We Have a Communication Problem When It Comes to Inflation

We want to make an important distinction between disinflation and deflation. The former is when the rate of price increases (i.e. inflation) is slowing, while the latter is when prices are actually dropping. Everyday people are saying that inflation is getting worse, or that prices are moving higher while certain politicians, media, and experts say that inflation actually is actually getting better.

While they're both right, there is still a large communication gap between the two. Everyday people are getting disinflation and deflation confused when it's said, while the other side is either directly or indirectly disregarding their voices and focusing on inflation in aggregate, neglecting certain details and failing to see it from their perspective, which is where a lot of the problem lies. So, while prices aren't increasing as fast as they were, they are still increasing, i.e. affordability is still getting worse for the majority of people.

More People Are Falling Behind:

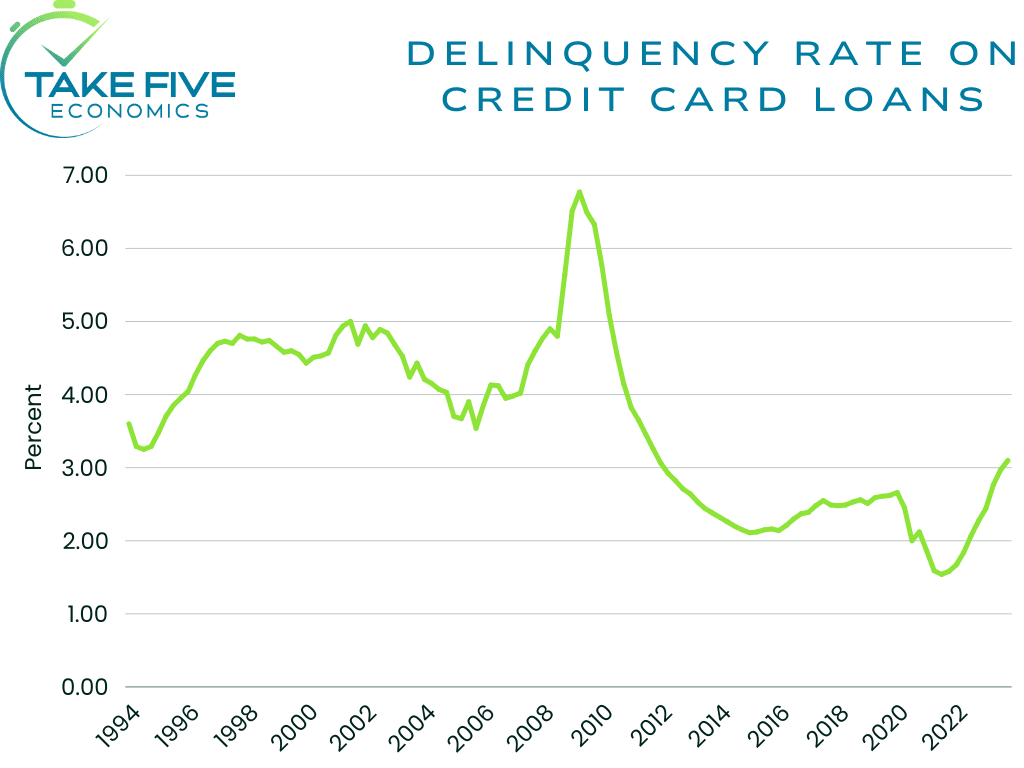

The delinquency rate on credit card loans has been rising since late 2021. As you can see, the easy money days of the 2010's brought this figure to all-time lows. Following the pandemic, the Fed cut interest rates to zero, creating negative real interest rates which pumped the economy and its participants full of liquidity. The drop to all-time lows reflects that environment, which was people taking out loans and spending at an astronomical pace because money was essentially free. The rise in 2022 to now is a result of the Fed raising

interest rates back up in an inflationary environment, i.e. money became more expensive at a time where everything else was becoming more expensive, and this started to squeeze people. We won't get into the wealth gap discussion today but stay tuned for future Articles on the subject.

