The Take Five Report: 11/2/23

I

Markets:

I-I

Global Market Recap:

United States:

- S&P: +1.05%

- Dow: +0.67%

- Nasdaq: +1.64%

- Russell 2k: +0.45%

U.S. markets opened the day at the breakeven mark, and would rally from that point through the first few hours of the day. Prices would flatten out during the middle block of the session leading into the Fed rate hike decision. Following the meeting, prices rallied again through the close and the major indexes finished in the green.

Asia:

- Shanghai: -0.45%

- Hong Kong: +0.75%

- Japan: +1.10%

- India: +0.77%

Asian markets this morning were mostly up following the Fed’s decision to hold rates. Data from South Korea showed a hot CPI for the third month in a row, increasing to 3.8% year over year compared to 3.6% expectations. Australia’s trade surplus also narrowed to its lowest in 32 months.

Europe:

- UK: +0.28%

- Germany: +0.76%

- France: +0.68%

- Italy: +0.88%

European stocks closed higher on Wednesday, extending recent gains, as investors digested the latest batch of earnings and economic reports, and awaited the Federal Reserve's monetary policy announcement that was due later in the day.

I-II

U.S. Sectors Snapshot:

- Communication Services: +1.47%

- Consumer Discretionary: +1.24%

- Consumer Staples: -0.10%

- Energy: -0.23%

- Financials: +0.65%

- Health Care: +0.21%

- Industrials: +0.33%

- Info Tech: +1.93%

- Materials: +0.05%

- Real Estate: +0.51%

- Utilities: +1.14%

II

Technicals:

