ECI Breaks Another Piece of the Market's Narrative

Highlights:

|

Index: |

Q4 2023: |

Q1 2024: |

Wall Street Expected: |

Take Five Expected: |

|---|---|---|---|---|

|

Employment Cost Index: |

0.9% |

1.2% |

0.9% |

1.2% |

|

Wages & Salaries: |

1.1% |

1.1% |

-- |

-- |

|

Benefits: |

0.7% |

1.1% |

-- |

-- |

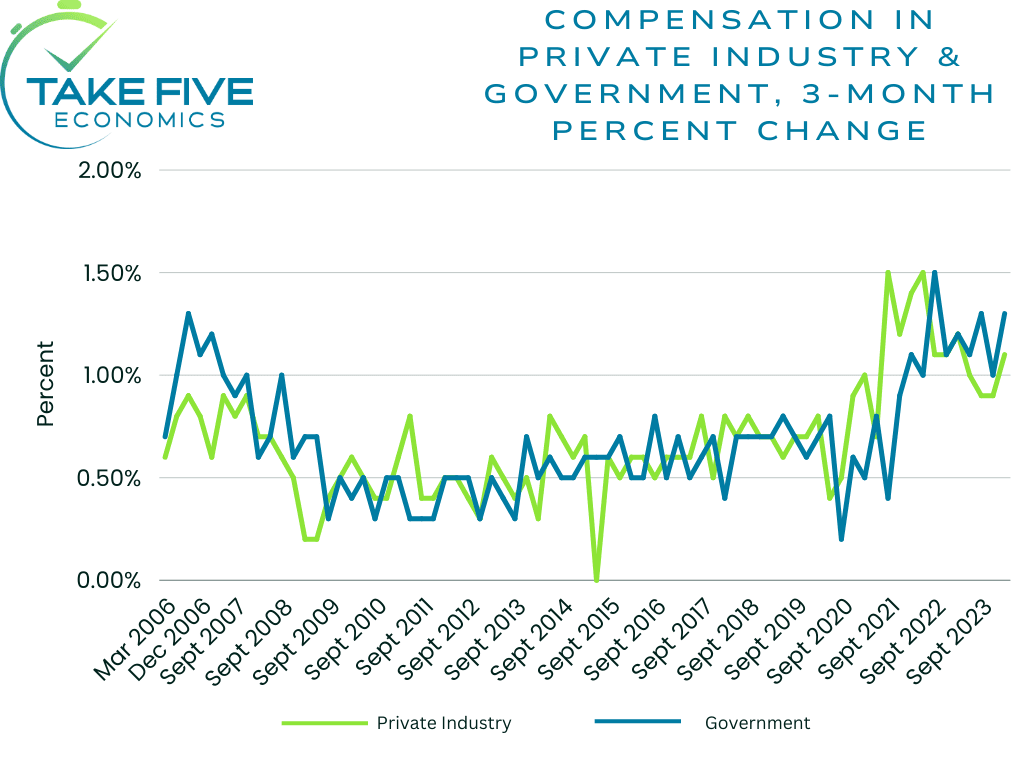

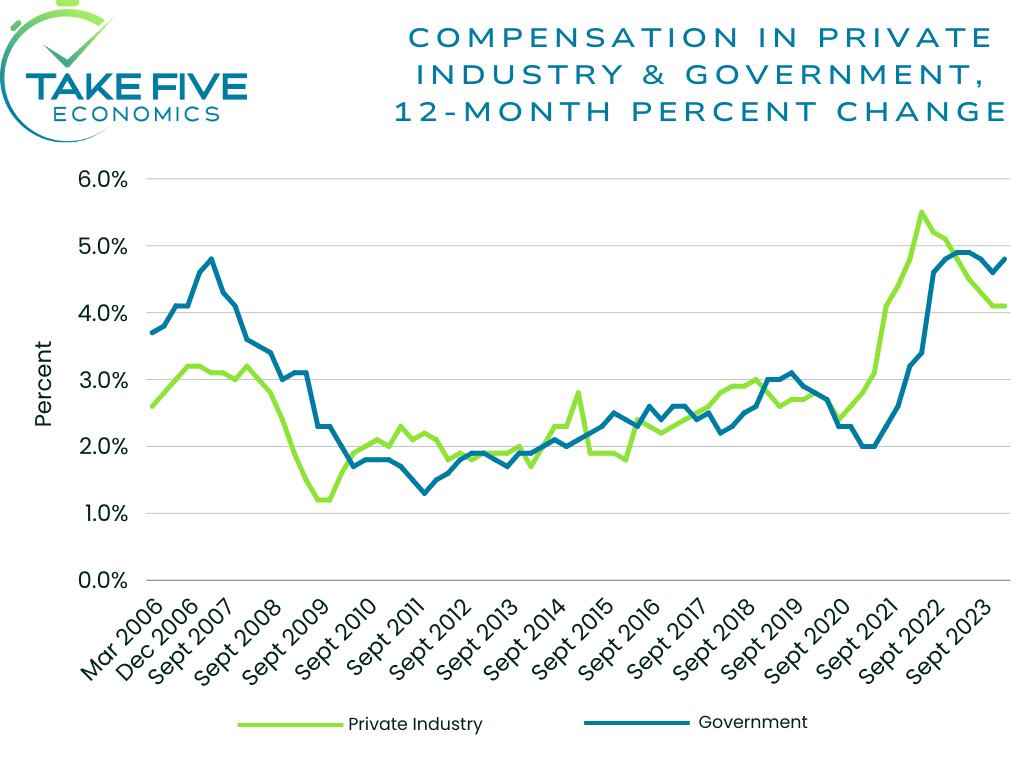

Employment costs for civilian workers increased by 1.2% in Q1, beating Wall Street's median forecast and matching our own expectations. This followed a 0.9% rise in Q4 of 2023. In terms of year over year, the ECI rose by 4.2%.