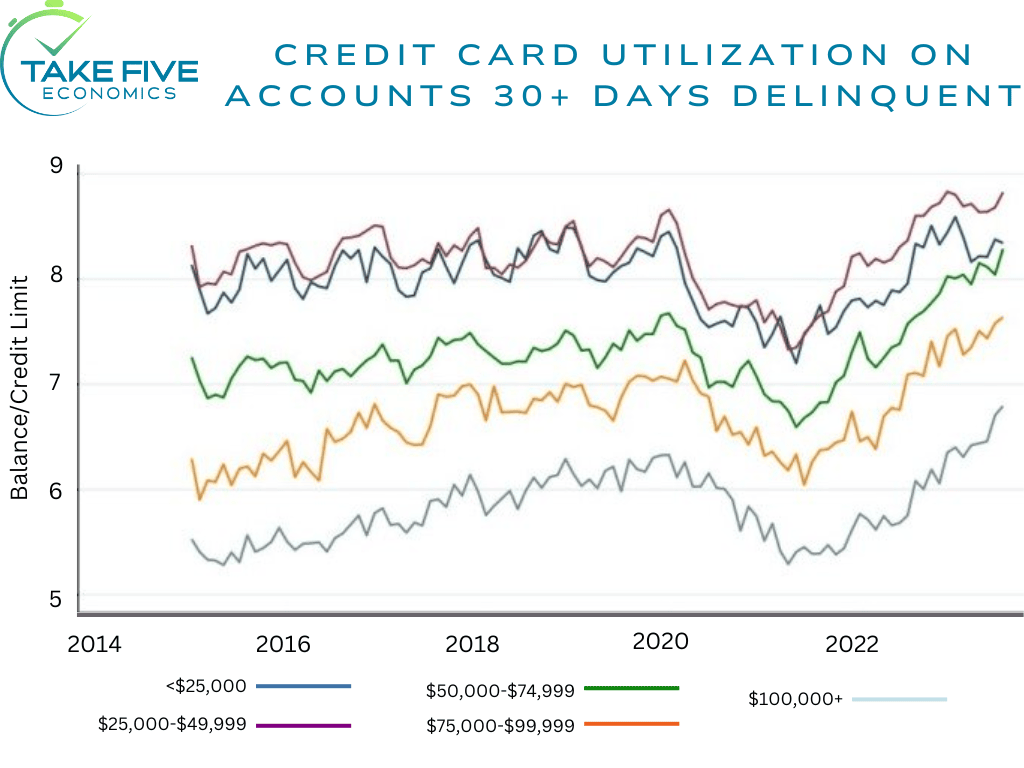

We bring up this chart from The Federal Reserve. It shows the average credit card usage on accounts that are already 30+ days overdue. It's above pre-pandemic highs and tells us that the people who are falling behind on payments are falling behind even further and they need to keep tapping into credit to cover more and more and more things even though their accounts are delinquent. It also doesn't help that current interest rates (as of 12/15/23) on credit cards averages anywhere between 17% and 20%, with some even higher.

Prices:

The middle and lower classes have been getting squeezed more and more as prices continue to rise. While gas prices are down year over year (but are still high in comparison to a few years ago), there are still many basic necessities and commonly purchased items where prices are still rising:

|

Index: |

Y/Y% Aggregate: |

|---|---|

|

Food at Home: |

1.7'% |

|

Food Away from Home: |

5.3% |

|

Electricity: |

3.4% |

|

Car Insurance: |

19.2% |

|

Car Repairs: |

8.5% |

|

Rent: |

6.9% |

|

Homeowner: |

6.7% |

|

Transportation Services: |

10.1% |

|

Apparel: |

1.1% |

These are only a few examples of headline indexes, but when you look at even more specific areas, it paints an even more detailed picture:

|

Index: |

Y/Y%: |

|---|---|

|

Bakery Products: (e.g. bread) |

4.1% |

|

Beef (e.g. ground beef, steaks) |

8.7% |

|

Tools & Supplies: |

2.8% |

|

Cleaning Supplies: |

3.1% |

|

Baby Formula: |

7.6% |

|

Medicinal Drugs: |

5.0% |

|

Pet Food: |

5.6% |

|

Alcoholic Beverages: |

2.9% |

|

Tobacco & Smoking Products: |

7.7% |

|

Personal Care: |

4.3% |

While some of these are offset by others, it still doesn't take all of the heat off. The initial increase from all of these indexes as aggregate inflation skyrocketed crippled everyone, and although the increases now are smaller in comparison, over time and when put together they begin to add up. Not to mention all of the other categories that may be minimally up or even down year over year but are still elevated.