II-I

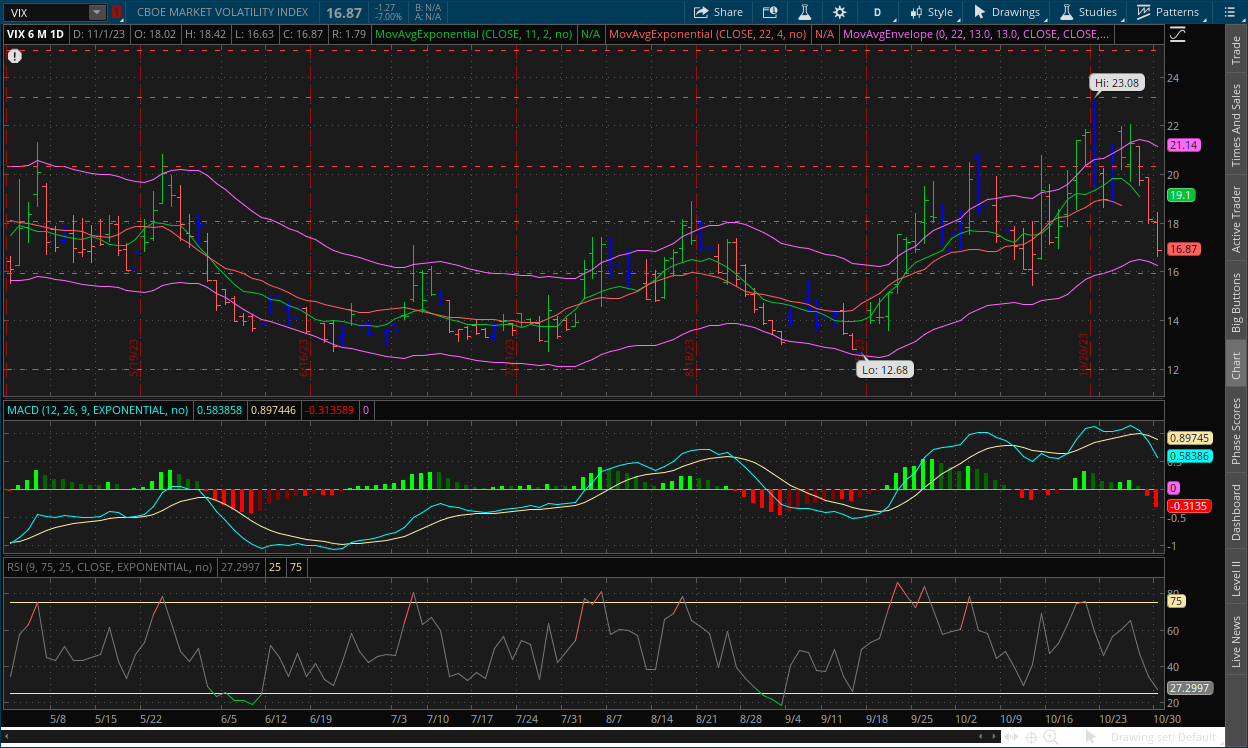

Volatility Index: (VIX)

Wednesday Recap:

The VIX opened yesterday’s session at $18.02, and reached a high of $18.42 early on. Prices fell to a low of $16.63 before closing at $16.87.

Daily Chart:

Strength moved convincingly in favor of the bears once again as they moved further below the centerline while inertia continued to shift heavily back in favor to the downside.

The bearish divergence in the MACD-H has now fully activated, and the VIX bears have begun to take back control of the market's fear gauge as we've theorized would be the likely outcome given the signals that we were seeing. The VIX bulls momentum in terms of price action has been weakening, and this was reflected in the divergence. The VIX’s MACD-H on the weekly chart was also at a point where the indicator has struggled to rise above historically (i.e. it was at a point of resistance), which made the activation of the divergence on the daily chart even more likely.

II-II

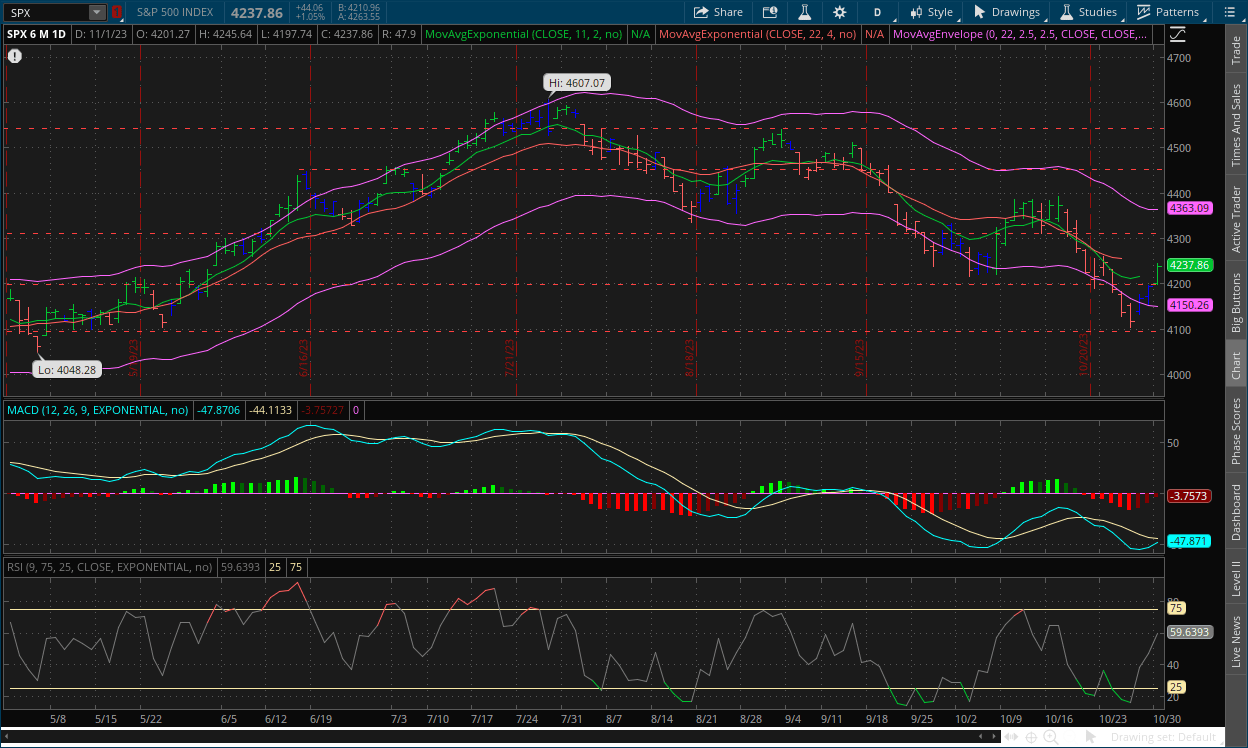

S&P 500: (SPX)

