shows that wage prices are steadily falling towards the Fed’s 3% target.

Putting It Together:

This report was a very soothing one for markets, and perfectly follows up the Fed’s sort of dovish tilt they took in their meeting last week. It checked the boxes of slower payroll growth, steadily rising unemployment, and slower hourly earnings growth as well. Nothing in this report is considered inflationary, and what Powell has done so far is nothing short of incredible in the way he has dealt with inflation so far.

IV

Market Psychology & Final Thoughts:

Psychology:

The psychology of market participants has dramatically shifted in the last week, going from no hope and recession talks to rallying and erasing nearly half of the bears’ progress made since August in one week and naturally it has to do with the Fed. Solid labor market data early in the week followed by Powell’s discrete dovish tilt, which was then followed by an even better labor market report on Friday. It will be interesting to see how this week shapes up, as there aren’t many economic reports and most major earnings have come and gone (with the exception of a few but let’s be real, people just care about the Magnificent Seven).

Final Thoughts:

Market futures are edging up as we head towards the open but not by much while the VIX is showing zero signs of life. European markets are pretty mixed as of right now, while crude futures are rising over 1% with bond yields gaining as well. Today will likely be a softer consolidation day just based on premarket movements and no major reports on the earnings and economic side. I hope you found this helpful, learned something about late stage unemployment, and start the week off right.