Wages:

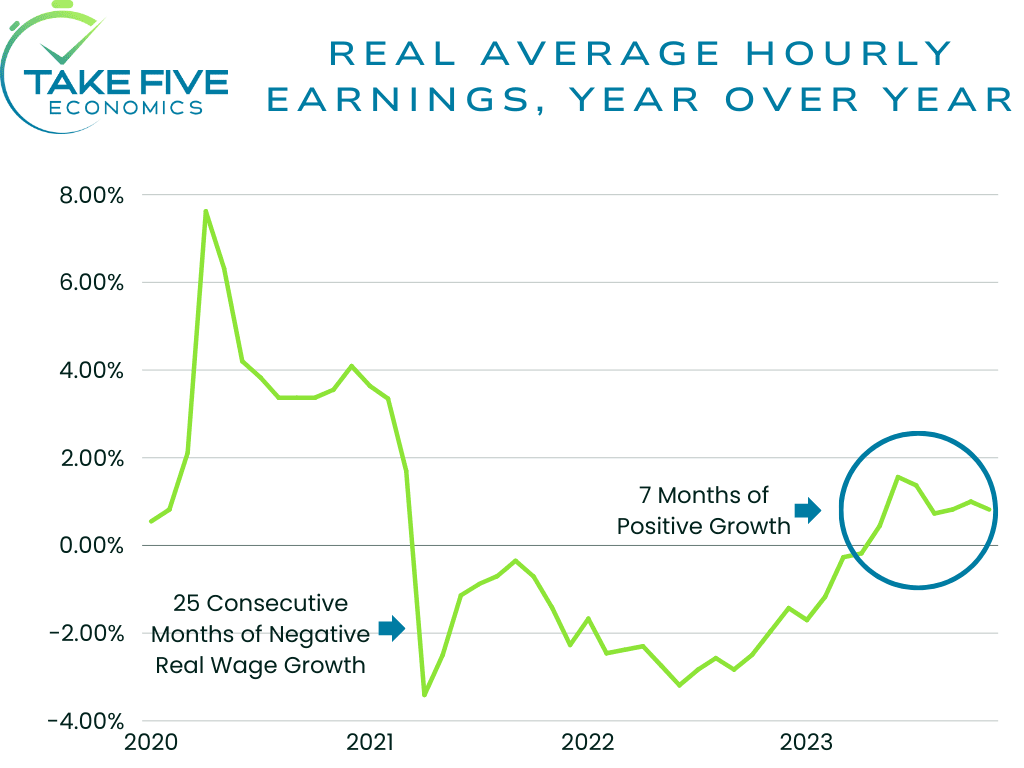

This chart shows real average hourly wages on a year over year basis and note that this measure is also in aggregate, and neglects to show a more detailed picture of more specific circumstances that people may be in. While real wages are finally outpacing inflation and have for 7 months, it isn't by too much and before the breakeven threshold was finally broken, there was 25 straight months of negative real wage growth.

Putting It Together:

The number of people in situations where their salaries and/or pay hasn't budged much over the last few years and is still negative when factoring in inflation is higher than people realize. Elevated and continuously rising prices are crippling the middle class.

While the rate of price increases isn't as fast, and on paper inflation is improving, prices are still rising, and many are having difficulty keeping up. There is a massive communication gap between people, as there has been for a long time now. We get that inflation is improving, but that's not the issue. The issue is that people still are struggling no matter which way you look at it and deserve the recognition and attention they as Americans need.