Wednesday Recap:

The market’s benchmark index opened the session at $4,201, and reached a low of $4,197 shortly afterwards. Prices jumped to a high of $4,245 before closing at $4,237.

Daily Chart:

Strength moved in favor of the bulls once again as they grow closer to breaking back above the centerline. Inertia continued to shift back towards the upside, but hasn’t shifted too much yet.

The bullish divergence began its activation process on Monday, and is likely one more green session away from full activation. The same analysis with the VIX applies to the S&P as well, the only difference being the price action from the bears wasn’t as weak as it was for the VIX bulls (that is reflected in the depth of the MACD-H’s second low compared to the height of the indicator on the VIX’s second peak). The $4,100 level like we've said is a huge psychological support level for the entirety of the market. The bears were able to bring prices to that point, but the bulls had enough.

III

Fundamentals:

III-I

Headlines:

1.) MarketWatch: Wall Street cheers signs that the Fed might be done raising interest rates

2.) MarketWatch: U.S. productivity climbs at fastest rate in three years

- T5 note: Will likely be the analysis in tomorrow’s report

3.) Wall Street Journal: Bank of England leaves key interest rate at 5.25%

4.) Bloomberg: Sweden investigates expanding nuclear power capacity

- T5 Note: Now this is something everyone should be pushing for

5.) Bloomberg: UK bonds lead global rally as bets on rate cuts next year build

6.) Financial Times: German unemployment hits highest level since June 2021

III-II

Did Powell Just Hint at a Potential Flip?

Jerome Powell along with the rest of the Federal Reserve decided to keep interest rates locked at 5.25%-5.50% once again. This was to be expected, as markets had priced in a 99% chance of this outcome through the Fed futures contracts. Powell reiterated a lot of the same jargon that he has for the last few months. He discussed once again how the Fed remains in reactionary mode, and are willing to raise rates if anything changes, that the full effects of interest rates have yet to be felt, and that a few good months of data don’t make a trend. But there were some interesting things Powell said that we thought were worth noting, specifically during the Q&A (per usual).

Long-Term Yields & The Housing Market:

Q: To what degree did the rise in long term bond yields supplant action by the Fed at this meeting?

A: …Things are fluctuating back and forth. That’s not what we’re looking for. With financial conditions, we’re looking for persistent changes that are material. The longer-term rates that have moved up, they can’t simply be a reflection of expected policy moves from us that we would then—that if we didn’t follow through on them, then the rates would come back down. So—and I would say on that it does not appear that an expectation of higher near-term policy rates is causing the increase in longer-term rates… In the meantime, though, perhaps the most important thing is that these higher Treasury yields are showing through the higher borrowing costs for households and businesses and those higher costs are going to weigh on economic activity to the extent this tightening persists and, you know, that the mind’s eye goes to the 8 percent—near 8 percent mortgage rate, which could have, you know, a pretty significant effect on housing.

Take Five’s Takeaway:

Powell is essentially saying that they need bond yields to remain higher for longer because it helps tighten financial conditions and allows them to keep their own policy rate unchanged through inflation’s volatility, as well as take their time. He also said that if they were to say they were going to cut rates, that yields would plummet as a result and cause financial conditions to loosen again. Higher yields from Treasuries affect credit card rates, mortgage rates, auto loans, etc., and the higher yields are slowly helping with that (although last week's GDP came as a surprise to everyone).