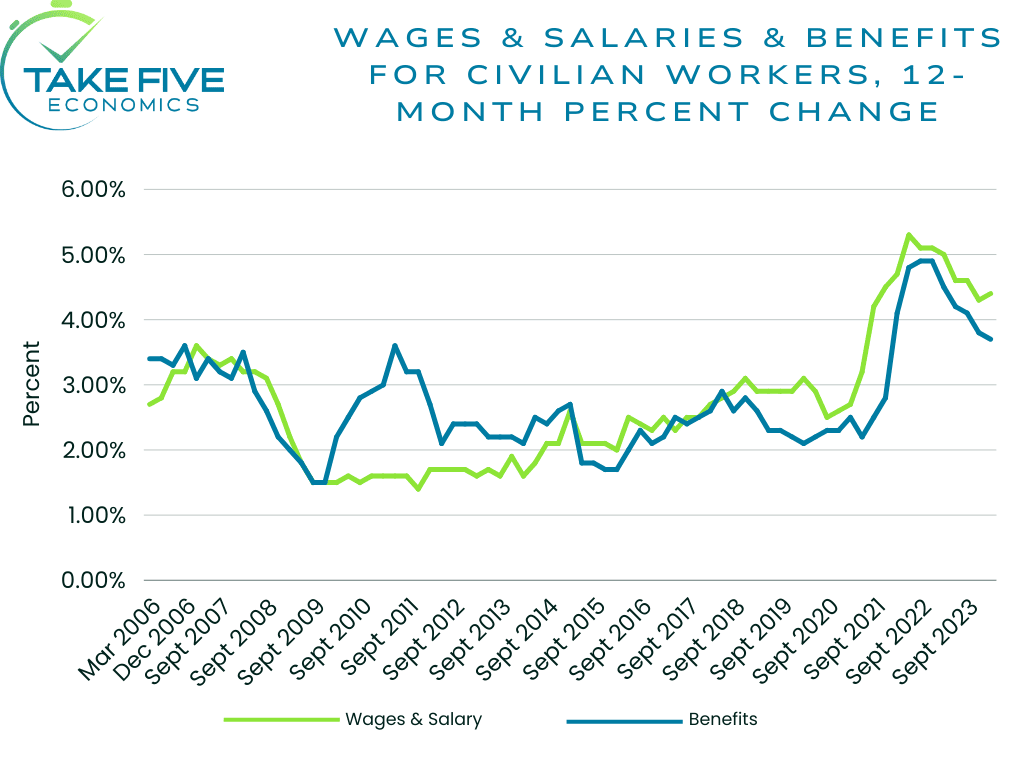

Adjusted for inflation, total compensation costs increased by 0.6% year over year, wages and salaries by 0.8%, and benefits by 0.1%.

Wages and salaries increased by 1.1% in Q1, matching the increase seen in Q4 of 2023. Benefits also increased by 1.1%, up from the 0.7% rise seen in the prior report. In terms of year over year, wages and salaries increased by 4.4% while benefits were up 3.7% year over year in Q1.

Finer Details:

In the private industry, compensation costs rose by 5.3% for union workers and 3.9% for nonunion workers year over year. During the same period, wages and salaries increased by 6.3% for union workers and 4.1% for nonunion workers. Benefit costs also increased, rising by 3.8% for union workers and 3.6% for nonunion workers.

For state and local government workers, compensation costs rose by 4.8% in the 12 months leading up to March 2024, compared to a 4.9% increase in the previous year. Wages and salaries increased by 5.0% during the same period, compared to a 4.7% increase the year before. Benefit costs also increased, rising by 4.5% in the 12 months ending in March 2024, compared to a 5.0% increase in the prior year.

Putting It Together:

The pickup in wage growth during Q1 remained well above its pre-pandemic average and put even more pressure on the market's rate-cut narrative moving forward as well as the Fed and their decisions regarding monetary policy as wage growth is one of the main determinants that can help fuel rises in inflation, and it's a metric that Fed officials and market participants pay close attention to in order to determine if there are underlying price pressures.

The Fed and specifically, Jerome Powell will be on the hot seat in Wednesday's policy meeting as markets will be hanging onto every word that Powell says. In our Take Five Reports, we've been firm on our stance that the market's narrative (i.e. rate-cuts) that has fueled the rally since November of 2023 is at a point where it will potentially break, to which then a correction is in store. But we've been adamant on the fact that any one of the catalysts can provide the fuel the bulls need in order to extend the rally. The PCE results on Friday did just that, as the report wasn't as bad as people were expecting following the GDP results the day prior.

While the ECI did come in hot, and deals a decent blow to the market narrative, but the PCE still provides some hope that Powell may not be as hawkish, or at least as harsh than was initially thought. If this is the case, and Powell beats around the bush so to speak, this will provide the bulls with the temporary fuel they need to keep moving prices upwards.

We say 'temporary fuel' because the dominant force (i.e. the Fed, interest rates, and inflation) of the market is still shifting away from the market's narrative, i.e. that inflation is improving, and the Fed will cut interest rates sooner rather than later which can be classified as a bullish narrative. In order for us to change our outlook, the dominant force needs to be re-aligned with the narrative, but right now there's a divergence between the two. The more likely scenario is the narrative will break, and a new bullish narrative will need to be reformed following this result, but as we've been telling our subscribers, be aware of a surprise bullish turn from Powell or in any one of the narrative specific catalysts moving forward. Remember: greed, euphoria and conviction (G.E.C.) are much harder emotions to break than fear, uncertainty, and doubt (F.U.D.).