The other noteworthy thing from this answer was his focus on mortgage rates, and specifically his finishing comment on the effects they’ll have on the housing market. Real Estate prices and more specifically, rents, have been extremely stubborn and this is something that has held up inflation for quite a while and something that Powell has been waiting to roll over. This comment suggests that due to the higher rates, he’s expecting prices and rents to fall, but we're unsure about that as we've changed our tune a bit. Some areas will be affected more than others though, as each market varies.

A Powell Flip-Flop?

Q: …One quick clarification I wanted to ask about Rachel’s question is you said you need slower growth. You had always said before a period of lower-than-trend growth. Has that changed? And two, it sounds to me like you’re basically saying here that kind of the dot plot is out the window, that every meeting is live with the possibility of a rate increase for right now. It doesn’t matter about the turn of the year, and that there’s not an objective way to determine whether or not you’ve got enough tightening in the system…

A: So the dot plot is a picture in time of what the people on the committee think is likely to be appropriate monetary policy in light of their own personal economic forecast. In principle, when things change, it’s not—that’s not like a plan that anybody’s agreed to or that we will do. That’s a forecast that would change… So I think the efficacy of the dot plot probably decays over the three-month period between that meeting and the next meeting.

In terms of growth, what I said was below potential. So what you have here recently is growth that is temporarily—potential growth is elevated for a year or two right now over its trend level. So the right way to think about it is what’s potential growth this year. People think trend growth over a long period of time is a little bit less than 2 percent, or I would say just around 2 percent… you’re actually seeing elevated potential growth. There’s catch-up growth that can happen in potential. And that means that if you’re—you could be growing at 2 percent this year and still be growing below the increase in the potential output of the economy.

Take Five’s Takeaway:

To get this out of the way first (similar to Powell), he essentially said that after the SEP and dot-plots are released, the Fed just throws them away and that they don’t matter too much, they’re just a snapshot of the current moment in time and that it can change the next day (similar to a balance sheet). This contradicts his earlier statements, but he’s flipped a lot recently and this is just another one of those and could be a hint towards a larger flip down the road.

This is what really piqued our interest, and also what could've caused the rally in markets yesterday. For the longest time Powell has said that GDP will likely need to see a period of below trend growth, which to him was firm at 2%, and he has been very adamant about that. Here, he flips on that statement. In the first sentence he says “In terms of growth, what I said was below potential.” Here he’s referring to an earlier statement in this Q&A, which is what sparked this question. He then goes onto say, “potential growth is elevated for a year or two right now over its trend level. So the right way to think about it is what’s potential growth this year… you could be growing at 2 percent this year and still be growing below the increase in the potential output of the economy.” Again being cryptic, but what we took from this is that they’re raising their tolerance level for GDP growth, which signals that things are improving.

To clarify, what he’s saying is this:

A.) Current Real GDP Growth = 4.9%

B.) Current Trend = 2.1%

C.) Potential Trend = 3.5% hypothetically over the next year or two

So here he’s now raising the Fed’s tolerance level for GDP growth by saying they no longer are concerned about GDP being below current trend, but below the potential trend, which is hypothetically in between the current trend and current real growth. And again, to reiterate, this is why we believe markets rallied yesterday, and it goes back to our formula:

A.) Technical signals pointing to a reversal or weakening trend

B.) Positive reinforcement or catalysts with Fundamentals (i.e. what Powell said)

C.) A shift in the current state of market psychology from adding those two things together

IV

Market Psychology & Final Thoughts:

Psychology:

The current state of market psychology is shifting. As we highlighted above: With the technical force signaling a reversal to the upside along with signals of a weakening trend, combined with positive catalysts and reinforcement from GDP and Powell’s comments, the current psychology has shifted back to bullish.

Final Thoughts:

U.S. indexes opened the session up significantly, with the VIX falling closer to the $16 support level. European markets are all up 1.50% or more as they head towards their close, with bond yields down and crude prices dropping as well. Apple earnings will be a key fundamental test moving forward, and one markets will be watching closely after hours tonight and will set the tone for tomorrow’s session. We hope you all found this helpful, at least in terms of how the Take Five Formula works, learned something about the Fed’s mindset, and have a damn good Thursday.